- FX: JPY and EUR find themselves supported with commodity dollars under pressure, as US investors slowly make their way to their trading stations.

- Euro has risen despite poor Eurozone data poor (e.g. Sentix investor confidence printed -13.7 vs. -6.9 expected and -5.8 last, while revisions showed German services PMI expanded at a much slower pace than anticipated in July.)

- Risk remains off the menu amid fresh escalation in US-China trade spat, after President Trump last week announced fresh tariffs. Chinese yuan has fallen sharply through 7 against the dollar to a record low today – will this annoy the Us President further?

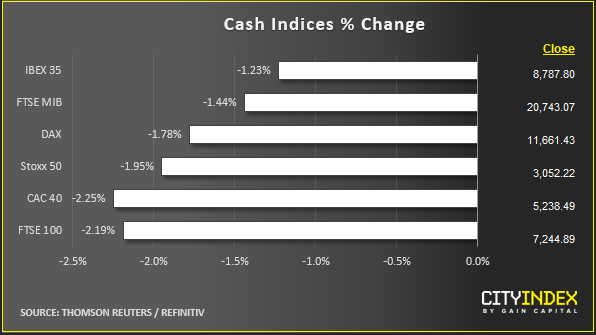

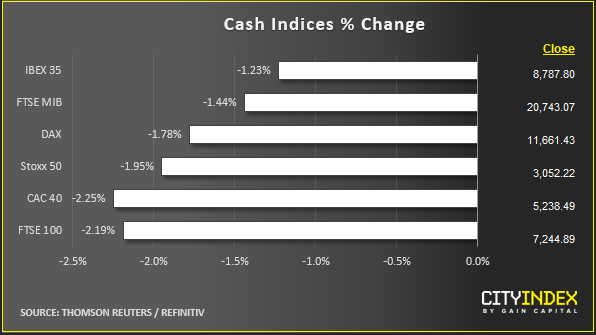

- Stocks are sliding after China retaliated against the latest salvo of Washington tariffs by letting yuan weaken below 7 to the dollar. Beijing also signalled it will cease some U.S. agricultural imports. There are virtually no U.S. imports left on which China has not already levied retaliatory tariffs, so reported plans to hold off from buying certain U.S. goods is an alternative avenue open to it and may be the shape of things to come. China’s agreement to purchase U.S. agricultural imports was one of the conditions demanded by the U.S. for agreeing to a pause in imposing further tariffs on the second-largest economy. So, it is possible China’s move will mark the beginning of a new cycle of escalation.

- Bonds: Thanks to weak data and dovish central banks, investors presumably continue to front-run central banks by buying haven bonds. As bonds extend rally, yields are continuing to fall to hit record low levels. The entire yield curve in Germany and Switzerland have fallen below zero recently and this morning saw UK 10-year yield drop to a fresh record low.

- Commodities: Gold has extended its rally on falling yields and as amid a sell-off in stocks and USD/JPY; crude oil on the backfoot amid demand concerns.

- Stock on the move: HSBC’s relatively solid second quarter results are cushioning the stock from a much harder hammering on Monday. It has fallen no more than 2% so far. Despite the shock departure of its CEO after just 18 months in the job, better than forecast profits and the revenues that rose faster than costs in the quarter left the shares down around 2% at last check.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM