On Wednesday, the last day of an atypically volatile February, stocks continued to struggle and fluctuate in the aftermath of a broad-based sell-off a day earlier that was driven by new Fed Chair Jerome Powell’s hawkish testimony in front of the US Congress’ House Financial Services Committee.

In his Tuesday testimony, Powell hinted that due to significant strides in the economy, strength in the labor market, higher wage growth, rising inflation expectations, and changes in fiscal policy, there could potentially be more rate hikes in 2018 than the three that were previously projected. That pivotal hint once again drove up expectations of an accelerated rise in interest rates, boosting US Treasury yields back up to near multi-year highs and placing renewed pressure on stocks, while aiding in a sharp extension of the US dollar’s recent rebound.

On Wednesday, bond yields retreated from long-term highs, but stocks continued to struggle for gains, and the US dollar index was able to extend its rebound further to hit a new one-month high. Powell, however, is not quite done yet. On Thursday, the Fed Chair is scheduled to deliver more testimony in front of the US Congress, this time for the Senate Banking Committee. As Powell has already made it clear to the House committee that heightened market volatility will not stop the Fed from raising interest rates as it sees fit, it is likely that he will deliver yet another hawkish statement to the Senate committee.

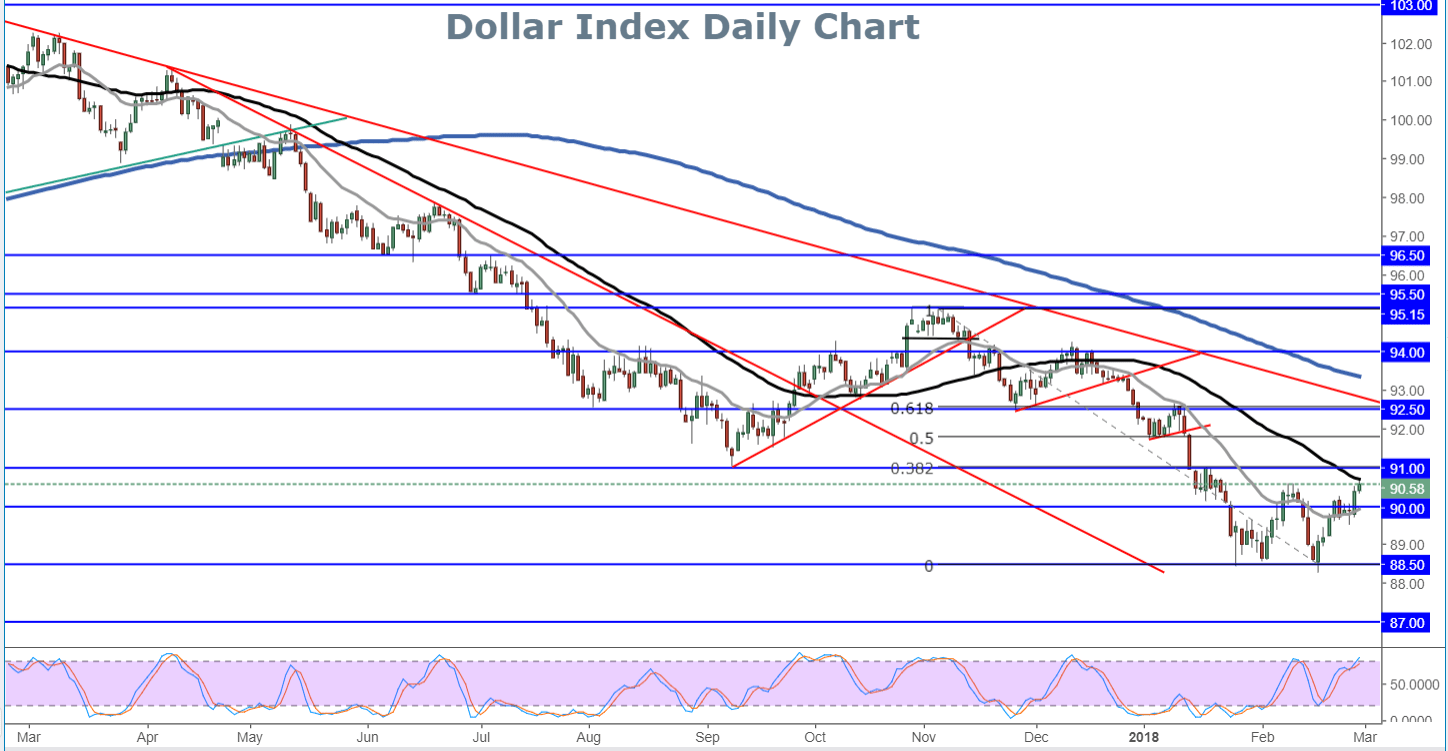

If Powell does continue to sound a more hawkish tone on Thursday, stocks are likely to be pressured further while the dollar could receive yet another boost. From a technical perspective, a potential bottoming pattern for the US dollar index has tentatively been established in the form of a double-bottom formation, a possible upside reversal pattern. This formation has been roughly formed from the January and February lows around the 88.50 price level. On Wednesday, the US dollar index briefly rose above the peak of this pattern, tentatively confirming a double-bottom breakout. In the process, the dollar has also hit its key 50-day moving average. Amid Powell’s continuing Congressional testimony, any further boost for the US dollar index above its 50-day moving average is likely to meet its next hurdle immediately to the upside around the 91.00 resistance level. Any further breakout above 91.00 could signal a potential upside reversal scenario, with the next major target around the 92.50 resistance area.