The race to become Britain’s next PM is off to a flying start, but investors are waiting for the highlights

And they’re off. With Theresa May’s first day as caretaker Prime Minister, campaigning by those jockeying to replace her can begin in earnest. In many ways, the contest began weeks ago. The dividing line between now and since May’s days were numbered hasn’t been particularly clear. Accordingly, the market impact is vague. The bookies favourite, Boris Johnson, may be tacking in an ever-harder Brexit direction each day and dragging rivals like Foreign Secretary Jeremy Hunt with him. But determining the extent to which markets care isn’t easy.

Yes, sterling has struggled today, within the context of its long-standing post-referendum trials. It is back on the $1.26 handle, having drifted there since Friday’s $1.2762 three-week high. But it crossed over immediately after Monday data showed British economic growth undershot even already pessimistic expectations. (Monthly jobs data due out on Tuesday morning are also widely expected to paint a negative picture).

- Furthermore, both one-month and one-week implied volatility, which show how much option traders expect the pound to swing over those time frames continue to trundle along close to 2019 lows

- As my colleague Matt Simpson points out, major speculators are the most bearish they have been on sterling since mid-January. This means hedging of negative positions is low, despite relatively cheap option pricing. In theory, events could change this picture in a flash. In practice, that seems unlikely for the time being

- UK equity markets, rising in step with global tariff relief (and possibly a tailwind from listless sterling) look just as unconcerned

- Gilt prices are under pressure; but then so are most developed market sovereign bonds, as investors feel less need for safe-havens, sending yields higher

- UK swap and short-term rates are scrambling to price more Fed easing after surprisingly low monthly jobs data; more so than Brexit trepidation

So it looks like markets are as relaxed as they can be under the circumstances. For that to be the case, chances that the next Tory leader could reopen discussions on the Northern Ireland backstop—as proposed by Boris Johnson—would have to be perceived as near zero. Markets also appear to ascribe weak odds to the possibility that the next PM/Conservative leader really believes they can avoid an election in the event of a no-deal Brexit. Rejection of no deal is one of the few Brexit choices with a parliamentary majority.

There are another 7 weeks of the contest to go though. Conservative MPs will whittle down the 10 remaining candidates to two. Rank and file party members will then select their next leader in a series of further ballots between 22nd June and 22nd July. With such an action-packed schedule ahead, chances that markets begin to price leadership-contest related risks as the field narrows ought to be better than 50-50. Still, it may be some weeks yet before such risks become present enough to warrant much reaction.

Chart thoughts

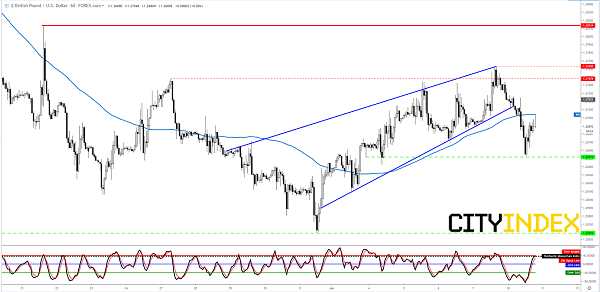

That could well be a de facto positive for sterling, which has essentially maintained its upswing from Monday’s one-week low to mark the 100-hour simple moving average in the chart below. Note the bounce barely tagged $1.26519 confirmed support. It may be that potential resistant effect of key trends, including the 100-interval average, will be weak; at least in the first instance. Traders won’t ignore the real key risk event just ahead: Tuesday’s UK Employment data. Still, judging how the current uplift just about survived Monday’s worse-than-foreseen growth and industrial readings, the weight from any negative impetus may also be shrugged off. In that event, upside targets would thereby remain $1.2750-$1.2760, though perhaps not much higher. After all, it will be quite some time before cable can range more than 110 pips in one clear leg.

Chart: sterling/U.S. dollar – hourly [10/06/2019 19:57:20]

Source: Tradingview/City Index