Market Brief: Will We Finally Get Clarity on Brexit This Weekend?

- After garnering the approval of the EU yesterday, Boris Johnson’s Brexit deal goes up for a tight vote in Parliament this weekend (though depending on amendments, BoJo may have to request an extension and delay the vote until Monday). One way or another, the pound and FTSE are poised for interesting opens to next week’s trade!

- Fed Vice Chairman Clarida did little to dissuade the market from expecting an interest rate cut in the last public comments ahead of the Fed’s end-of-month meeting. Markets are currently pricing in a more than 90% probability of a 25bps cut in two weeks’ time.

- USD/CAD is testing key support ahead of the country’s upcoming razor-thin federal election.

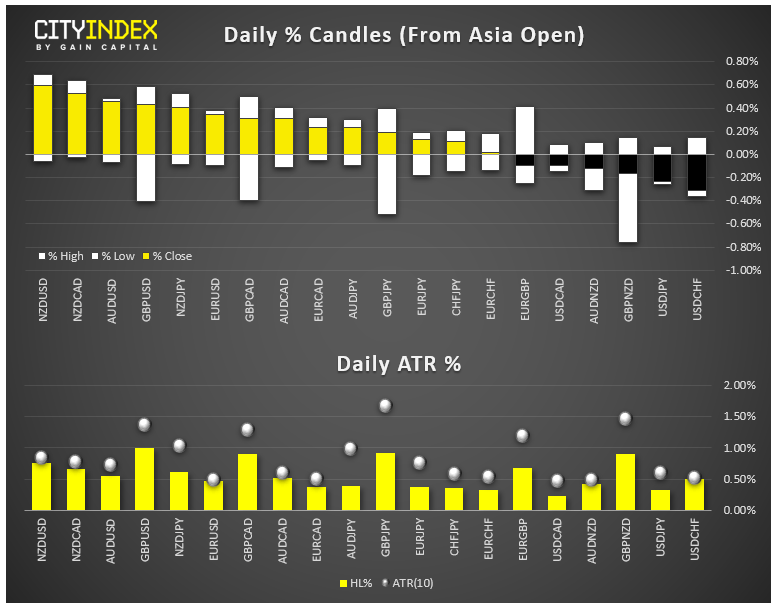

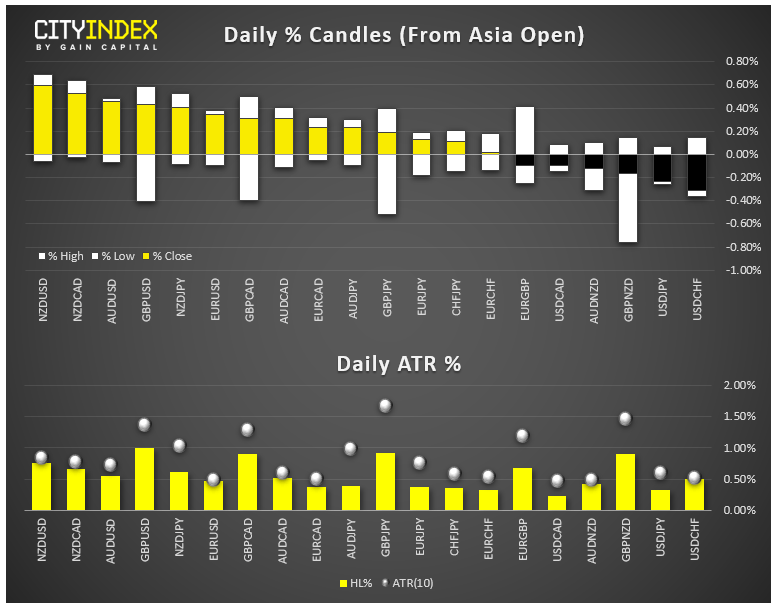

- FX: The pound was the strongest major currency today on Brexit deal optimism, while the US dollar brought up the rear for the second straight day.

- Commodities: Both oil and gold traded lower on the day.

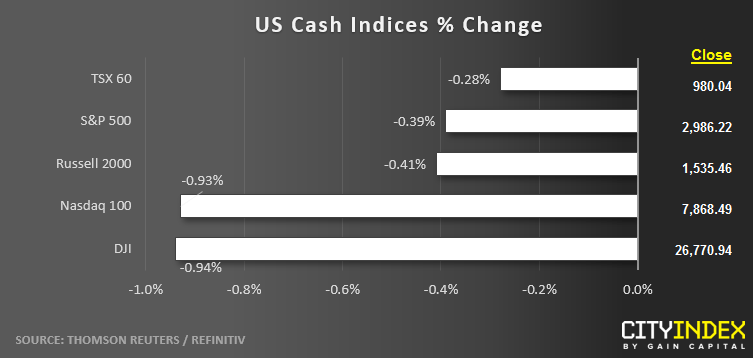

- US indices closed lower on the day, dragged down by generally weak performance in high-profile, large-cap companies (see below).

- REITs (XLRE) were the strongest major sector on the day, while Communication Services stocks (XLC) brought up the rear.

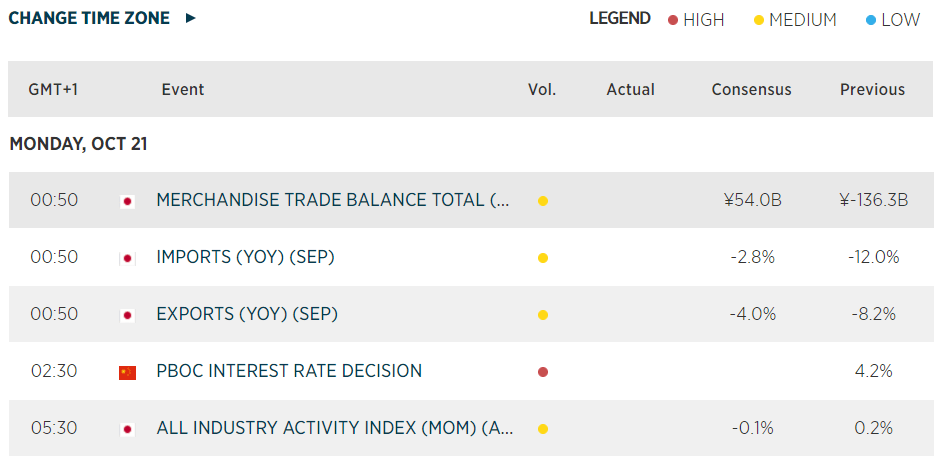

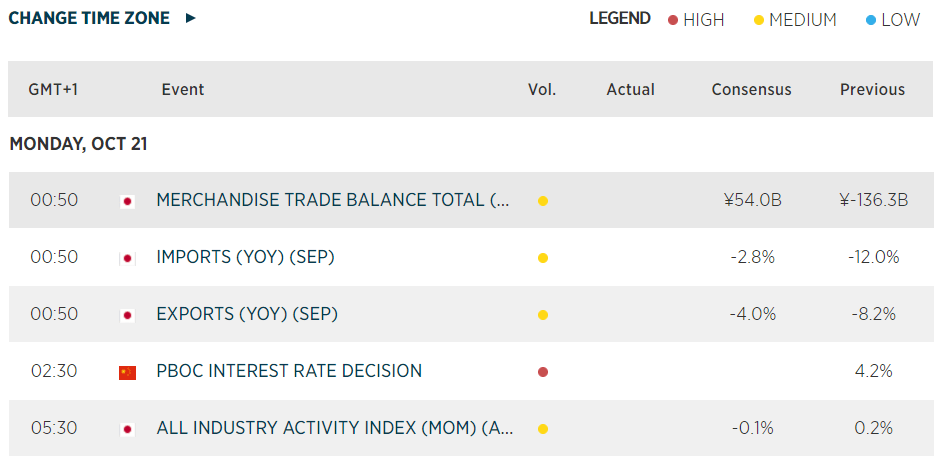

- Check out the key economic events and themes we’ll be watching in the coming week!

- Stocks on the move:

- Coca-Cola (KO) bucked the market’s general weak trend, gaining 2% on the day after reporting solid earnings, with smaller cans and strong sales of Coke Zero Sugar boosting the company’s bottom line.

- American Express (AXP) dipped -2% after narrowly beating earnings and revenues expectations.

- Boeing (BA) dropped -7% on a Reuters report stating that employees misled regulators about the safety issues with the company’s 737 MAX jet.

- Slack Technologies (WORK) dumped -9% today and is now down nearly -50% from its intraday IPO-day peak in June.

- Netflix (NFLX) gave back another -6% today and is now trading below Wednesday’s closing level, when it reported mixed earnings.

- Johnson and Johnson (JNJ) dropped -6% on an asbestos-related recall of baby powder products. The company’s brand famously benefitted from aggressive early recalls of cyanide-laced Tylenol in 1982, but traders are selling first and asking questions later this time around.

Latest market news

Yesterday 08:33 AM