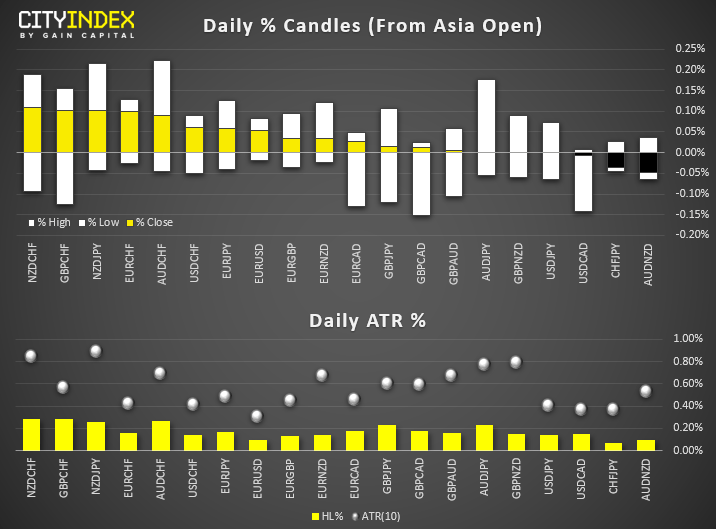

View our guide on how to interpret the FX Dashboard

Forex Brief:

- Australia’s manufacturing PMI contracted slightly at 49.4 (50.1) prior, making it the 2nd dip into negative territory over the past 3 months. Service PMI however expanded slightly at 50.1, up from 49.9 prior. J

- CPI in Japan rose to 0.4% YoY as expected, yet with it remaining so far from their 2% target after all these years, BOJ could still act at any of the coming meetings. They have been more vocal about forward guidance and are essentially deciding policy on a per-meeting basis. Their next meeting is on the 20th January.

- Reports are circulating that MAS (Monetary Authority of Singapore) are considering allowing crypto derivates on their exchanges.

- A quiet end to the week for volatility so far. Overall, daily ranges are just 30% of their ATR – but hopefully this will pick up with PMI’s from Europe, US and Canadian retail sales.

Price Action:

- DXY: On track for a small, bullish pinbar week with a potential swing low at 97.68.

- EUR/USD: Bearish outside day suggests a swing high could be in place at 1.1097

- USD/JPY: Consolidating above 108.23 support, I’m not convinced we have the data to see a breakout of the 108.23 – 109.07 range today.

- USD/CAD:1.3200 could prove to be a pivotal level on USD/CAD around US PMI and CA retail sales.

Equity Brief:

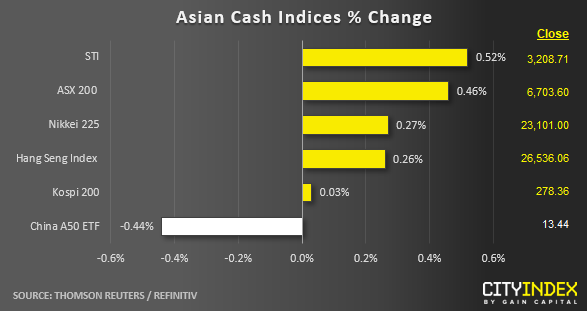

- Most key Asian stock markets have recorded modest gains between 0.20% to 0.50% but with muted volumes as U.S-China trade deal fatigue hit the nerves of market participants.

- In yesterday’s late European session, media has reported that China top trade official, Vice Premier Liu He has invited U.S. officials for another round of trade talk in Beijing to be taken place before Nov 28, U.S. Thanksgiving holiday. So far, the U.S. Trade Representative Office has not confirmed or commented on China’s invitation.

- U.S. President Trump is now expected to sign the Hong Kong Democracy Bill into legislation soon. Global Times, a pro- Beijing media has published an article that China can possibly retaliate by placing sanctions on U.S. lawmakers who interfere in China’s internal affairs and even blacklist “relevant U.S. firms” and hold back cooperation with U.S. on some global issues that will complicate the U.S-China Phase One trade deal.

- Meanwhile, Hong Kong has seen a relatively calm state in the past two days ahead of local council elections to be held this Sunday versus intense confrontations between anti-government protestors and the police at the start of this week. Protestors that are still being held out at Hong Kong Polytechnic University have dwindled significantly to below 100.

- Alibaba’s secondary listing in Hong Kong has started to see decent bids in the “gray market” before its official start of trading on 26 Nov. According to media report, some institutional investors saw bids as high as HK$182 in gray-market trading today, a 3.4% premium above the issue price of HK$176.

Up Next:

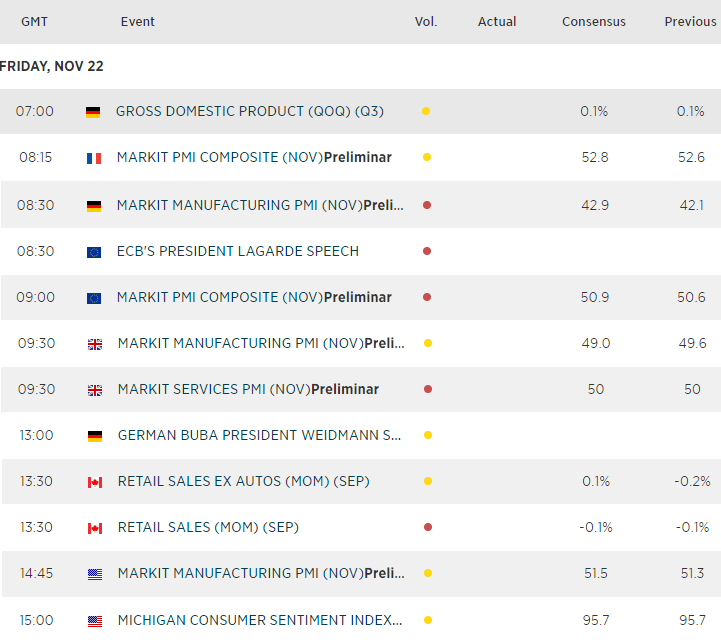

- PMI data from Europe and US are the calendar highlights to see the week.

- France kicks off at 08:15 GMT and expected to see their expansive PMI’s increase, whilst German PMI’s at 08:30 GMT are expected to see their rates of contraction soften. And, with the broader European reads released at 09:00 GMT, it makes a decent case to monitor Euro pairs and DAX. Ultimately, the stronger the data the more bullish it could be for Euro, and conversely weaker prints (particularly if negative and contracting faster) brings forward expectations for ECB to ease and weigh on the currency.

Matt Simpson and Kelvin Wong both contributed to this article

Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.Latest market news

Today 07:55 AM

Today 04:47 AM