Market Brief: US-China Trade Fears Rear Their Heads Again

- US-China trade fears reared their heads again, with news that US was considering curbing limits on portfolio inflows into China hurting risk appetite across the board.

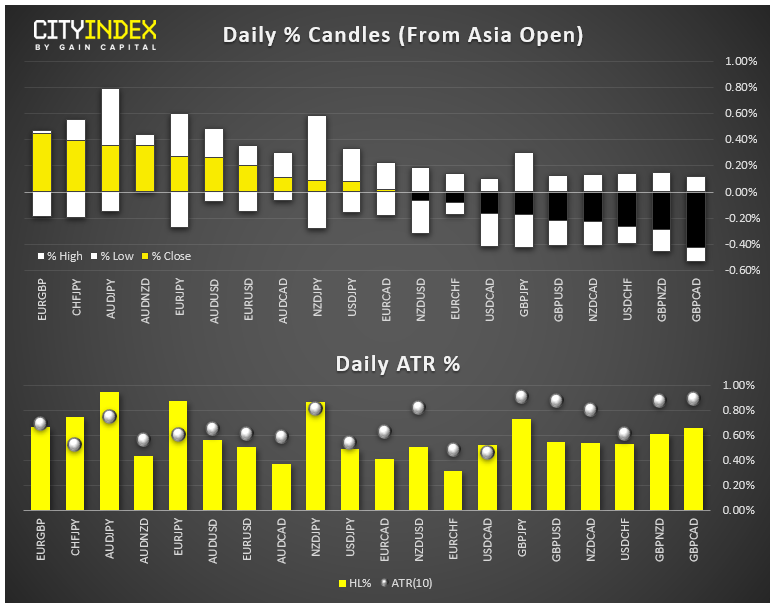

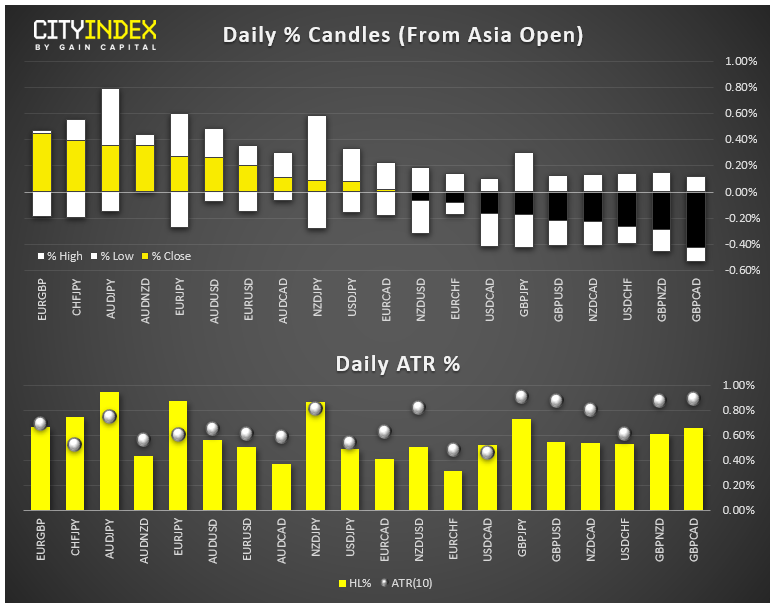

- FX: The safe haven Swiss franc was the strongest major currency on the day, and the British pound was the weakest ahead of this weekend’s highly-anticipated Conservative party conference, which could set the agenda for Brexit.

- US data: Durable goods orders rose +0.2% m/m, beating expectations of a -0.1% drop. While personal spending missed expectations at just +0.1% m/m, Core PCE (the Fed’s preferred inflation measure) did tick up to 1.8%, near the central bank’s 2.0% target.

- Commodities: Gold ticked lower on the day despite risk-off trading in other markets, while oil lost nearly 1% (though it did rally off the intraday lows on a lack of progress between the US and Iran)

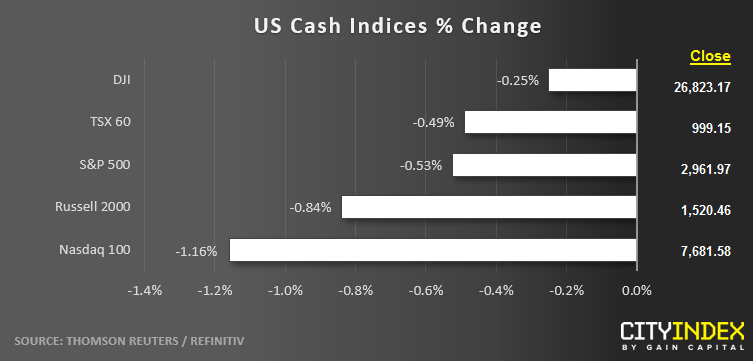

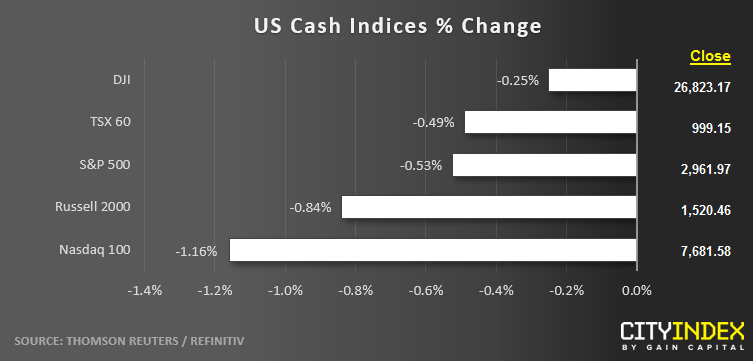

- US indices closed lower on the day, with the tech-heavy Nasdaq 100 leading the way to the downside.

- Financials (XLF) were the only sector to rise on the day, while the growth-heavy Technology (XLK) and Communication Services (XLC) sectors were the worst performers.

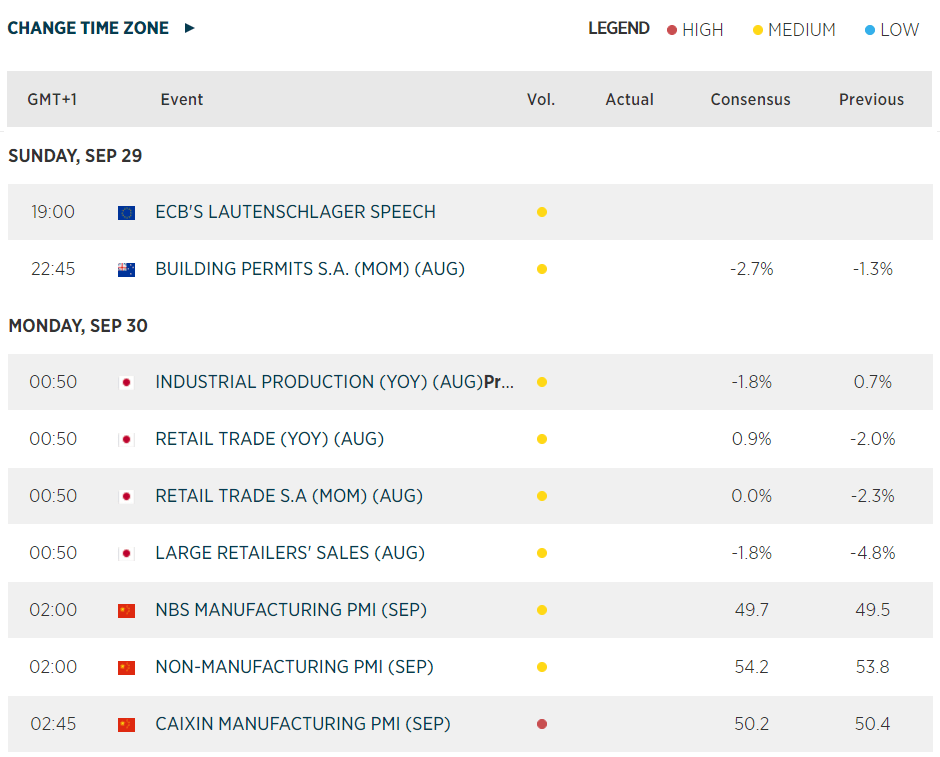

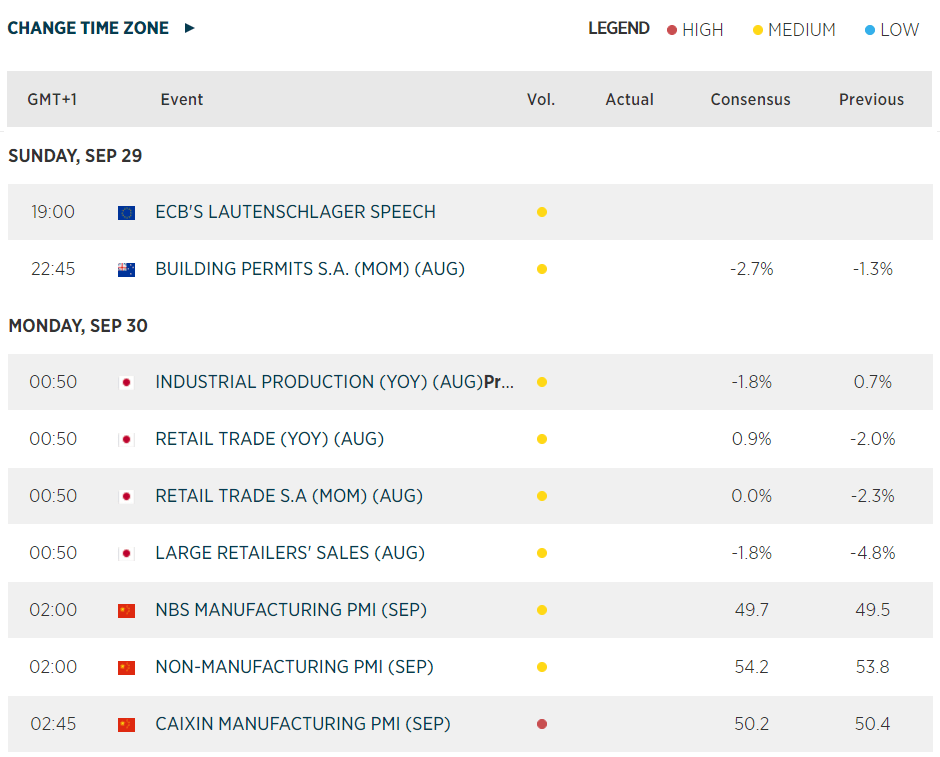

- See a full rundown of the key market events and trends we’ll be watching next week!

- Stocks on the move:

- Micron (MU) shed -11% today, despite reporting upbeat earnings, as traders were disappointed in the company’s forward guidance.

- Peloton (PTON) dropped another -2% in its second day of trading following yesterday’s IPO. The stock is now trading -13% down from Thursday’s IPO price of $29.

- Wells Fargo (WFC) gained 4% after naming banking veteran Charles Scharf as its new President and CEO.

- Alibaba (BABA) slumped -5% on news that the US government was looking into actions to limit US portfolio inflows into China.

Latest market news

Today 08:15 AM

Today 05:45 AM

Yesterday 11:09 PM