Market Brief: US Stocks Dip Alongside European Currencies in Quiet Trade

- The latest news in the US-China trade war is that the US is unlikely to extend waivers for companies to do business with Chinese handset maker Huawei.

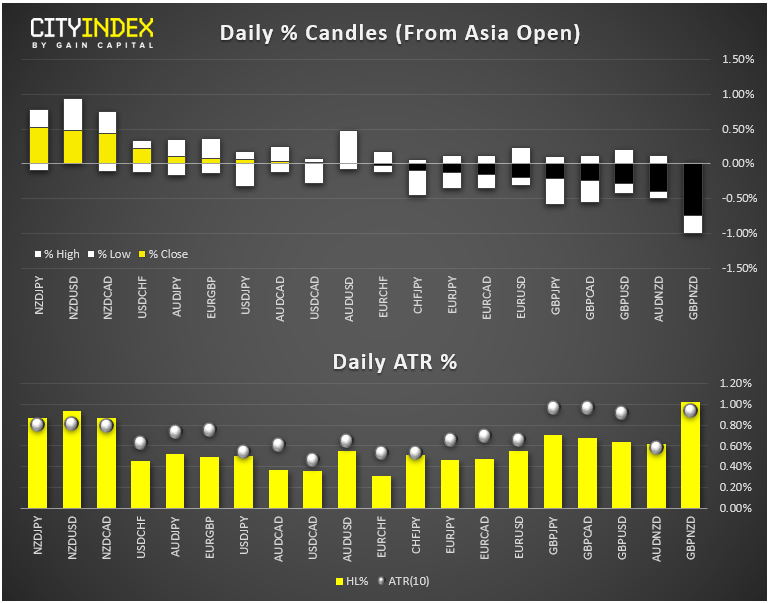

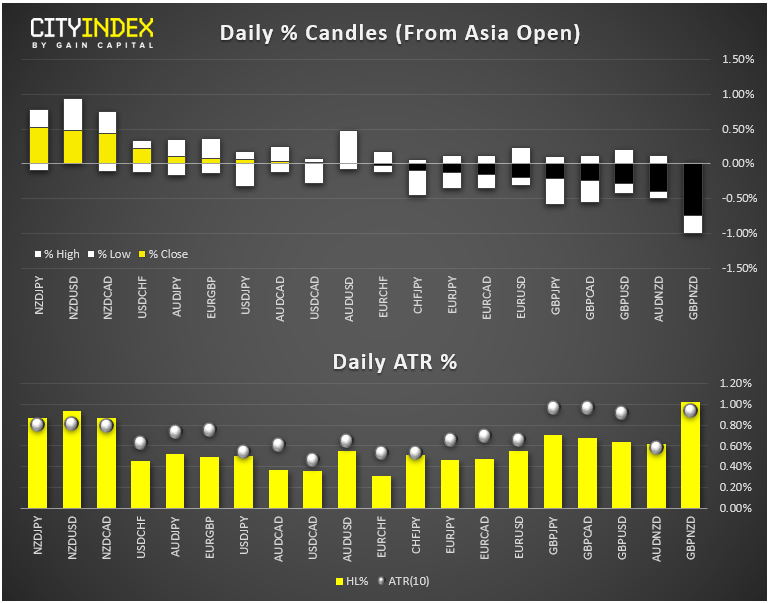

- FX: The kiwi was the strongest major currency on the day, while the Swiss franc brought up the rear. We’re also keeping a close eye on the breakdown in EUR/USD.

- This morning’s US data came out almost exactly as expected across the board: Q2 GDP (3rd reading) came in at 2.0% as anticipated, Weekly jobless claims printed at 213k vs. 212k eyed, and August trade balance was -72.8B vs. -73.4B expected, and pending home sales beat at 1.6% vs. 1.0% anticipated.

- Commodities: Gold and oil were essentially flat on the day.

- Cryptoassets took another leg lower today, with market benchmark Bitcoin briefly breaking below $8,000 before recovering back above that level as of writing.

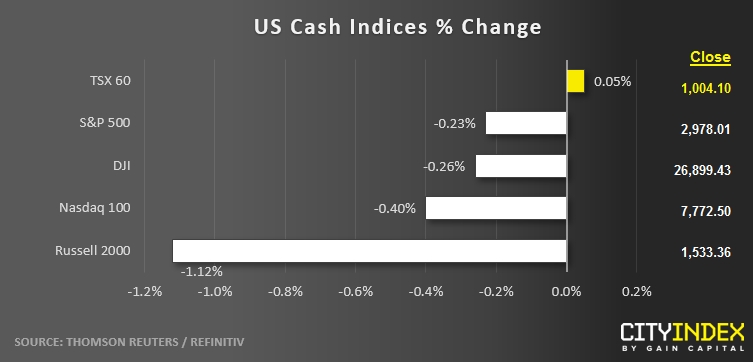

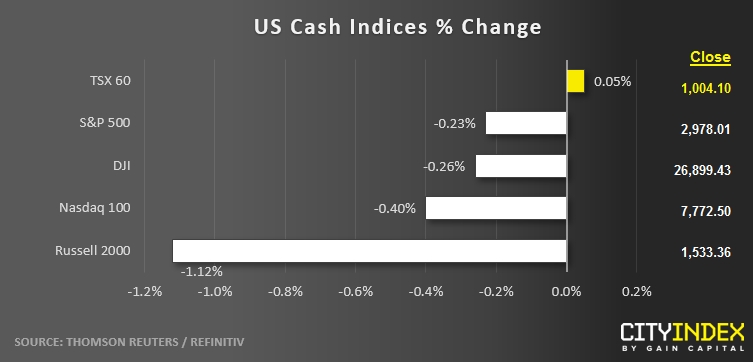

- US indices edged lower in quiet trade today.

- REITs (XLRE) were the strongest sector on the day while Energy stocks (XLE) were the weakest.

- Stocks on the move:

- Beyond Meat (BYND) tacked on 12% after McDonald’s (MCD, +0%) announced it would be testing Beyond burgers in Ontario.

- Rite Aid Corporation (RAD) tacked on 3% after reporting better-than-expected Q2 earnings.

- Peloton (PTON) dropped -11% in its first of trading as a public company.

Latest market news

Yesterday 08:33 AM