Market Brief: US Shrug Off AMZN’s Miss, Approach Record Highs

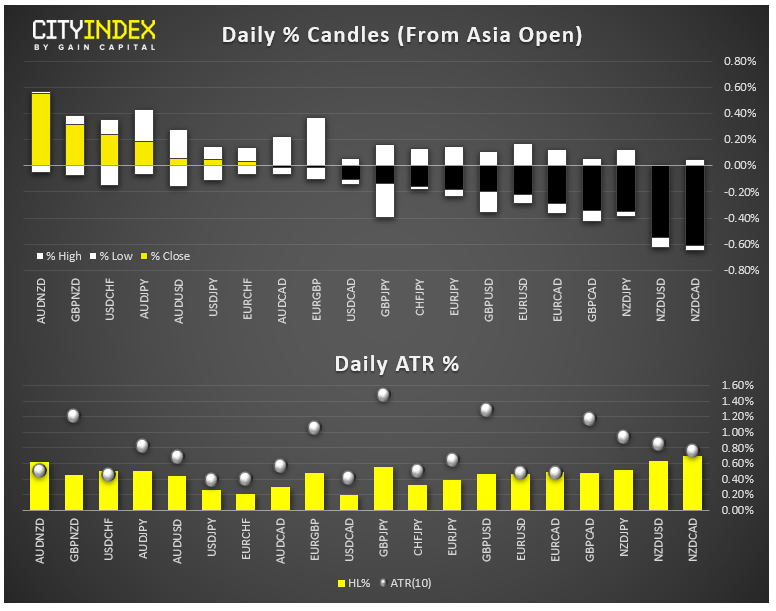

View our guide on how to interpret the FX Dashboard.

- US officials struck an optimistic tone on the “Phase One” trade deal with China, noting that they were close to finalizing some sections of the agreement following a call between the two trade teams.

- The EU and UK remain at loggerheads over a possible Brexit extension, with each side waiting for the other to clarify its position before making a decision – watch for fireworks over the weekend and early next week!

- FX: The Canadian dollar was the strongest major currency on the day, while the New Zealand dollar brought up the rear.

- Commodities: Oil gained nearly 1% today. Gold was essentially flat.

- Bitcoin and other cryptoassets surged more than 10% after Chinese President Xi Jinping endorsed blockchain technology.

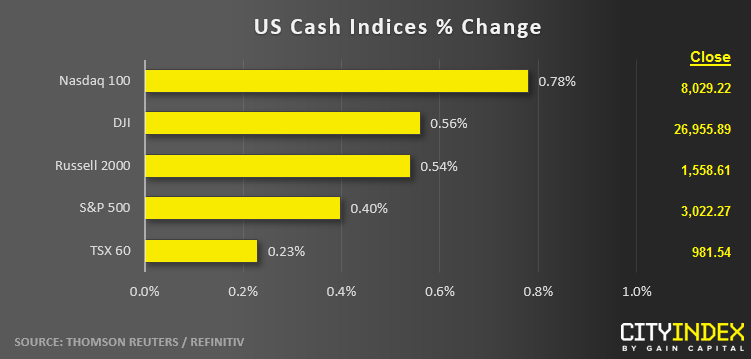

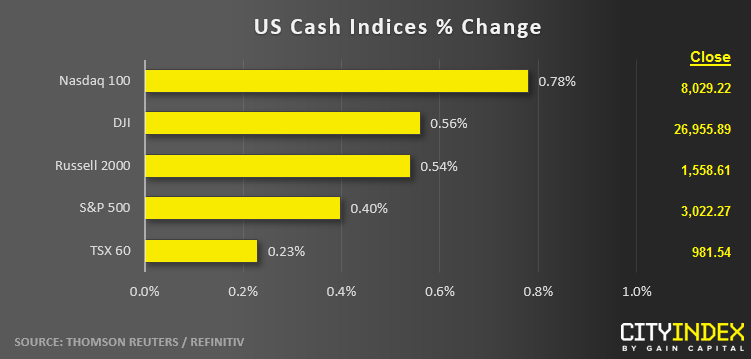

- US indices closed solidly higher in a risk on day, within striking distance of July’s record highs.

- Technology (XLK) was the strongest major sector again today, gaining more than 1%. REITs (XLRE) were the weakest with a more than -1% loss.

- Stocks on the move:

- Intel (INTC) gained 8% following an earnings “trifecta” (beat on profits, revenues, and raised guidance).

- Amazon (AMZN) gapped sharply lower but ultimately closed down just -1% after missing on both earnings and guidance after the bell yesterday.

*There are no high-impact macroeconomic events scheduled for release during Monday’s Asian session trade.

Latest market news

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM