FX Brief:

- RBA minutes shows they discussed keeping cuts for an emergency at this month’s meeting (when they cut anyway). There was little reaction from AUD, although eyes are no on Australia’s employment data on Thursday to see if it will increase the odds of another cut.

Chinese inflation rose 3% YoY, above 2.9% expected although PPI declined -1.2% YoY as forecast (-0.8% prior). - Trump imposed steel tariffs on Turkey late on Monday night and threatened there could be more, following Turkey’s movement into Syria. Trump is also reported to be meeting with Erdogan next week to demand a ceasefire, although no date has been set.

- GBP was slightly firmer on a BBC report that the EU were mulling a new emergency summit to “get Brexit deal done”.

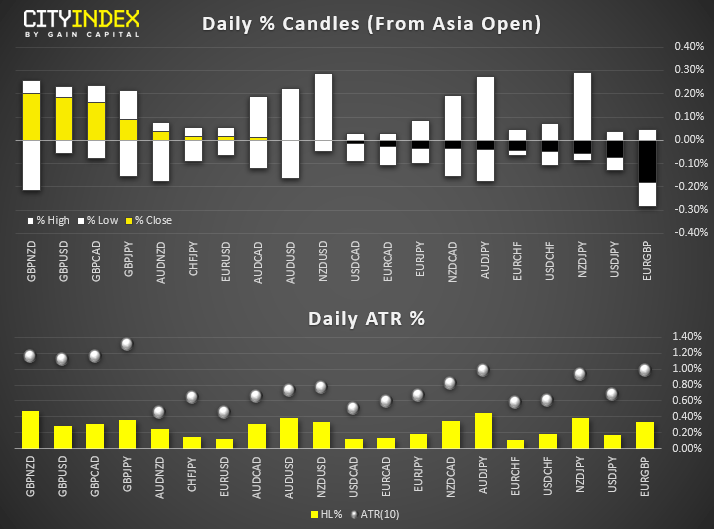

- Minor ranges in FX, GBP is currently the strongest major. USD/JPY is hovering around 108.30 after printing a bullish inside day yesterday (a potential continuation pattern). However, DXY remains under pressure but holding above the lower trendline of its bullish channel.

Equity Brief:

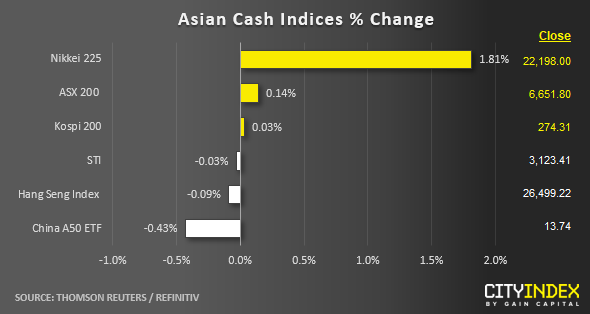

- Muted trading seen today in key Asian stock markets with the exception of Japan where the Nikkei 225 has staged a “catch up” rally of 1.81% due to a national holiday closure yesterday.

- China has continued to pour “cold water” over last Fri’s trade talk as Chinese officials wants to hold more talks to hammer out the details before China President Xi agrees to put the “phase one” into signature. In additional, lacklustre producer prices seen in China also give the excuse for profit-taking activities. China’s producer price index has fallen to -1.2% y/y in Sep, the third consecutive month of negative y/y growth and the steepest decline recorded over three years.

- The focus will now shift to Europe where UK and EU officials will meet at a make-or-break summit this Thurs and Fri that will determine whether UK is headed for a no-deal Brexit at the end of this month.

- Also, U.S. Q3 earnings reporting session kickstarts this week by releases from key financials firms; Citigroup, JP Morgan, Goldman Sachs and Wells Fargo will report earnings today. Bank of American’s earnings due on Wed.

- Earnings from the U.S. industrial sector will be scrutinised as well where U.S. manufacturing activity has tumbled to a more than 10-year low in Sep as per surveyed by ISM. Industrial firms are also among those most at risk from the on-going U.S.-China trade war. CSX Corp will report on Wed follow by Honeywell International on Thurs.

- After a thin trading session seen in the U.S. stock market overnight due to Columbus Day, the S&P 500 E-Mini futures has inched up higher by 0.25% in today Asian session to print a current intraday high of 2973.

Up Next

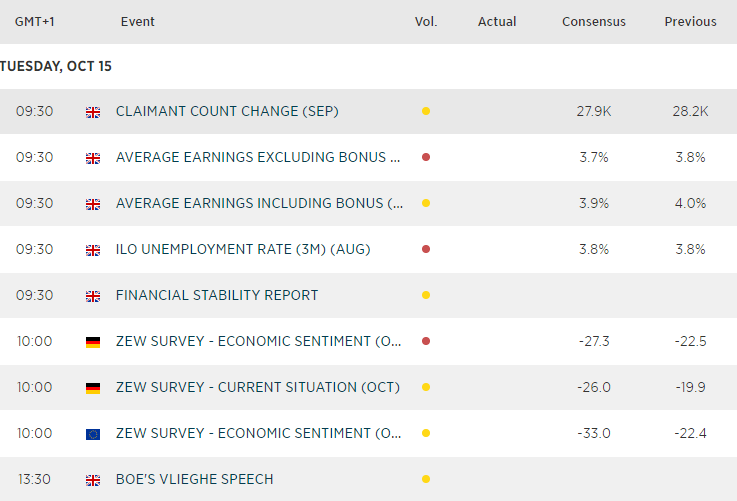

- UK unemployment is expected to remain at multi-decade lows of 3.8%. Typically, unemployment tends to change by +/- 0.1 ticks so, given its long-term downtrend and extremely low level it would likely take a +0.2 rise for it to make a material impact on GBP.

- UK earnings hit 4% for the first time since 2008, although hiring slowed as we approach the latest Brexit deadline.

- The German and Eurozone ZEW economic sentiment reads made a surprise bounce in September, although they remain firmly pessimistic overall. Given raised hopes of Brexit deal ahead of the weekend, perhaps we’ll see it rebound a little further. Either way, its strength of weakness can have a direct impact in EUR crosses should they deviate too from expectations.

Matt Simpson and Kelvin Wong both contributed to this article

Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.Latest market news

Today 08:15 AM

Today 05:45 AM

Yesterday 11:09 PM

Yesterday 11:01 PM