Market Brief: US Indices Break Out, Bulls Eye Record Highs

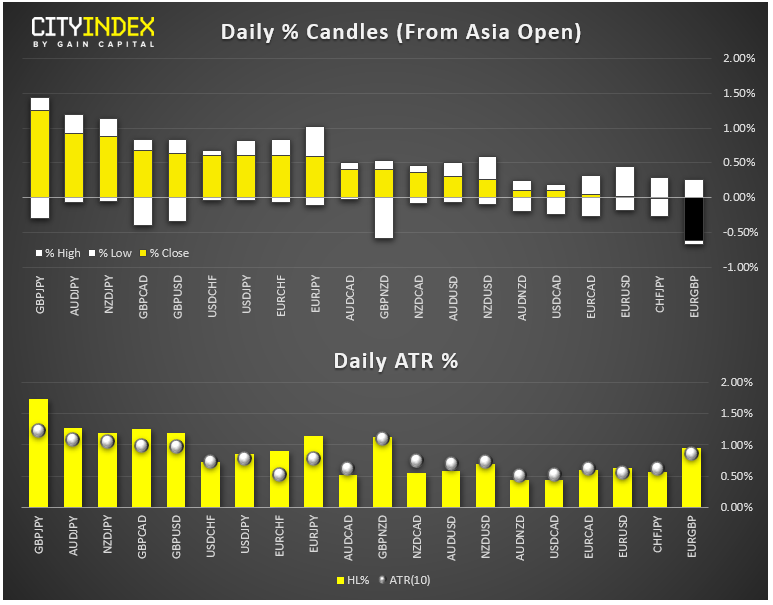

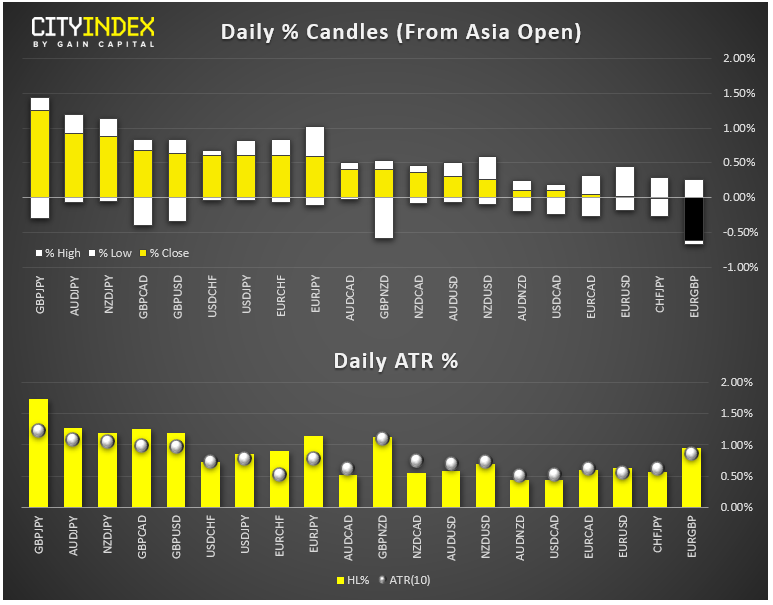

- FX: The pound was once again the strongest major currency as traders grew increasingly confident that Brexit would be delayed again (much to PM Johnson’s chagrin, as he claimed he’d rather “be dead in a ditch” than delay Brexit). The safe haven Japanese yen and Swiss franc were the weakest major currencies in risk-on trade.

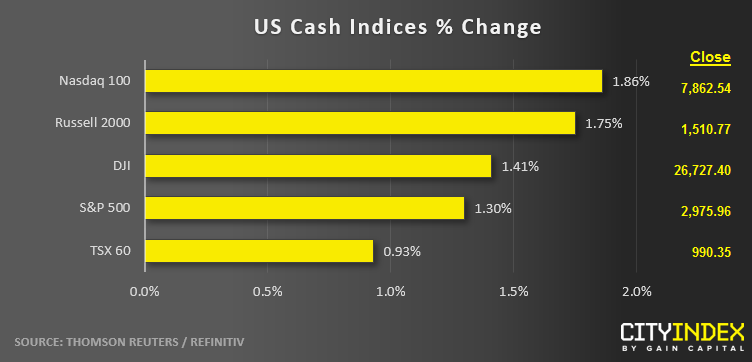

- Confirmation of a resumption in US-China trade talks boosted risk appetite across the globe today, with China’s Global Times editor Hu Xijin (seen as a mouthpiece for the Chinese government) noting that “there’s more possibility of a breakthrough” from these talks.

- US data: Both the ADP employment report (195k vs. 148k eyed) and ISM Non-Manufacturing PMI report (56.4 vs. 54.0 eyed) beat expectations today, though the employment component of the ISM report did drop 3 points in a negative sign ahead of tomorrow’s NFP report. US initial jobless claims came in near expectations at 217k.

- Commodities: Gold shed over 2% amidst risk-on trade. Oil finished the day marginally lower.

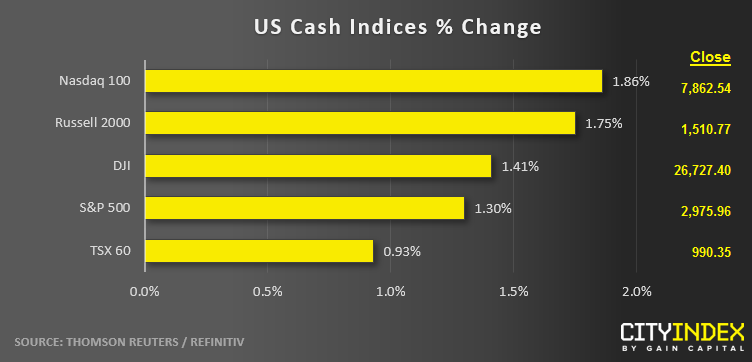

- US indices gained about 1.5% across the board to break out of their 1-month sideways ranges.

- Financials (XLF) were the strongest sector on the day, while higher-yielding REITs (XLRE) and Utilities (XLU) were the weakest sectors.

- Stocks on the move:

- Slack Technologies (WORK) reported a larger-than-expected loss, but recovered to trade just -3% lower on the day after initially falling by more than 10%.

- Signet Jewelers (SIG) surged 26% off a record low after beating on earnings and raising full-year guidance.