Market Brief: US Dumps All Its Data Ahead of Thanksgiving Holiday

View our guide on how to interpret the FX Dashboard.

*Note that there will not be a US version of the Market Brief on Thursday or Friday due to the Thanksgiving holiday.*

- US data: The first revision of Q3 GDP data came in at +2.1% vs. +1.9% eyed. Durable Goods Orders (Oct) rose +0.6% m/m, beating expectations of a -0.9% decline (Core Durable Goods also beat expectations). Pending Home Sales (Oct) fell -1.7% vs. a +0.2% reading eyed. Personal Spending (Oct) rose 0.3% m/m as anticipated. Finally, weekly jobless claims printed at 213k, below the 221k reading eyed.

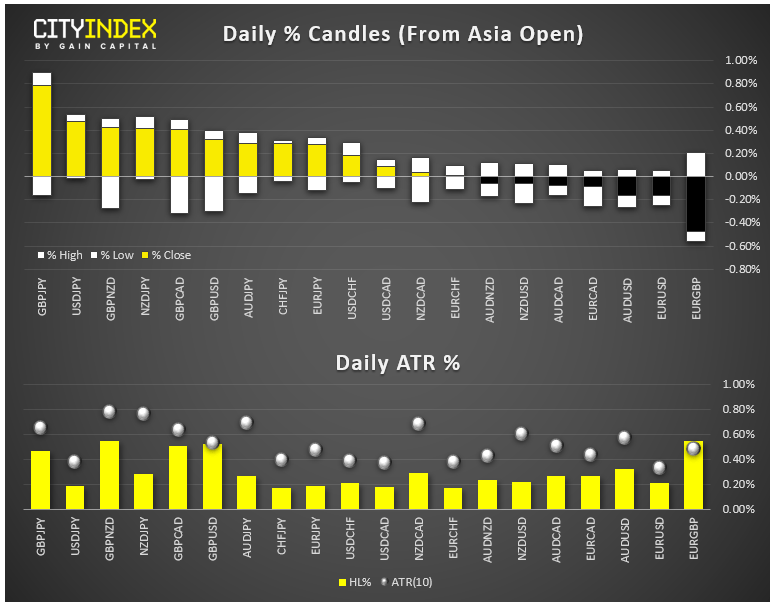

- FX: The pound was the day’s strongest major currency despite Labour reportedly gaining ground in the most recent YouGov poll while the Japanese yen brought up the rear.

- USD/JPY hit its highest level since May near 109.50, and USD/CHF tagged the parity (1.00) level for the first time since early October.

- Commodities: Both gold and oil edged lower on the day, with the latter falling on the back of a larger-than-expected EIA inventories. Bitcoin bounced back $500 off its 6-month low.

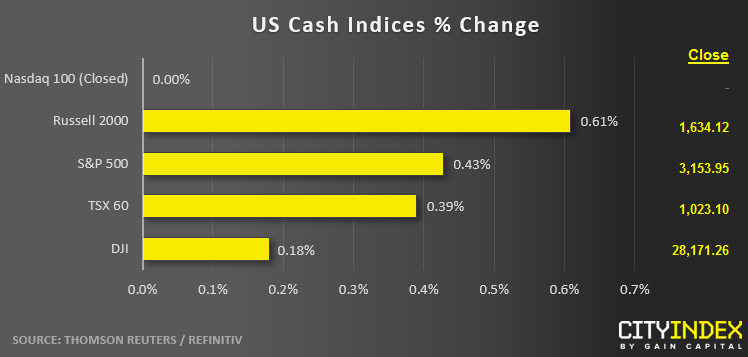

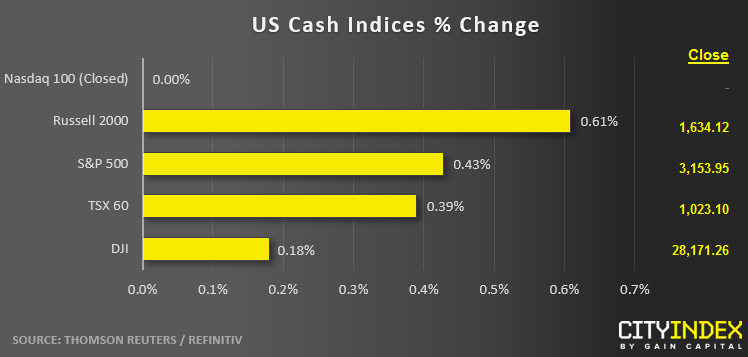

- US indices closed moderately higher in low liquidity, pre-holiday trade.

- Consumer Discretionary (XLY) stocks were the day’s best performers; Industrials (XLI) were the weakest, and the only major sector to fall on the day.

- Stocks on the move:

- Deere and Company (DE) fell -4% after reducing guidance in agricultural and construction sales in 2020.

- Manchester United (MANU) gained 12% after crosstown rival Manchester City was valued at nearly $5B.

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM