View our guide on how to interpret the FX Dashboard

FX Brief:

- China condemned the US “Hong Kong Human Right and Democracy Act” earlier passed by the US senate, and reiterated their commitment to the “one country, two systems” formula. Stating that the US should stop interfering in Hong Kong and China’s affairs, it could be the latest roadblock to the [in]famous phase-1 trade deal.

- Beijing added more stimulus by cutting their new benchmark lending rates again, a move which was widely expected according to a Reuters poll. Lower funding costs are aiming to bolster a slowing economy amid the ongoing US-China trade dispute.

- Exports from Japan contracted by -9.2% YoY (-7.6% forecast and -1.6% prior), making it the fastest contraction in 3 years. Not too surprisingly, shipments to US and China also fell. With their economy moving closer to a recession, Japan’s economy minister pledges to provide a ‘sizeable’ economic stimulus package. It also raises the odds of easing from BOJ who are now deciding whether to pull the trigger on a meeting-by-meeting basis.

- AUD and NZD are the weakest majors, JPY and CHF are the strongest amid a mildly risk-off session. Carry trades such as AUD/JPY and NZD/CHF are the weakest pairs of the session, although volatility has remained contained with most pairs ranging just 50% of their 10-day ATR. Trade-tease fatigue springs to mind….

Equity Brief:

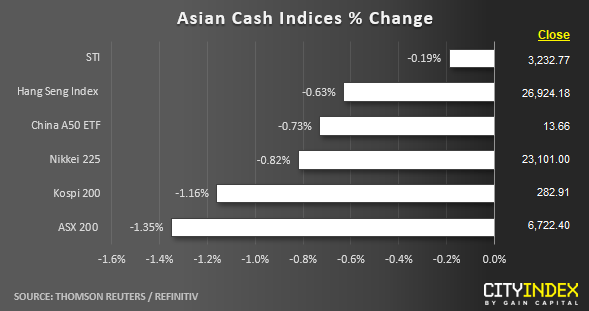

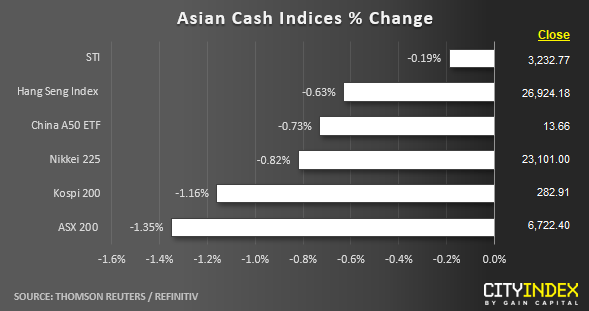

- Key Asian stock markets are all trading in the red today as U.S-China trade related woes have resurfaced via an indirect channel. The U.S. Senate has passed the Hong Kong Human Rights & Democracy Act unanimously that supports Hong Kong anti-government protestors. China has voiced displeasure and raised warning of retaliation that can complicate the negotiation process of ironing out the final parts of the “Phase One Trade Deal” before another tranche of U.S. tariffs on Chinese imports kicks in on 15 Dec.

- Also, the USD/CNH (offshore Yuan) has continued it inch higher to retest a 5-day high at 7.0430 that has also triggered the current risk off behaviour in stocks.

- Japan’s exports fell 9.2% y/y in Oct, below consensus estimates of a 7.6% y/y drop that has marked the steepest decline in three years. The lacklustre export data has been driven by plummeting shipments of cars and aircraft engines to U.S. and plastic materials to China.

- The worst performer as at today’s Asia mid-session comes from one of the significant gainers from yesterday, Australia’s ASX 200 that has dropped by -1.40% and wiped out 3 days of prior gains. Localised factor is in play that has exacerbated the decline where Westpac Banking Corp has been slapped by regulators with 23 million of anti-money laundering breaches that dragged down the entire financial sector. Shares of Westpac Banking has tumbled by -3.24% coupled with significant losses seen in the remaining “Big 3” (CBA -1.67%, NAB -2.31% & ANZ -1.93%).

- Latest media report according to sources on the mega secondary listing of Alibaba shares in Hong Kong will be priced at HK$176 per share. In the secondary listing, eight Alibaba’s Hong Kong listed shares will be equal to one Alibaba’s New York listed ADS. Based on yesterday, 19 Nov closing price of Alibaba’s New York ADS (BABA) of US$185.25, Hong Kong’s Alibaba listed price will be at a 2.9% discount to their New York share price in USD terms.

- The S&P 500 E-mini futures has continued to inch lower in today’s Asian session by -0.14% and printed a current intraday low of 3108.

Up Next

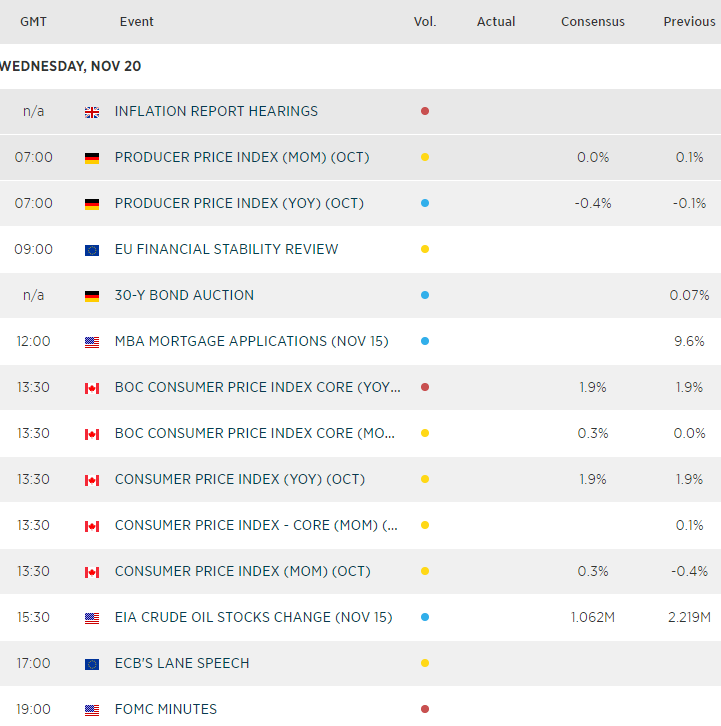

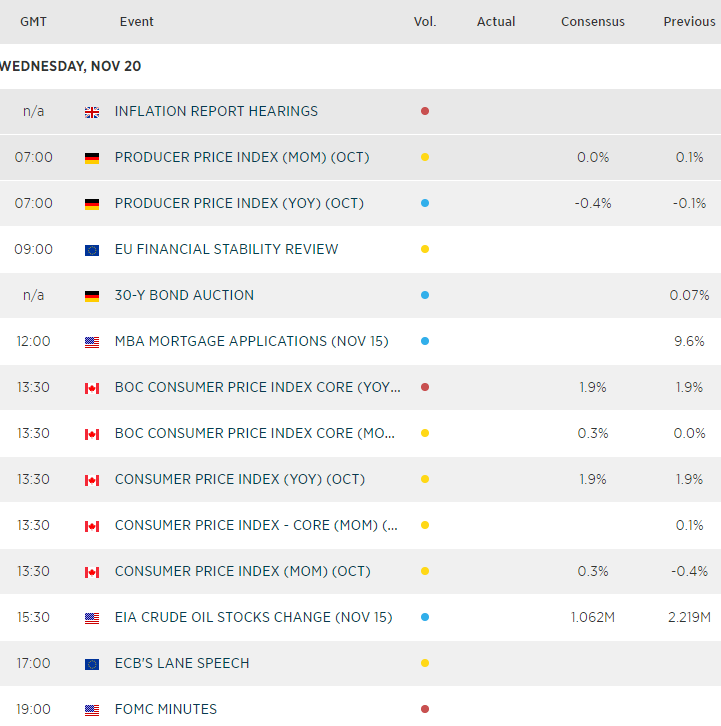

- Canada CPI for Oct out at 1330 GMT – consensus estimates are set at 1.9% y/y and 0.3% y/y for core CPI, a significant lower print may see downside pressure on the CAD that can alter Bank of Canada’s neutral stance on monetary policy where Canada’s policy interest rate has remained unchanged for more than a year.

- Fed FOMC minutes out at 1900 GMT – In the recent weeks, Fed Chair and several officials have guided market participants towards a “wait and see” approach in terms of monetary policy after three rounds of interest rate cuts. Thus, minutes may not alter the near-term policy outlook on interest rates.

Matt Simpson and Kelvin Wong both contributed to this article

Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.Latest market news

Today 08:33 AM