Market Brief: Trump’s Speech Fails to Inject Volatility

View our guide on how to interpret the FX Dashboard.

- In a speech to the Economics Club of New York, President Trump generally praised the US economy and repeated his view that the Fed should continue to cut interest rates. Trump offered no noteworthy insights on the trade war with China. Later, economic adviser Kudlow refused to put a timeline on a US-China trade deal.

- Another front in the trade war? Fox Business reported that US trade representatives will submit a report on possible tariffs on EU automakers as soon as tomorrow.

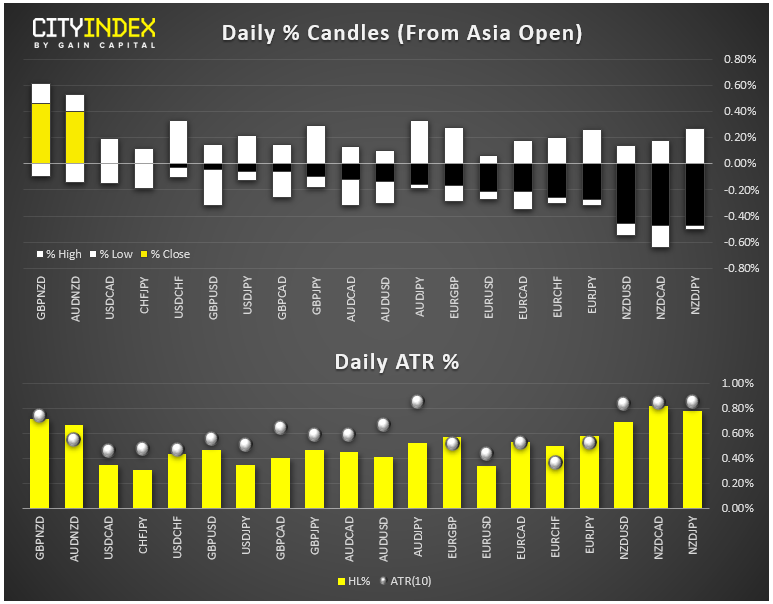

- FX: The Japanese yen and Swiss franc were the strongest major currencies on the day, while the New Zealand dollar was the weakest.

- Commodities: Both gold and oil edged lower in quiet trade.

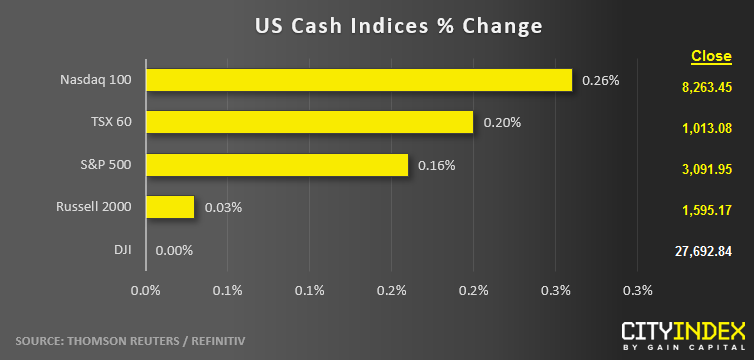

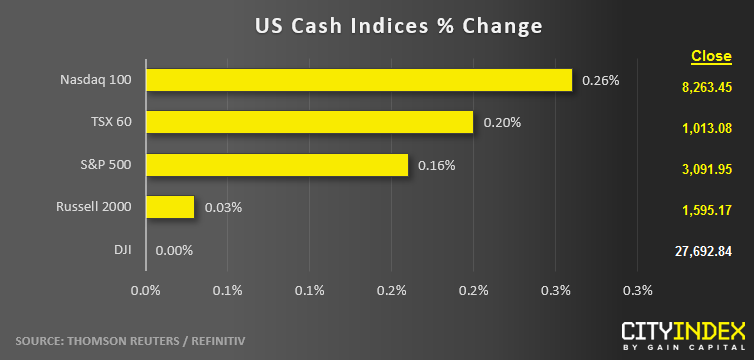

- US indices closed modestly higher in another low volatility session.

- Health Care stocks (XLV) were the strongest sector on the day; Energy stocks (XLE) were the worst.

- Stocks on the move:

- Walt Disney (DIS) rose 1% today despite some reports of access problems for the first day highly-anticipated Disney+ streaming service. Of course, a service having too many first-day users is probably a good sign long-term!

- Tyson Foods (TSN) was able to shrug off a disappointing earnings report to rise 7%.

- Homebuilder D.R. Horton (DHI) tacked on 3% after reporting an earnings trifecta (better earnings, revenues, and raised guidance).

- This week will be a big one for cannabis stocks – see our full earnings preview report!