- European stocks and US index futures extended their losses after Donald Trump raised fresh doubts over the US-China trade deal. The US President suggested the deal may have to wait until after the US election in November 2020. At a London press conference, Trump said: “In some ways I like the idea of waiting until after the election for the China deal." However, the losses were contained because of contradictions in his remarks – for example, he had earlier said talks were progressing "very well with China” and that Beijing wanted to do a deal now. However, the markets were spooked as these headlines hit the wires:

- TRUMP SAYS CHINA TRADE DEAL IS DEPENDENT ON WHETHER I WANT TO MAKE IT

- TRUMP SAYS I HAVE NO DEADLINE ON TRADE

- TRUMP SAYS PROBABLY BETTER TO WAIT UNTIL AFTER THE ELECTION FOR THE CHINA DEAL

- TRUMP SAYS WE WILL SEE WHETHER THE CHINA DEAL IS GOING TO BE RIGHT

- TRUMP SAYS I HAVE NO DEADLINE ON CHINA DEAL AND IT MIGHT BE BETTER TO WAIT UNTIL AFTER NOVEMBER 2020 ELECTION

- Was Trump bluffing again, in an effort to exert more pressure on China, after the latter retaliated against Trump signing the Hong Kong bill? Investors were having none of it and they sold European stocks sharply again this morning, although some mainland European indices such as the FTSE MIB and DAX were holding in the positive territory after yesterday’s massive slide. US stock index futures were sharply lower, along with risk-sensitive currency pairs such as the USD/JPY and EUR/JPY. Safe-haven gold and silver rose.

- CNH was among the weakest currencies, hurt by the latest US-China trade headlines. In other Emerging Market FX news, the South African rand dropped 1% against the US dollar as the nation’s GDP disappointed expectations with a print of -0.6% q/q which fell well short of expectations. But in Turkey, the rate of inflation rose 10.6% y/y in November from 8.6% in October. This ended a year-long downward trend in inflation, potentially creating a dilemma for the CBRT which, under the pressure of president Erdogan, has been reluctantly cutting interest rates from 24% to 14% currently. Erdogan wants to see further rate cuts.

- Talking of rate cuts, there was none in Australia as had been widely expected. The RBA decided to leave monetary policy unchanged and the Aussie dollar responded by extended its gains from the day before, when stronger Chinese manufacturing PMI data had boosted the commodity dollar. Interestingly, the AUD and NZD were once again ignoring the sell-off in the stock markets, although the CAD weakened further ahead of the BOC rate decision on Wednesday.

- GBP managed to extend gains as activity at UK’s construction sector continued to contract in November, albeit as a slower pace. The latest construction PMI printed 45.3 versus 44.5 expected and 44.2 last. This was the 7th consecutive month of sub-50.0 readings. This comes as Moody’s decided to lower its outlook on the UK banking system from stable to negative. The ratings agency said Brexit uncertainty has eroded “the country’s growth prospects” and low interest rates are hitting lenders’ profitability. Nonetheless, the pound was able to touch the $1.30 handle, as investors continued to ignore deteriorating fundamentals amid optimism that the upcoming UK elections will put an end to years of Brexit uncertainty, which, in turn, should kickstart an economic recovery.

View our guide on how to interpret the FX Dashboard

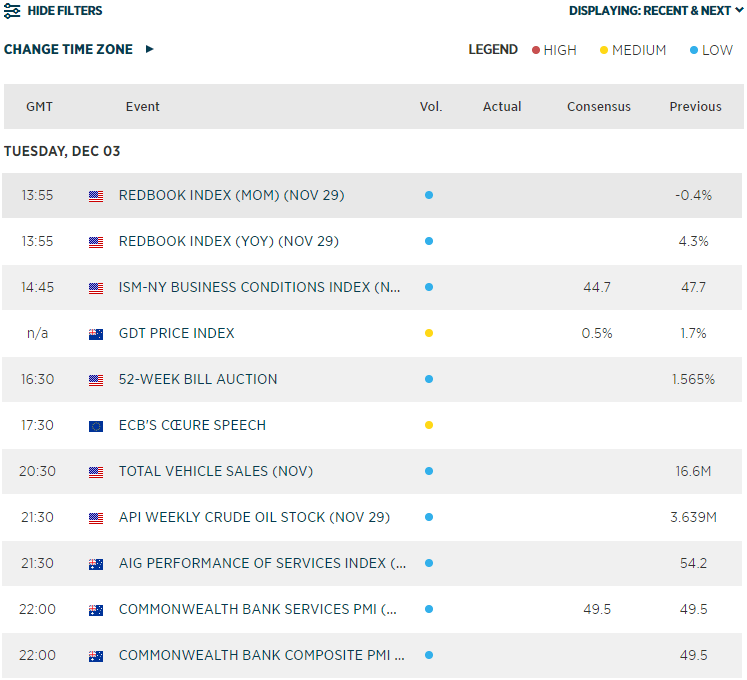

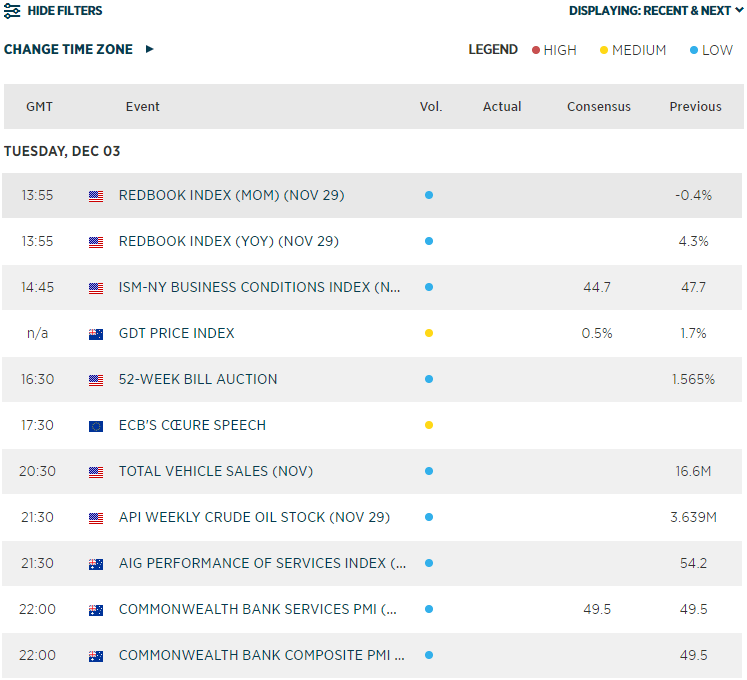

- Coming up later:

Latest market news

Yesterday 11:48 PM

Yesterday 11:16 PM

Yesterday 05:00 PM