FX Brief:

- Optimism surrounding trade talk progress between US and China saw AUD and NZD extend their rallies, stopping just short of key resistance levels. Given the extend of gains this past week, it’s possible we could see some profit taking around current levels.

- After a shaky start, Just Trudeau looks set to retain power in the Canadian elections. Yet with only 157 seats under his belt (below the 170 threshold for a majority) there’s no majority government on the horizon. The Canadian dollar is stronger over the session, seeing CAD/JPY hit a 3-month high and USD/CAD touch a 3-month low.

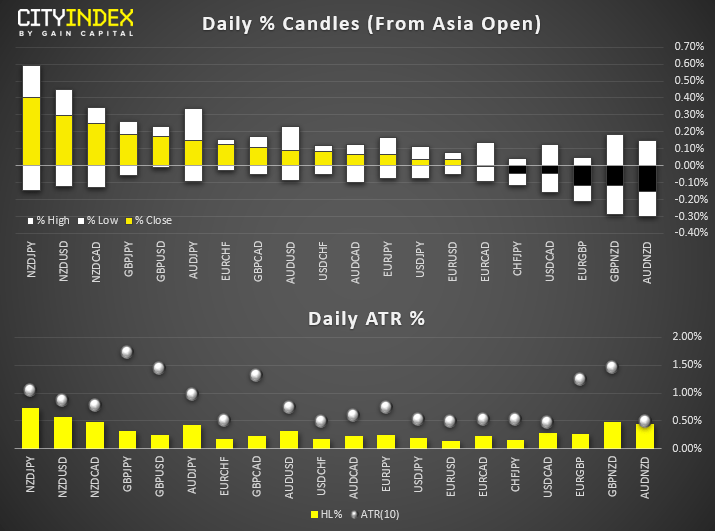

- NZD and GBP are the strongest majors, CHF is the weakest.

- A day of compression overall, with the majority of FX pairs we track remaining well beneath their daily ATR’s. With economic data relatively light, we could find ranges to be smaller unless headline risk provides a catalyst for markets. That said, with Canadian retail sales out it puts CAD crosses into focus, particularly if it is a strong miss given CAD pairs are arguably overstretched over the near-term.

Equity Brief:

- Asian stock markets have taken the cue from the positive performances seen on the key U.S. benchmark stock indices overnight where the S&P 500 and Nasdaq 100 have rallied by 0.70% and 0.90% respectively. “Trade deal optimism” has taken the centre stage again over Brexit uncertainties as U.S. President Trump has commented that trade negotiations are in progress that has raised the expectation of the “Phase One” U.S.-China trade deal to be signed off in Nov.

- The top performer today is South Korea’s Kospi 200 that has rallied by 1.41% led by semiconductor heavy weights; Samsung Electronics and SK Hynix that have soared by 1.5% and 2.00% respectively in line with stellar performance seen in U.S. semiconductor stocks overnight. The U.S. PHLX Semiconductor Sector Index that comprises 30 stocks has recorded a gain of 1.90%.

- Singapore’s stock market bulls have awoken as well for today where Straits Times Index (STI) has rallied by 0.80% so far on the back drop of mergers and acquisition headlines.

- Keppel Corporation has jumped up to 15% after a surprise S$4 billion partial offer from Singapore’s state owned Temasek that will raise its stake in Keppel Corporation to 51%. The latest action from Temasek has increased market speculation that there might be consolidation soon in Singapore’s offshore and marine sector (Q&M). Another Q&M stock, Sembcorp Marine has continued to rally by 1.50% today after it rocketed 11.6% yesterday. Temasek also has an indirect stake in Sembcorp Marine via its parent firm, Sembcorp Industries.

- The S&P 500 E-Mini futures has managed to consolidation its overnight U.S. session gains in today’s Asian session as it holds above the 3000 psychological level and inched up higher by 0.20% to print a current intraday high of 3014.

Up Next

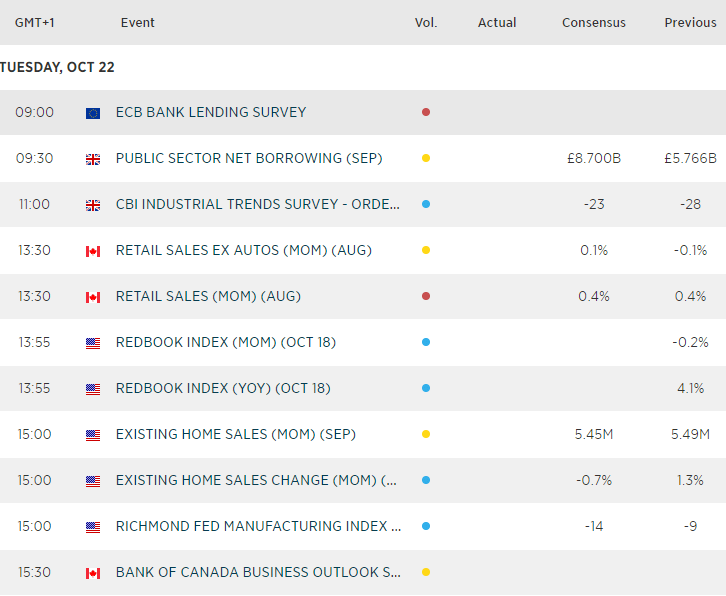

- Canadian retail sales puts CAD pairs into focus, right after the election. Expected to remain steady at 0.4% MoM, it could take a read at 0.2% or lower to have a materially negative impact on CAD, given it is currently supported by a Trudeau win and improved relations between US and China.

- However, we’ll also keep an eye on BOC’s quarterly business outlook survey as it will provide them with a pulse check over investment and sentiment from the sector. And therefor likely direction of their economy and monetary policy. Given their rates remain relatively high and one of the few developed nations to not be easing, then any whiff of weakness form the business sector could change sentient towards the Canadian dollar.

Matt Simpson and Kelvin Wong both contributed to this article

Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.Latest market news

Today 08:33 AM