FX Brief:

- Ahead of trade talks, White House advisor Peter Navarro has listed “seven deadly sins” from China; Cyber attacking, IP theft, forced technology transfer, goods trade balance, China state-owned subsidies, FX manipulation and fentanyl shipped to “kill countless Americans”.

The US are to hit Europe with a 10% tariff on European-made Airbus plan and 25% on French wine, Scotch and Irish Whiskey and continental cheese. - Fed Williams see’s monetary policy as “in the right place”, although the outlook for the economy is mixed. On tariffs he sees risks to the economy as relatively modest.

- Australian exports fell -3% in September and weighed on their surplus. Yet it still touched a marginal 2-day high following yesterday’s bullish doji at multi-year lows.

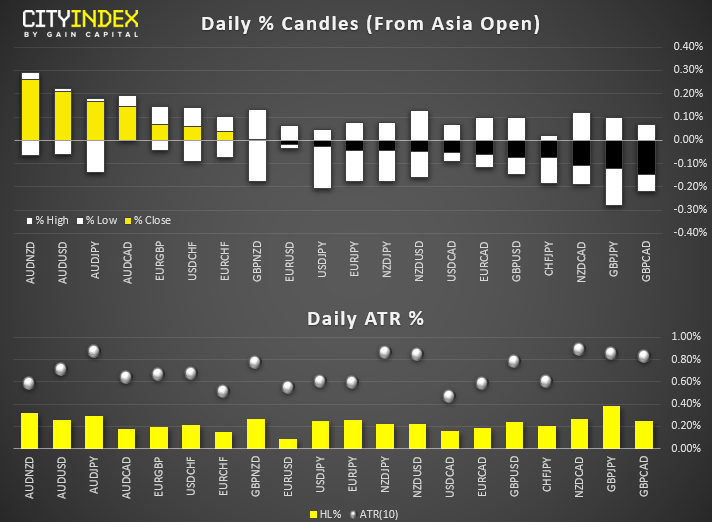

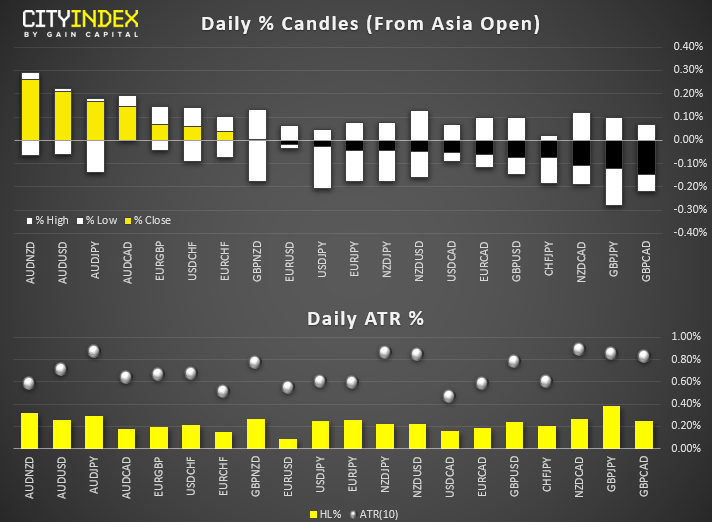

- Minor ranges overall, AUD is the strongest major, elsewhere majors remain in low-ranging holding patterns.

Equity Brief:

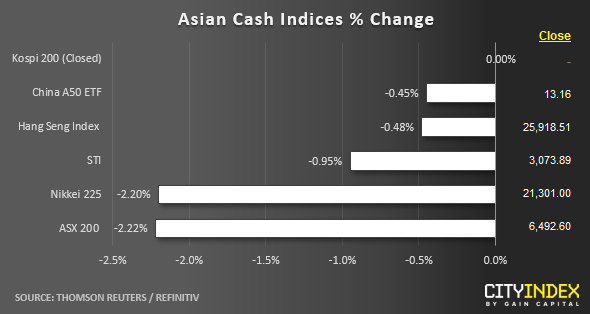

- Asian stock markets have continued to see further downside, taking the cue from another bloodbath seen overnight in the U.S. stock markets. In additional, the U.S. benchmark stock index, S&P 500 has seen its first back to back drop of more than 1% in 2019. South Korea’s Kospi 200 has managed to “escape” the bleeding as its stock exchange is closed today for a public holiday.

- One of the worst performers as at today’s Asian mid-session is Japan’s Nikkei 225. It shed 2.20% in line with a stronger JPY where the USD/JPY hit a 3-day low of 107.00. Also, latest data on Japan’s services sector for Sep has indicated a slow-down in growth over Aug where the Jibun Bank Japan Services PMI dropped to 52.8 from 53.3 seen in August.

- The slowdown in growth seen in Japan’s services sector, the main driving force so far in order to maintain a positive economic growth to offset the negative impact from a 9-month export slump is a concern to market participants. The government has just imposed an increase in sales tax to 10% from 8% that came into effect on 01 Oct which can lead to a slowdown in future domestic consumption where the services sector is dependent on.

- Australia’s ASX 200 also sees further downside as it tumbled by -2.23% to print a 4-week low of 6475 led by technology and energy stocks that has declined by -2.50% and -3.02% respectively.

- Adding salt to the on-going negative sentiment, the U.S. administration has decided to hike tariffs on European produces; 10% tariffs on European aircrafts and 25% duties on other goods such wines and cheese as punishment for illegal EU aircraft subsides.

- After a 2-day decline of 3.5% in the S&P 500 to print a low of 2875 seen yesterday, the S&P 500 E-Mini futures has traded sideways in a tight range of 9 points so far in today’s Asian session.

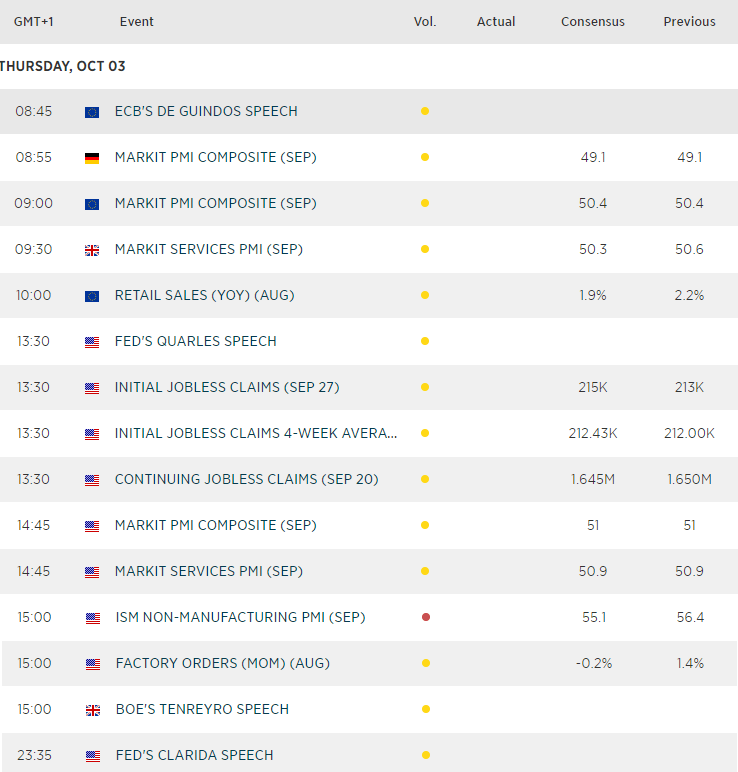

Up Next

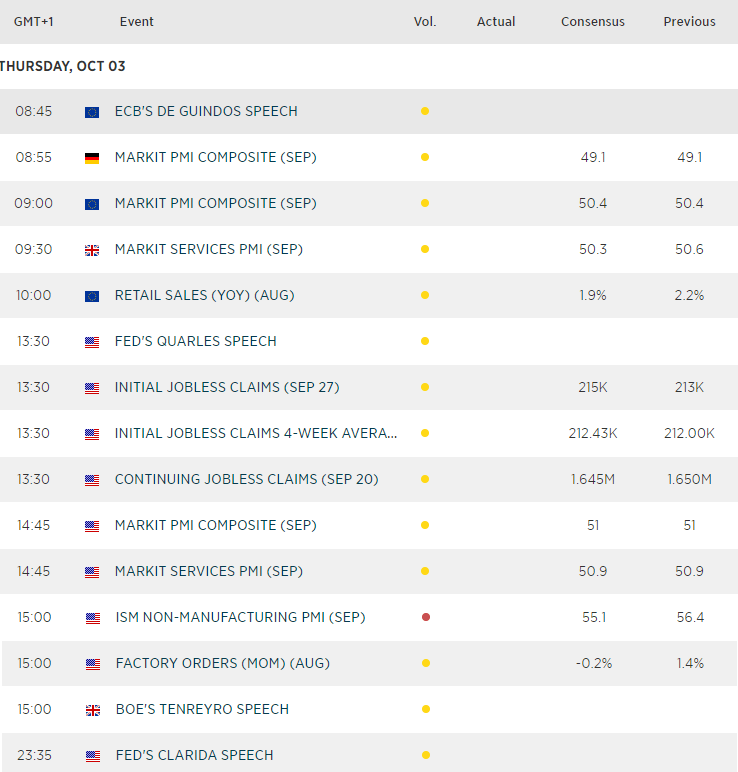

- Final PMI reads for France, Germany and the Eurozone are released early in the European session. Major revisions aren’t expected but if they are lowered, it simply feeds into the negative sentiment regarding global growth, Keep Euro crosses and DAX on your radar.

- However, the highlight could be ISM’s non-manufacturing PMI for the US. Given we saw ISM manufacturing tank to a 10-year low this week, Non-manufacturing (NM PMI) could receive extra scrutiny. Although NM PMI has remained expansive since the GFC, a slower rate of expansion points towards a broader slowdown and could exacerbate risk-ff sentiment if it slows enough later today. Therefor a weak print could weigh on USD and US indices.

Matt Simpson and Kelvin Wong both contributed to this article

Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.