Market Brief: Traders Shrug Off Impeachment Headlines

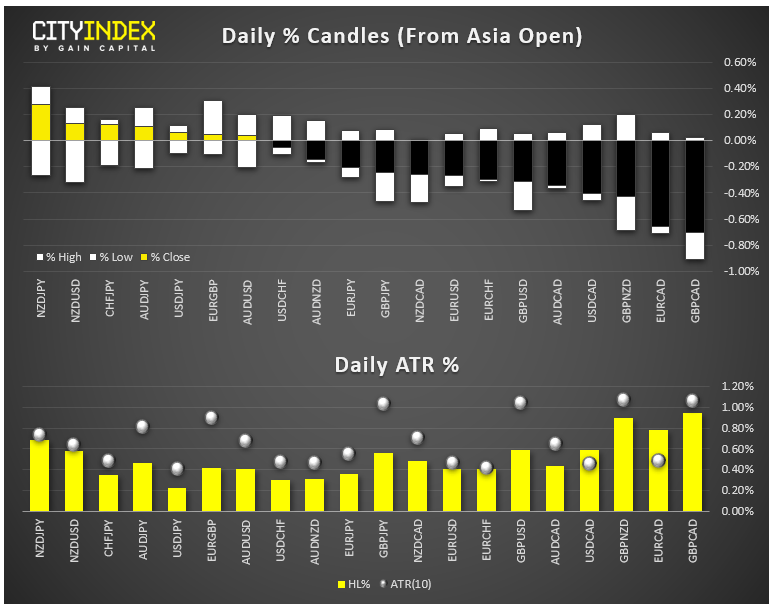

View our guide on how to interpret the FX Dashboard.

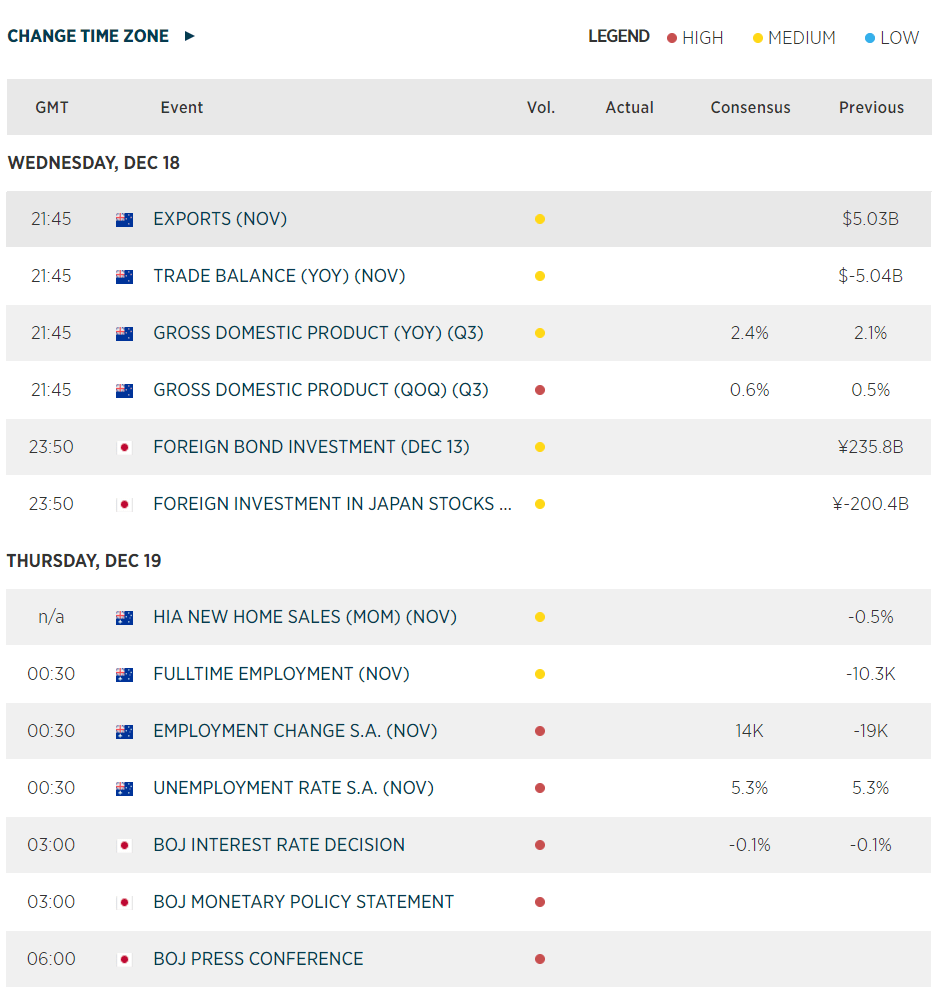

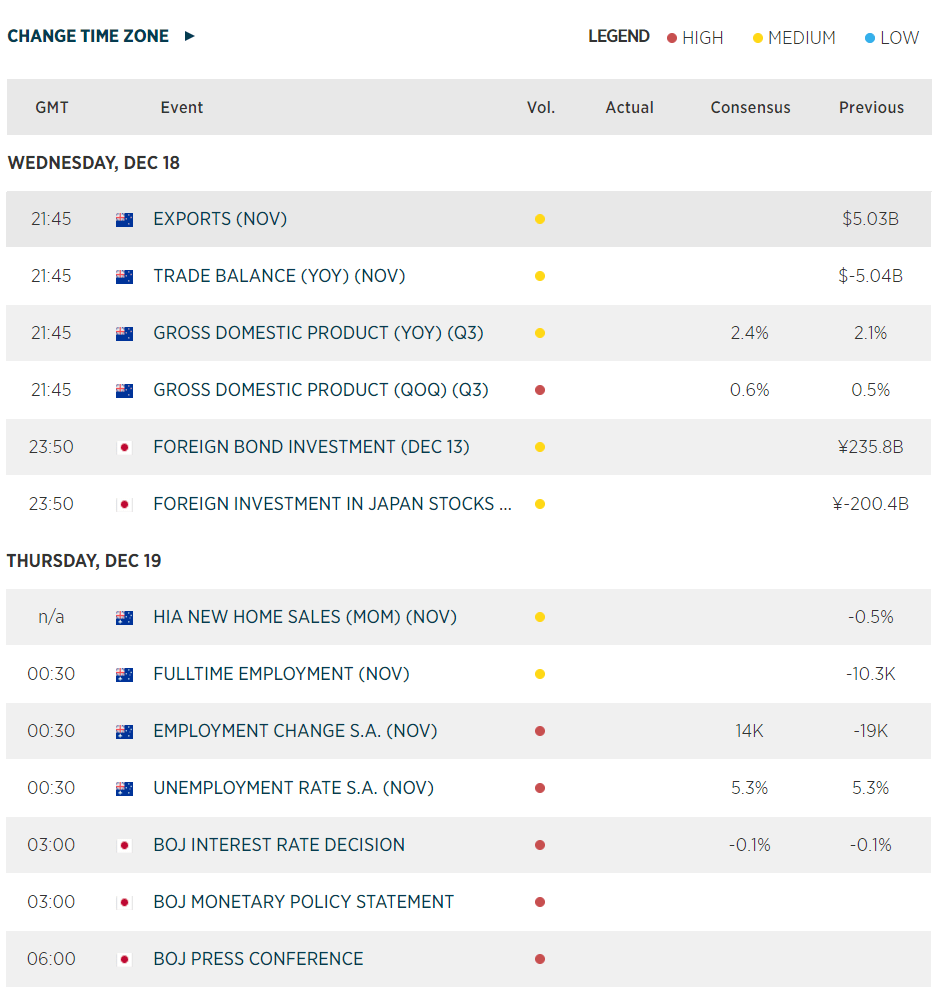

- As we go to press, the House of Representatives is still debating over impeaching President Trump, with a vote expected later this evening. The vote is anticipated to fall along party lines in favor of impeachment, though the likelihood that the Senate removes the President from office remains remote, limiting the impact on markets.

- Fed members Williams and Evans both spoke out in favor of leaving interest rates unchanged in the near-term, cementing the impression that the Fed will be on hold heading into the new year.

- FX: The Canadian dollar was the strongest major currency on the day on the back of solid inflation (CPI) and housing (Teranet price index) data. The euro and British pound were the day’s weakest major currencies. Tomorrow’s Bank of England meeting will be among the last major trading events of the week, year, and decade.

- Commodities: Oil closed essentially flat on the day, despite data showing a smaller-than-expected drawdown in inventories. Gold was also flat while Bitcoin rallied back above $7k to erase the last two days’ worth of losses.

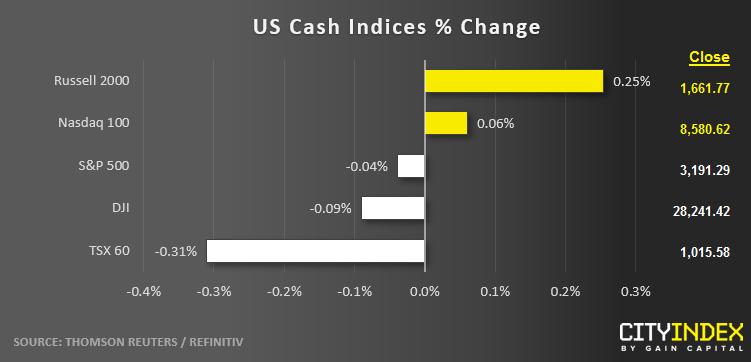

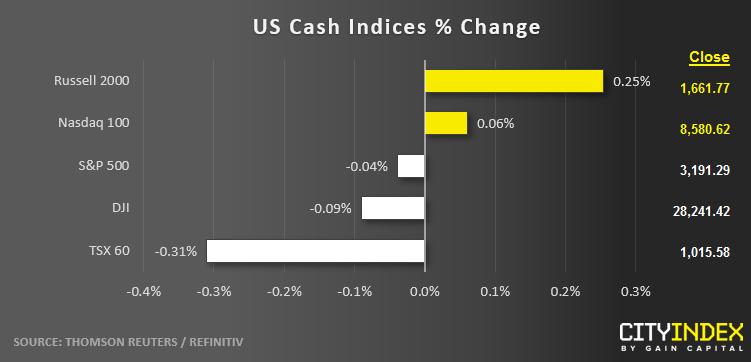

- US indices closed mixed in quiet pre-holiday week trade. European indices closed mixed, with German stocks sliding, while UK stocks ticked higher in quiet trade.

- REITs (XLRE) went from worst to first to be the strongest major sector today; Industrials (XLI) were the weakest.

- Stocks on the move:

- FedEx (FDX) shares dumped -10% after a big miss in the shipping company’s earnings and outlook for next year.

- Automaker Tesla (TSLA) is reportedly considering cutting the price of its Model 3 sedan. The stock closed the day 4% higher.