Market Brief: Traders Ratchet Down Expectations for US-China Trade Talks

- Traders are downbeat heading into this week’s US-China trade talks in Washington DC after last night’s announcement that the Trump Administration would be blacklisting eight Chinese technology giants, today’s rumors that US government pensions would curtail investments in Chinese stocks, and the announcement of visa bans on Chinese officials from the Xinjiang province. At a minimum, traders will be looking for another delay to the next round of tariff escalation to declare the talks a success.

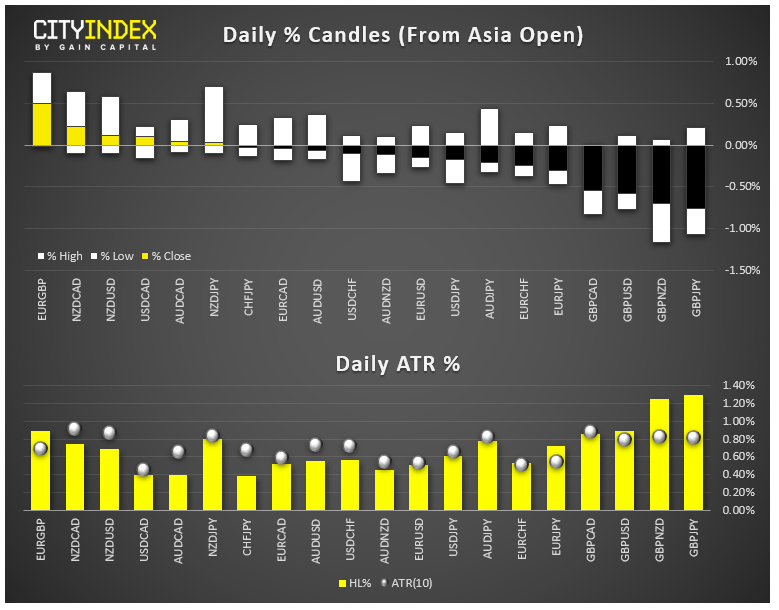

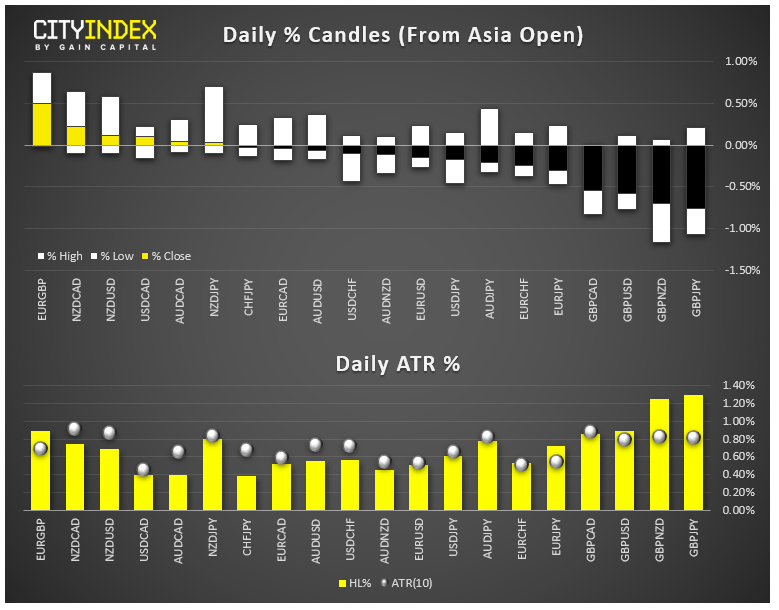

- FX: The British pound was the weakest major currency as Boris Johnson’s Brexit proposal looks increasingly unlikely to garner approval from the European Union. Speaking of Europe, the euro was the second-weakest major currency today, with a German official stating there is no need for a fiscal stimulus package. There was a three-way tie for the strongest major currency between the New Zealand dollar, Swiss franc, and Japanese yen.

- US data: PPI (Sept) printed at -0.3% m/m, well below the +0.1% reading expected. Core PPI also missed at -0.3% m/m vs. +0.2% eyed. A weak CPI report later this week could help cement the case for an interest rate cut from the Federal Reserve at the end of the month.

- Commodities: Gold edged higher on the day while oil ticked lower after the EIA cuts its forecast for 2020 world oil demand.

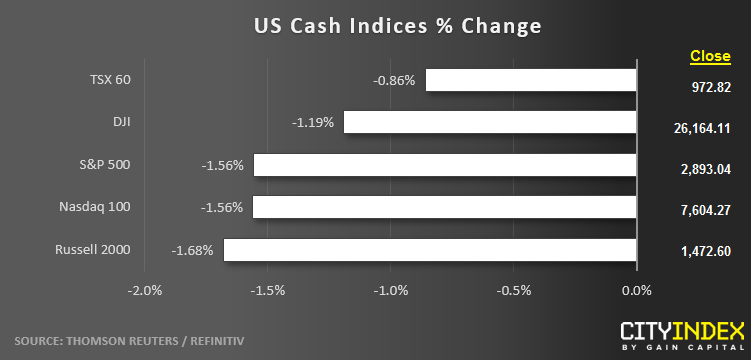

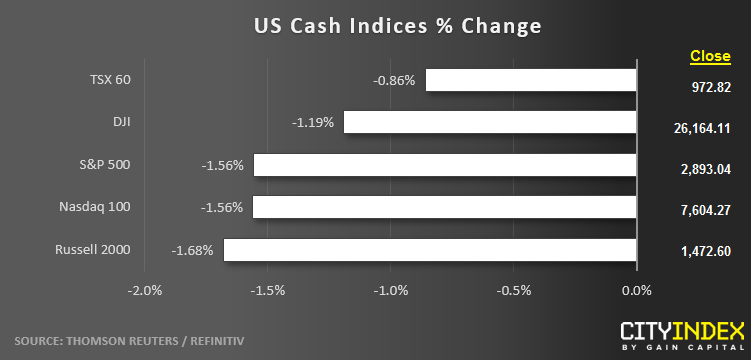

- US indices closed more than -1% lower across the board on US-China concerns. See what we'll be watching in the upcoming earnings season!

- All eleven sectors fell on the day, led lower by Financials (XLF). REITs (XLRE) fell the least on the day.

- Stocks on the move:

- Domino’s Pizza (DPZ) gained 5% after the company announced a $1B buyback program, despite cutting its outlook for the next three years.

- Chinese company stocks like Alibaba (BABA, -4%), JD.com (JD, -4%) and Baidu (BIDU, -2%) all slide on reports that the White House was considering limits on Chinese stock holdings in government pension funds.

- Big US banks like Bank of America (BAC, -2%) and JP Morgan Chase (JPM, -2%) slid amidst a drop in Treasury yields.

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM