Market Brief: Trade Troubles Tank Risk Appetite

View our guide on how to interpret the FX Dashboard.

- Despite announcing a deal “in principle” two months ago, the US-China “phase one” trade agreement appears to be in jeopardy once more. In addition to this week’s protectionist actions and rhetoric against South American nations and France, President Trump implied that there is “no deadline” for the phase one deal and that it may have to wait until after the 2020 election.

- Later, Commerce Secretary Wilbur Ross suggested the US would go through with another round of tariffs on Chinese goods in two weeks’ time unless there was substantial trade progress.

- The IEA stated that OPEC is likely to delay its decision on output “until the market becomes clearer” later this week.

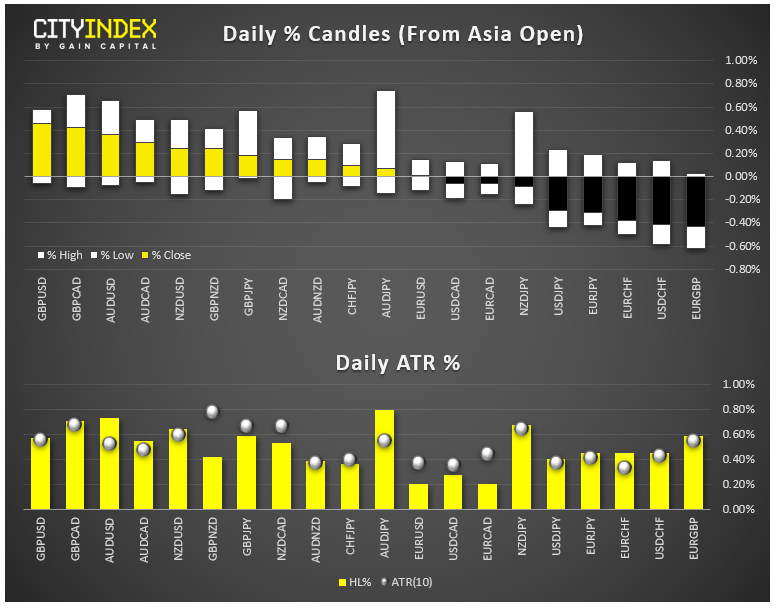

- FX: The British pound was the strongest major currency on the day (see four possible scenarios we’ll be watching ahead of next week’s election!). The US dollar was the weakest major.

- Commodities: Gold gained nearly 1% in a safe haven bid; oil tacked on about 0.5% on the day.

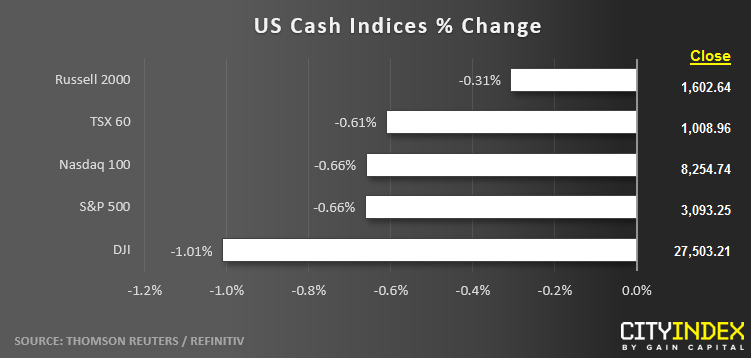

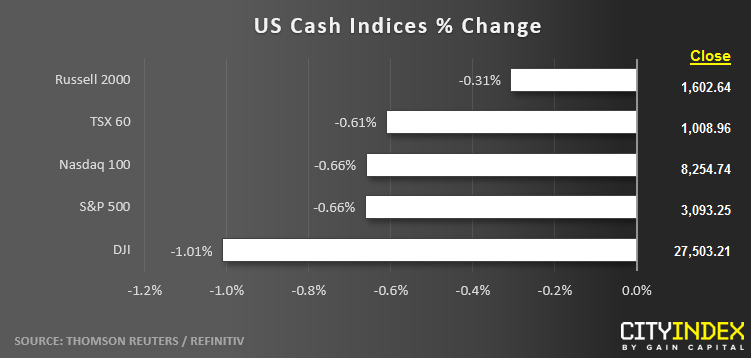

- US indices closed nearly 1% lower on the day on concerns over the fate of the long-promised “phase 1” trade deal between the US and China, though indices did finish off the morning’s worst levels.

- REITs (XLRE) were the strongest major sector on the day (and only one of two, along with Utilities (XLU) to rise). Energy (XLE) and Financials (XLF) brought up the rear.

Latest market news

Today 04:00 PM

Today 01:15 PM

Today 11:30 AM

Today 08:18 AM