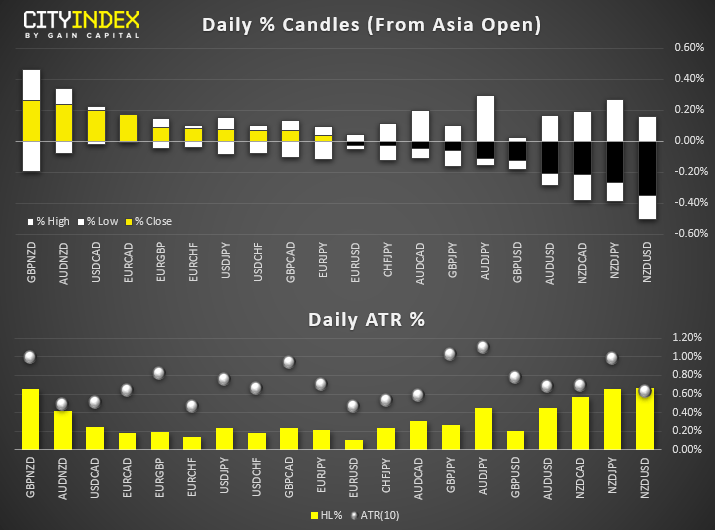

- Ranges were painfully small with a lack of news throughout most of the Asia session, although NZD and AUD went on to be the weakest majors and provided the most volatility later on. USD is the strongest major.

- The yield curve inversion slightly soured sentiment to help with JPY inflows, and weighing on most Asian FX pairs.

- Australian construction work contracted by -3.8%, it’s worst year over year quarter since December 2017. And if PMI data is anything to go by, could set be weaken further with the sector contracting at -39.1, it’s month since 2013.

- RBNZ’s Greame Orr echoed concerns of his peers that monetary policy has its limits and needs to be partnered with broader, fiscal and structural economic policy.

- The PBOC are reported to be releasing their own crypto currency as early as November, according to Forbes.

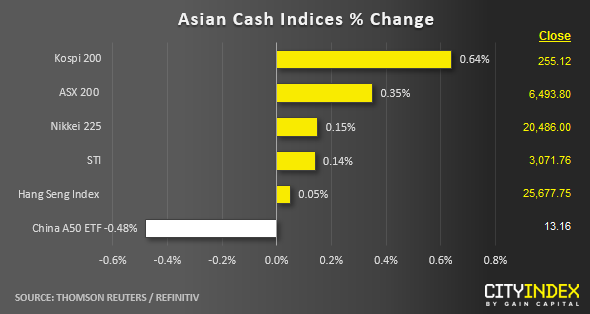

- Ahead of the European session open, China and Hong Kong stock markets have underperformed as at today’s Asian mid-session where China policy makers and media cast doubts on the credibility of the U.S. administration on getting a trade deal done ahead of the 2020 U.S. election after U.S. President Trump’s “flip flop” antics.

- The China A50 has dropped by -0.48% while the Hang Seng Index (HSI) is almost unchanged. Tencent Holdings, the biggest weightage component stock in the HSI and major China property developer, Country Garden have underperformed; down by -1.29% and -2.38% respectively.

- Negative news flow is the main catalyst that drives Tencent’s share price down today where it has been reported that China’s antitrust regulator is investigating Tencent’s music streaming subsidiary over several exclusive licensing deals with major records labels such as Universal and Sony. These agreements have forced rival music streaming providers; Alibaba and Baidu to sublicense content from Tencent at higher prices.

- The Kospi 200 and ASX 200 have recorded modest gains where the ASX 200 has inched higher by 0.35% supported by the technology and materials stocks.

- The S&P E-mini futures has started to consolidate in today’s Asian session, inched up by 0.28% so far after an intraday decline of -1.35% in yesterday’s 27 Aug U.S. session from its high of 2899.

Up Next

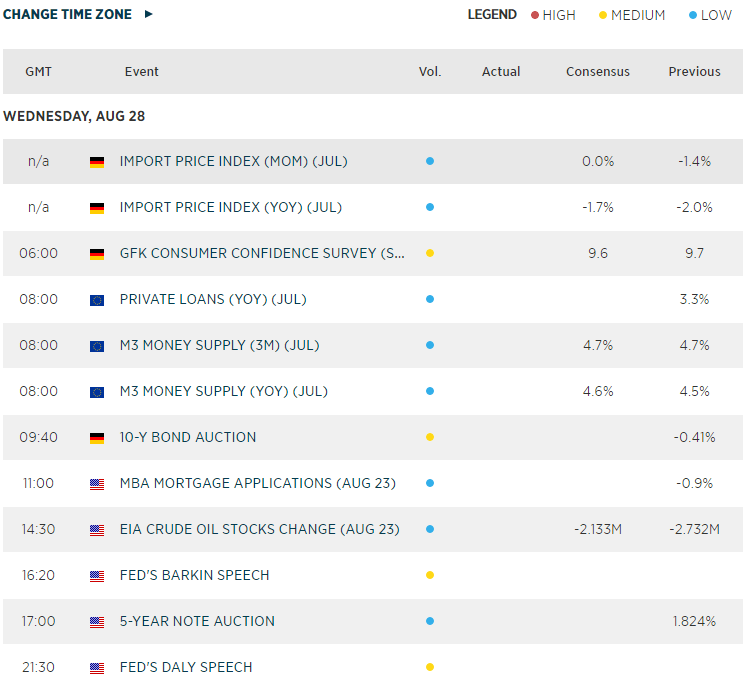

- Germany Gfk Consumer Confidence survey where consensus is pegged at 9.6, slightly down from the previous reading of 9.7

- No first-tier data to mull over for the European or US session, which again keeps any updates and / or setbacks surrounding the trade war as a possible market driver. Basically, keep an eye on Trump’s tweets.

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM