Stock market snapshot as of [13/8/2019 7:24 PM]

- What a difference an unexpected announcement of a delayed imposition of tariffs can make (even though there’s no guarantee the postponement will become a suspension)

- Nevertheless, relief and cheer are holding, hours after the U.S. Office of the Trade Representative (USTR) said that the additional import duty on certain Chinese imports announced by President Donald Trump last month, would now be delayed till 15th December from an initial date of 1st September

- There’s little detail from Washington so far on what motivated the change, though China’s equivalent of the USTR said that it will hold talks with U.S. counterparts over the next two weeks. With a cocktail of pressures remaining on risk-seeking, including Hong Kong, which still simmers, and the real possibility of another reversal in Washington-Beijing relations, Tuesday’s stock market rebound will probably require solid further impetus to extend beyond the next 24 hours

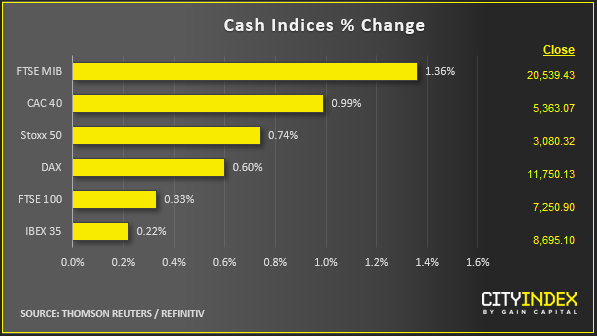

- Italy’s political turmoil, is another case in point, though the main stock gauge there rose more than 1% as banks swung higher. The Rome parliament’s failure to set a date to debate an early election, as expected, after Deputy Prime Minister Matteo Salvini’s demand, offers the country’s volatile bond markets some temporary respite

- For U.S. investors, rising core CPI, suggests a quicker return to the Fed’s 2% target than expected, which a negative for further rate cuts. As such, current euphoria may face a wake-up call on the policy easing front too as the most up to date U.S. readings continue to roll in. July Retail Sales are due on Thursday

Stocks/sectors on the move

- A broad-based rally leaves few U.S. sectors without strong gains at last look, 10 of the S&P 500’s 12 major demarcations are posting gains of at least 1%. Technology shines the most with a 2.4% jump, led by Hardware which surges almost 4% on the back of a 4.6% advance by Apple. The defensive Real Estate and Utilities sectors also rose, though sharply underperformed with fractional gains only.

- With oil prices also reviving, on trade hopes, oil majors also contribute a solid chunk to Wall Street’s upside

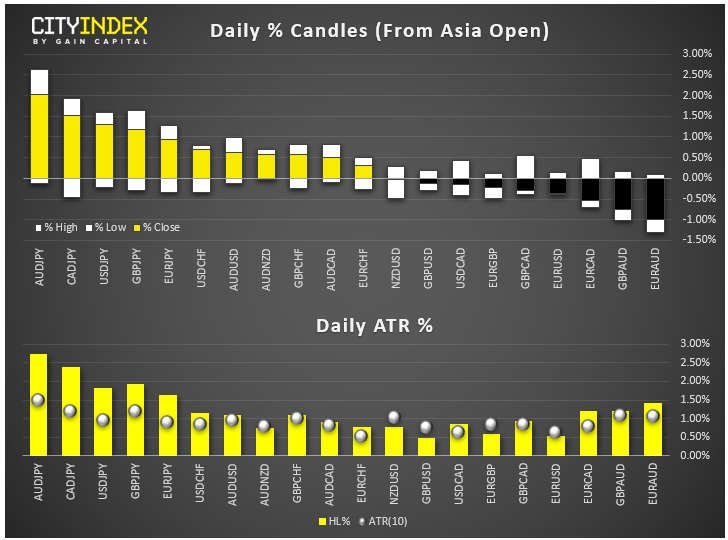

FX snapshot as of [13/8/2019 7:24 PM]

FX markets

- FX trading has also been upended by the latest U.S. change of heart, with ‘risk-on’ currencies quickly taking back the initiative from ‘safe-haven’ ones like the yen and franc, whilst keeping the toppy dollar on the backfoot

- The euro and the Aussie shone at last check with AUD/JPY holding a 2% gain measured since the Asia open. Sterling also showed signs of retaining gains from a bounce from multi-year lows, as it also rises against the yen with help from better than expected wage data

- Despite Tuesday's risk-off bounce across markets, underlying risk aversion means traders may be still be underestimating possible further downside for the Hong Kong Dollar and Sterling, even after recent sharp volatility

- The Aussie also drove the euro sharply lower, whilst the single currency also relinquished earlier gains against the dollar

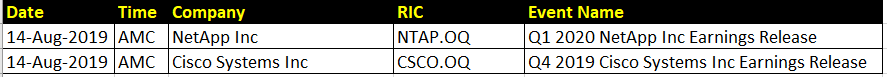

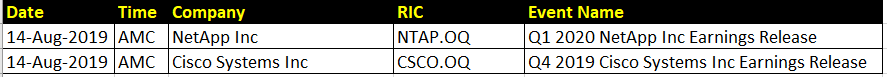

Upcoming corporate highlights

AMC: after market close

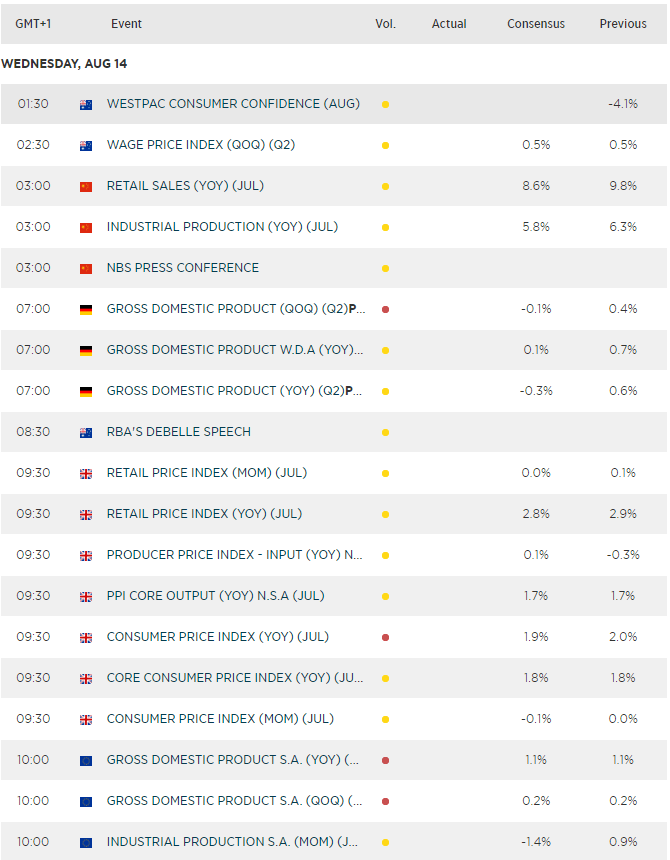

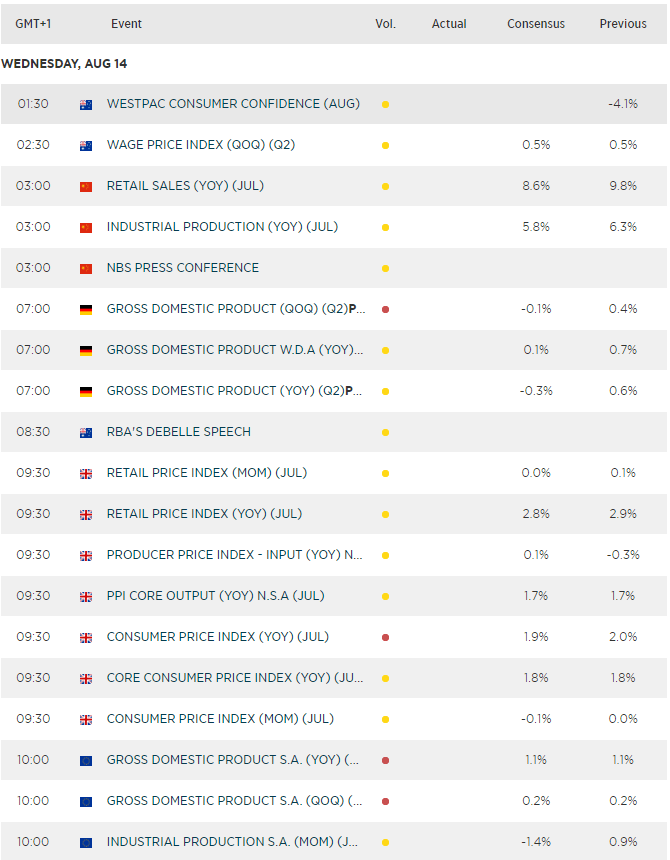

Upcoming economic highlights