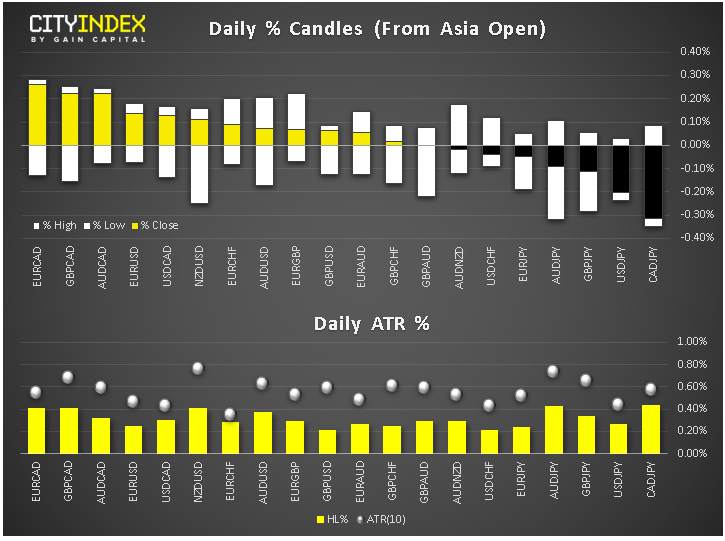

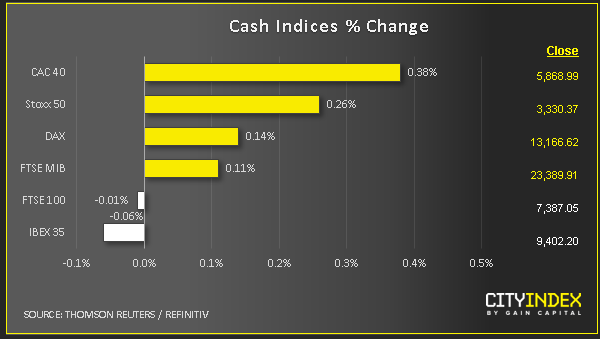

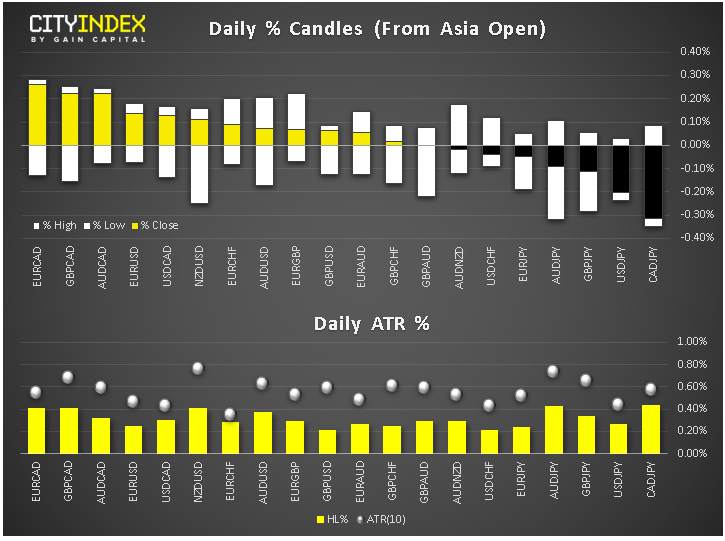

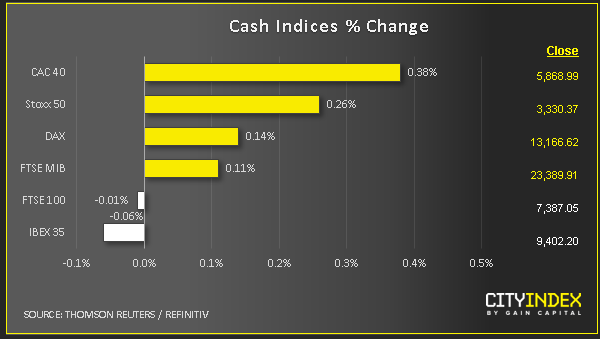

- At 13:30 GMT, the euro and yen were the strongest while North American dollars brought up the rear. Gold edged higher, stocks were mixed and bond yields fell back a little after yesterday’s gains. It has been a quieter session thus far, hopefully ahead of a bit more volatile US session later.

View our guide on how to interpret the FX Dashboard

- EUR managed to rebound a tad after yesterday’s sell-off on the back of better than expected data. Eurozone Final Services PMIs were revised higher with Italian flash PMI coming in one whole point better than expected. Meanwhile German factory orders rose 1.3% against 0.1% expected, while Eurozone retail sales was in line with a gain of 0.1% month-over-month.

- NZD recovered after initially dropping in Asian session when it was hurt by weak New Zealand employment data, which boosted expectations for RBNZ to cut rates again.

- Gold was somewhat desperately trying to cling onto key support around $1480, finding mild support thanks to the stock market rally pausing for a breather. The precious metal fell sharply on Tuesday, partly because we saw further unexpected improvement in economic data and thawing of US-China trade frictions, both helping to underpin the buck and undermine haven assets. But the buck and yields were both a touch weaker, allowing the metal to rebound.

- JPY was showing strength after being one of the weakest currencies over the previous two sessions. It was supported by short-side profit-taking as stocks eased back a tad.

- Stocks: Here are some of today’s main company news, courtesy of colleague Ken Odeluga:

- Marks & Spencer surged almost 8% initially on glimmers of hope in its flagship clothing division. The stock later faded to rise of 2%-4% as firm food sales contrast with weak profit growth and a 2.1% revenue drop.

- Intu Properties - 20% after warning it will probably need to raise fresh equity as the commercial rent downtrend shows no signs of abating.

- U.S.-listed shares of Japan's Softbank point lower after the WeWork investor reported a $6.5bn quarterly loss, its first in 14 years.

- BMW beat Q3 core profit estimates though kept guidance unchanged.

- SocGen +5.6%: Despite a big drop income from equities, strong capital growth proves to be a relief.

- Coty beat on Q1 EPS, shares indicated higher.

Latest market news

Today 08:15 AM