Market Brief: Stocks Stage Late Rally Despite Fed’s Caution Toward Further Rate Cuts

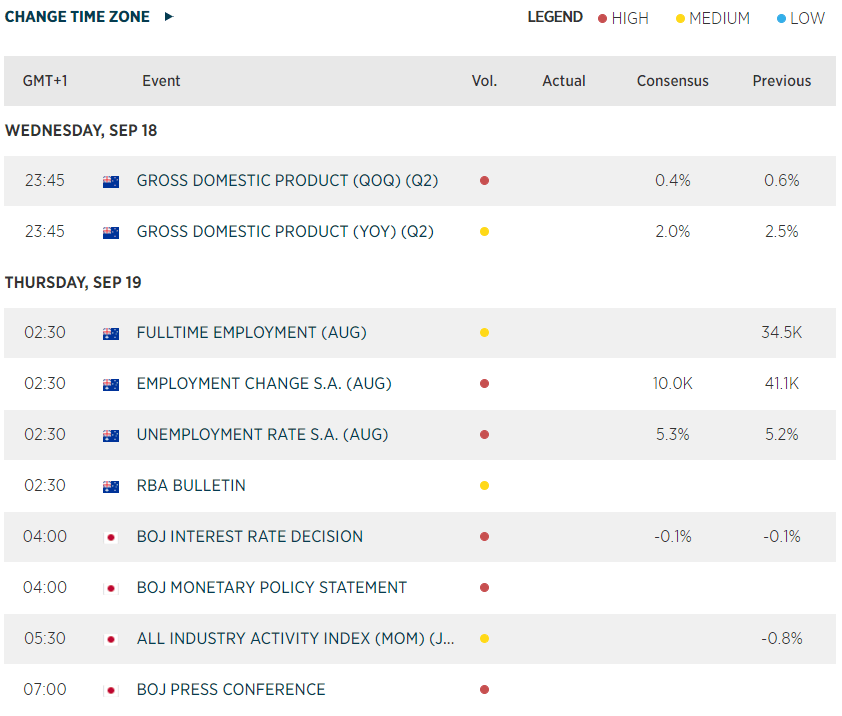

- As expected, the Federal Reserve opted to cut interest rates 0.25% to the 1.75-2.00% range today. In its accompanying economic projections, most Fed policymakers projected that the central bank was done cutting interest rates for the year, though Fed Chairman Powell did hint at the potential for further balance sheet expansion depending on how conditions evolve.

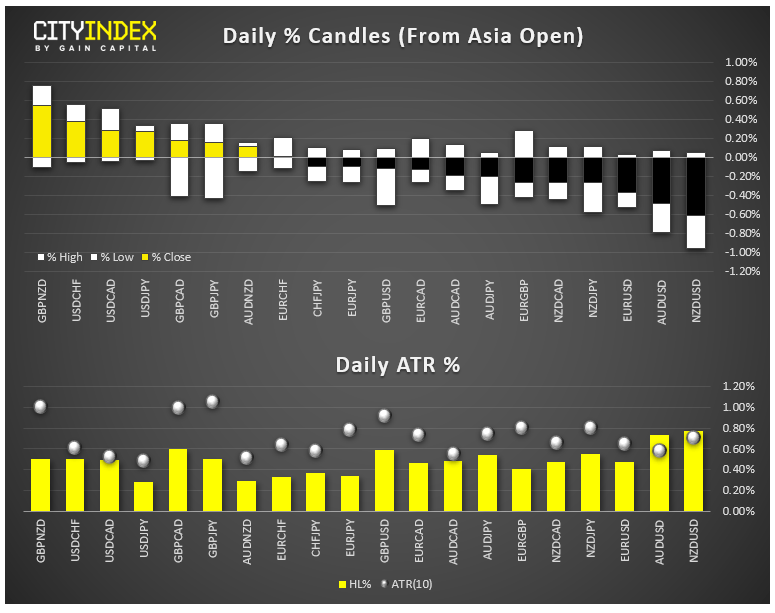

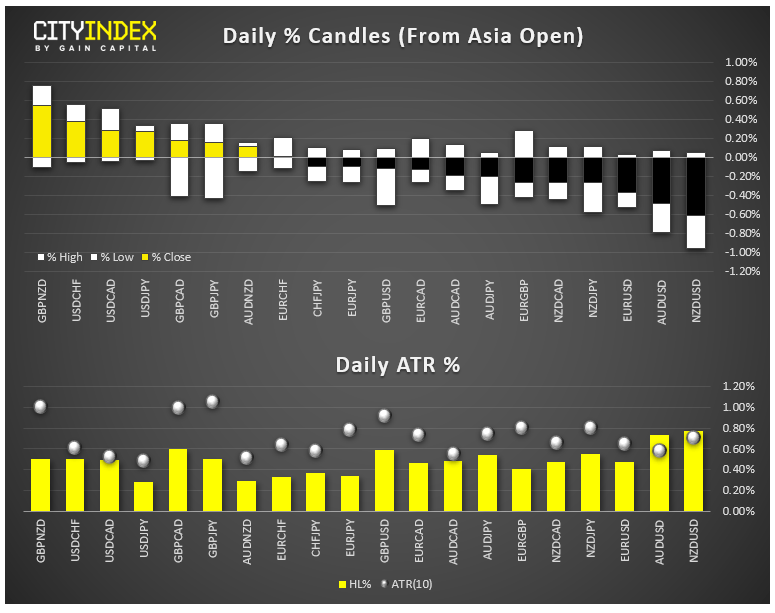

- FX: The pound and US dollar were the strongest major currencies today, while the aussie and kiwi brought up the rear.

- Commodities: Oil dropped another -2% today as President Trump seemingly opted for “a diplomatic response” (including additional sanctions) on Iran rather than a military response. Gold fell nearly -1%.

- A couple of the major altcoins surged today, with both Ethereum (ETH, +2%) and Ripple (XRP, +10%) seeing noteworthy rises. Cryptocurrency benchmark Bitcoin remains mired around the 10,200 area.

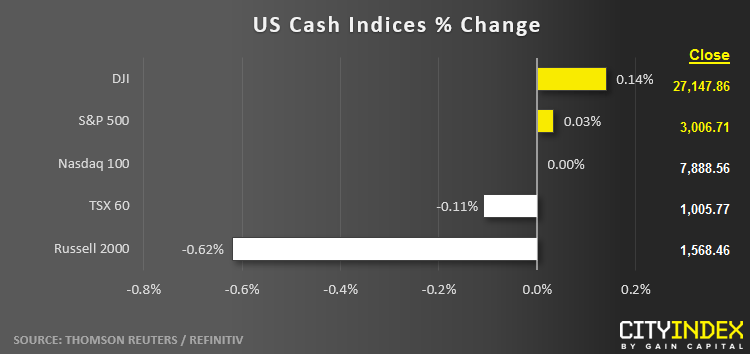

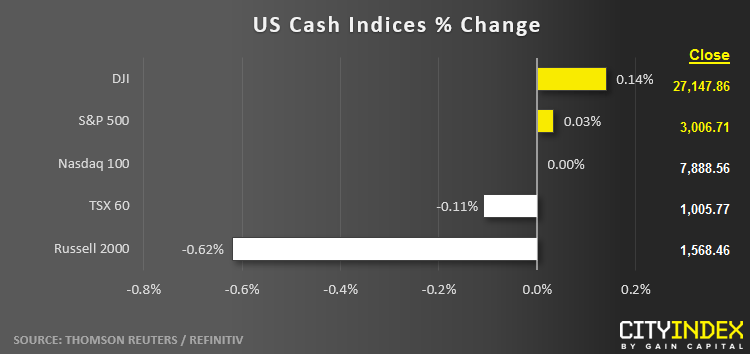

- US indices closed mixed after a late rally as Fed Chairman Powell moderated the hawkish tone of the central bank’s statement.

- Energy (XLE) once again brought up the rear among the major sectors; Financials (XLF) led the way to the topside.

- Stocks on the move:

- FedEx (FDX) dumped -13% after cutting its outlook for 2020 and warning on risks to the global economy.

- McDermott International (MDR) collapsed -63% after announcing that it engaged a turnaround consulting firm.

- Recent IPO Chewy Inc (CHWY) slumped -6% after reporting a larger-than-expected loss

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM