Market Brief: Stocks Slump on Trade Worries (30th Time We’ve Written That Title!)

View our guide on how to interpret the FX Dashboard.

- A Reuters report midday suggested that the much-ballyhooed “Phase One” trade deal between the US and China may not be completed this year, driving risk assets lower across the board. Later comments from the White House that “progress is being made” stemmed the selloff, but traders are getting increasingly fed up with rhetoric and will increasingly want to see action as we move into December.

- The FOMC minutes from the central bank’s October meeting showed most policymakers viewed interest rates as appropriate barring a material change to the economic outlook – steady as she goes for the world’s largest central bank!

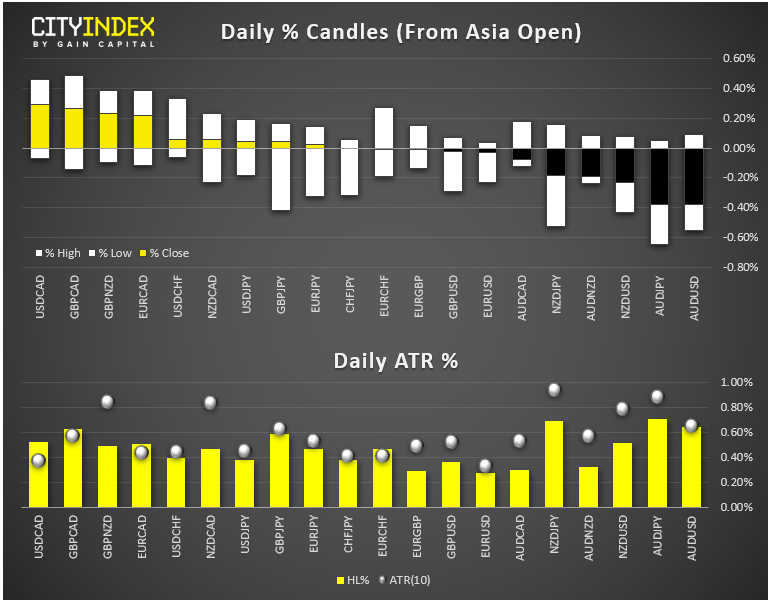

- FX: The US dollar was the strongest major currency on the day; the aussie brought up the rear.

- Commodities: Oil surged 3% on the day on the back of a smaller-than-expected build in inventories. Gold was essentially flat on the day.

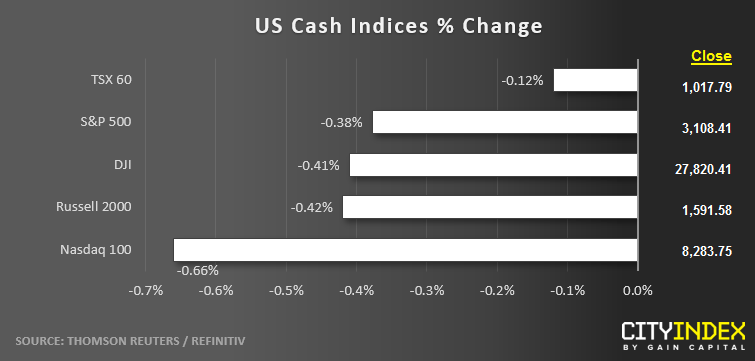

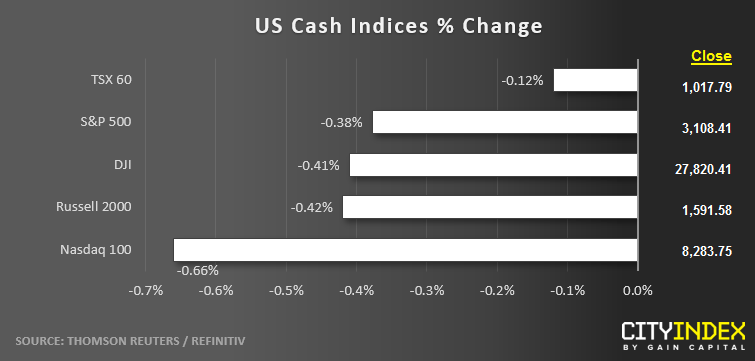

- US indices closed roughly -0.5% lower across the board on worries over the US-China trade deal timeline.

- Energy (XLE) was the strongest sector on the day; materials (XLB) brought up the rear.

- Stocks on the move:

- Retailer Target (TGT) exploded 14% higher on the day after reporting an earnings trifecta (beat on earnings, beat on revenues, raised guidance).

- Lowe’s (LOW) gained 4% on better-than-expected earnings.

- See our report on the “streaming wars” and the potential impact on the stocks of Walt Disney (DIS) and Netflix (NFLX)

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM