Market Brief: Stocks Finish Mixed as Traders Weigh Earnings, Amazon May Weigh Tomorrow

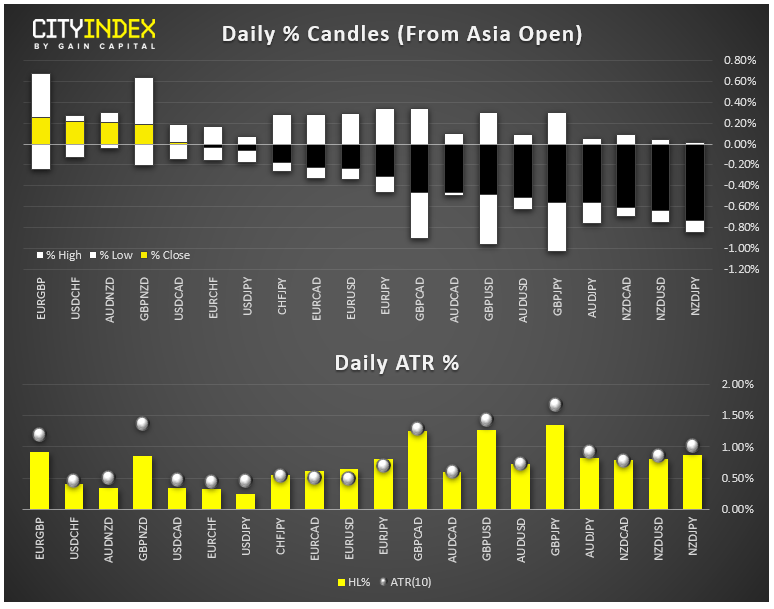

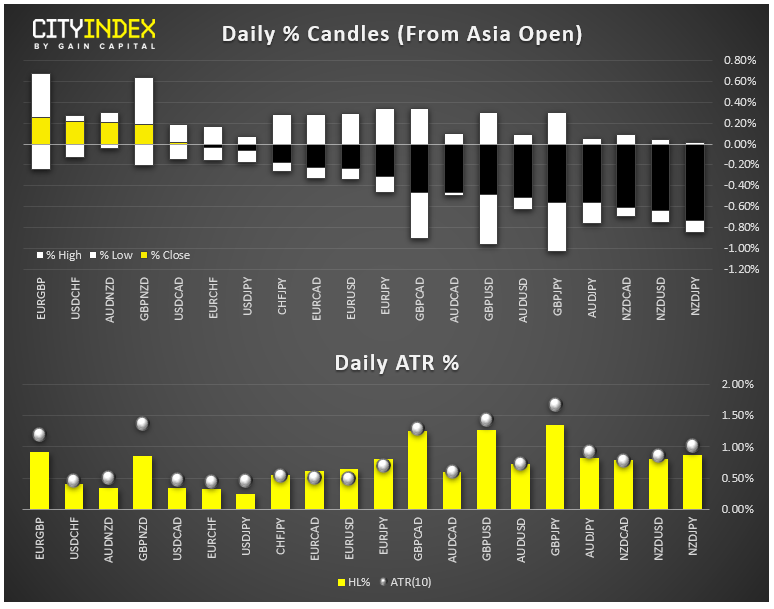

CI: View our guide on how to interpret the FX Dashboard.

- In his final meeting as the head of the European Central Bank, Mario Draghi didn’t rock the boat, leaving policy unchanged, highlighting downside risks to the economy, and urging fiscal policymakers to do their part one last time.

- The British pound fell against most of its major rivals as PM Boris Johnson continues to push for a general election in December. Late reports suggest that the EU may not announce the length of a Brexit extension until Monday.

- FX: The Australian and New Zealand dollars were the weakest major currencies on the day, while the Japanese yen and US dollar were the strongest.

- US data: Durable Goods Orders (Sept) missed expectations, declining -1.1% m/m; New Home Sales (Sept) met expectations at 701k; Initial Jobless Claims came in at 212k, a tick below expectations. Both the Markit Manufacturing and Non-Manufacturing PMI surveys came in a bit soft.

- Commodities: Oil ticked up in quiet trade after yesterday’s surge, while gold tacked on more than 0.5% in a broad-based metals rally.

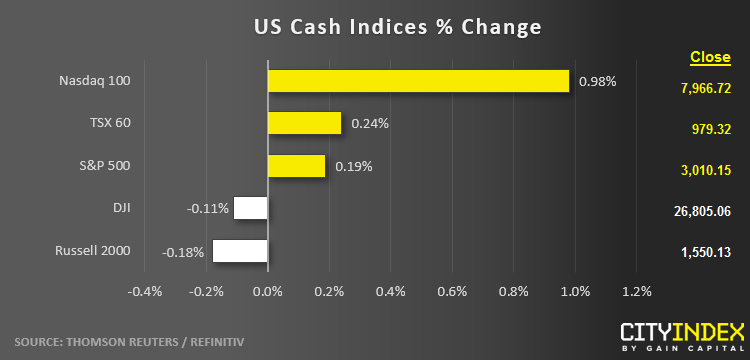

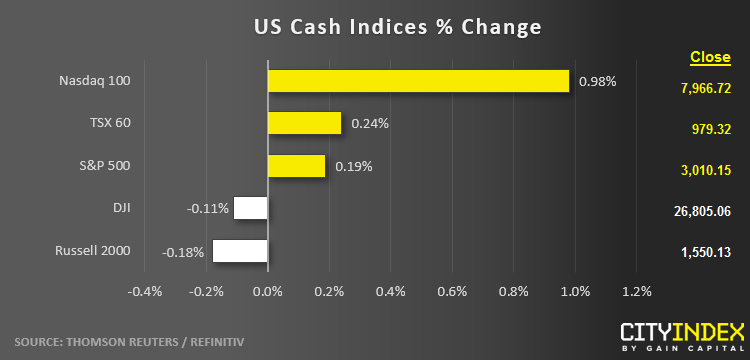

- US indices closed mixed at the end of a quiet day.

- Technology (XLK) was the strongest sector on the day while Communication Services (XLC) brought up the rear.

- Stocks on the move:

- A trio of earnings winners from yesterday included Tesla (TSLA, +18%), Paypal (PYPL, +9%), and Microsoft (MSFT, +2%)

- On the other side of the coin, Ford (F, -7%), eBay (EBAY, -9%), and Twitter (TWTR, -21%) all fell after issuing disappointing earnings in one way or another.

- Amazon (AMZN) just reported weaker-than-expected earnings ($4.23 vs. $4.62 eyed), though revenue did edge out expectations. The stock is currently shedding -6% in volatile after hours trade.

- Intel (INTC) reported stronger-than-anticipated revenues, leading the stock to trade higher by 6% after hours.

Latest market news

Today 08:28 AM

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM