Market Brief: Stock Indices Finish the Day at Breakeven AGAIN

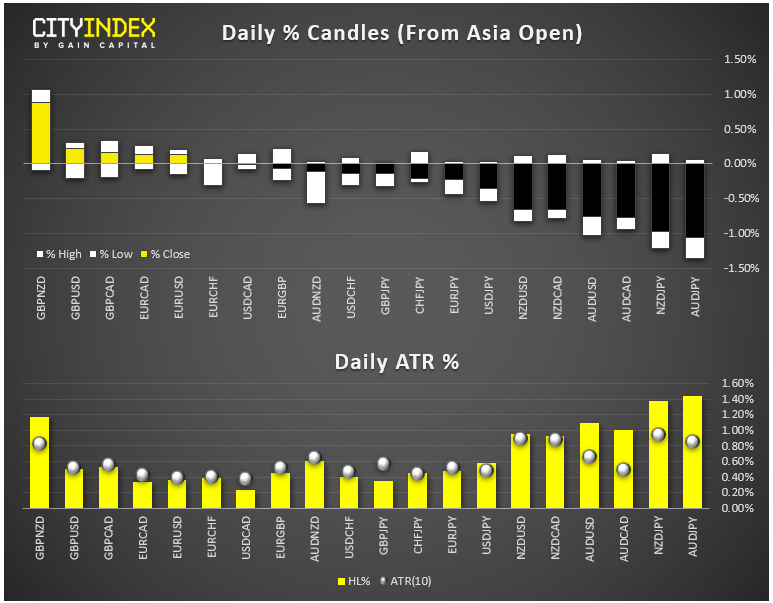

View our guide on how to interpret the FX Dashboard.

- A set of balanced speeches from Fed policymakers has pushed traders to expect no changes to US interest rates through December 2020, and the US dollar predictably finished in the middle of the major currency pack today.

- FX: The safe have Japanese yen was the strongest major currency today, while the risk-sensitive Australian and New Zealand dollar were the weakest performers on the day.

- US data: US PPI came in a tick hotter than expected at +0.4% m/m; Core PPI was also stronger at +0.3%. Initial jobless claims were higher than anticipated at 225k.

- Commodities: Gold rallied on falling yields while oil dipped today.

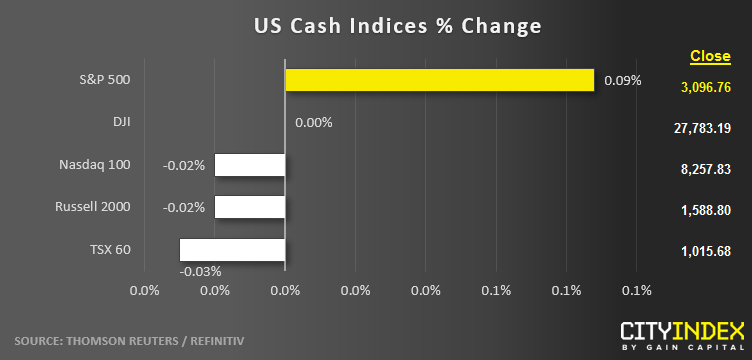

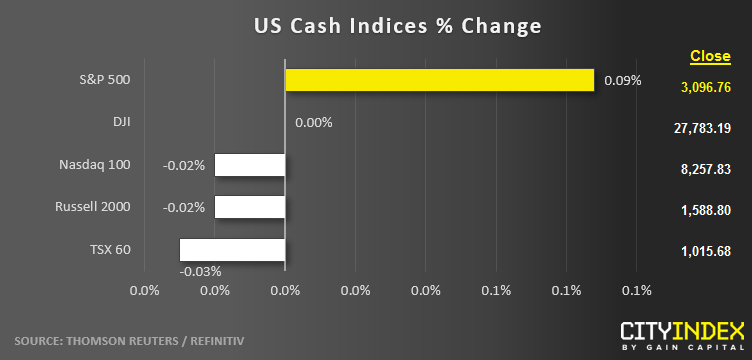

- US indices closed mixed, fitting the theme of choppy, lackluster trading that we’ve seen throughout the week. The Dow has now closed +/- 0.01% on three of the first four days this week.

- REITs (XLRE) were the strongest sector on the day; Energy (XLE) was the weakest, falling along with oil prices.

- Stocks on the move:

- Canopy Growth Corporation (CGC) reported dismal earnings, with losses more than twice as large as analysts were expecting amidst slowing same-store sales growth. The stock fell -14% on the day, dragging down the broader industry of cannabis-focused Canadian firms.

- Nvidia (NVDA, +1%) is set to report earnings as we go to press and will be a key bellwether for growth in the broader tech sector.

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM