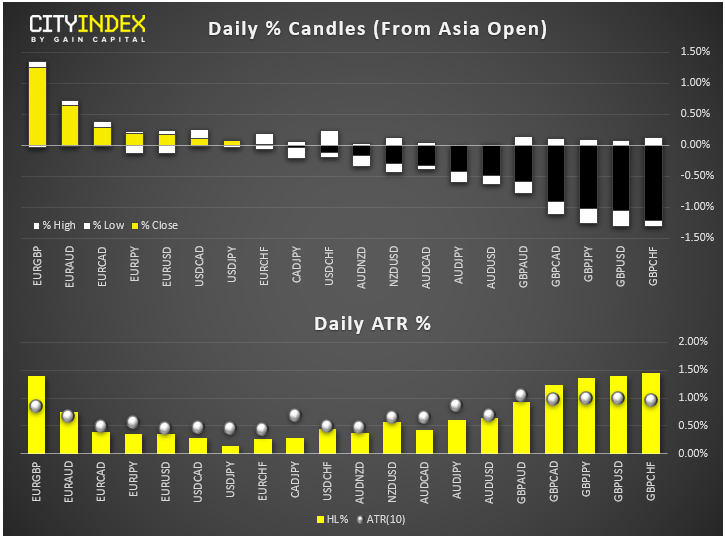

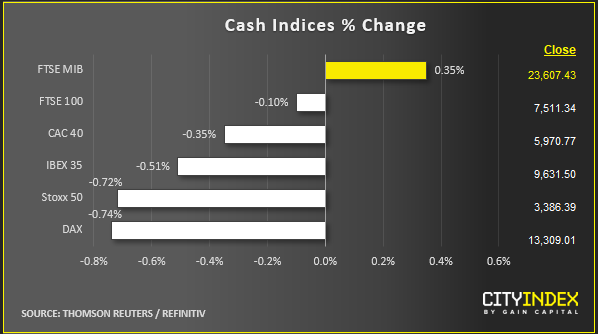

- Market update at 12:35 GMT: In FX, GBP was by far the weakest major currency while haven CHF was the strongest. Stocks were mostly in the red in Europe, although off lows, while Italian shares bucked the trend with the FTSE MIB being the sole major index in the green. Crude oil was up for the 4th straight day. Metals, including gold, silver and copper, all edged higher. Bitcoin was lower.

View our guide on how to interpret the FX Dashboard

- GBP was hit by a double whammy of bad news this morning. Reports emerged that the UK government wanted to block the EU transition extension beyond 2020 which raised concerns that this could potentially result in a hard Brexit. Then, the latest wages data came in below expectations at 3.2% 3m/y vs. 3.4% expected, while unemployment claims grew more than anticipated to 28,800 vs. 21,200. GBP/USD was testing THIS key support level.

- Stocks in the aerospace and defence took a hit this morning after Boeing’s (BA) decision to temporarily suspend production of its 737 Max airliner from January. Unilever (ULVR) tumbled 5.6% after warning that it will miss its full-year revenue growth targets.

- FTSE’s big rally came to a halt along with European shares. As my colleague Fiona Cincotta reported earlier, domestic focused stocks that had rallied following a resounding win from the Conservatives and Brexit clarity once again found themselves on the back foot amid the threat of no (trade) deal Brexit. Lloyds, RBS and home builders dominated the lower reaches of the index.

- Market sentiment remains overall upbeat despite today’s mild sell-off in European stocks. Indeed, Wall Street has just hit a fresh record high on Monday. The agreement between the US and China to agree to a phase one deal, which is yet to be signed, has helped de-escalate the damaging trade war between the world’s biggest economies. There were no fresh developments on this.

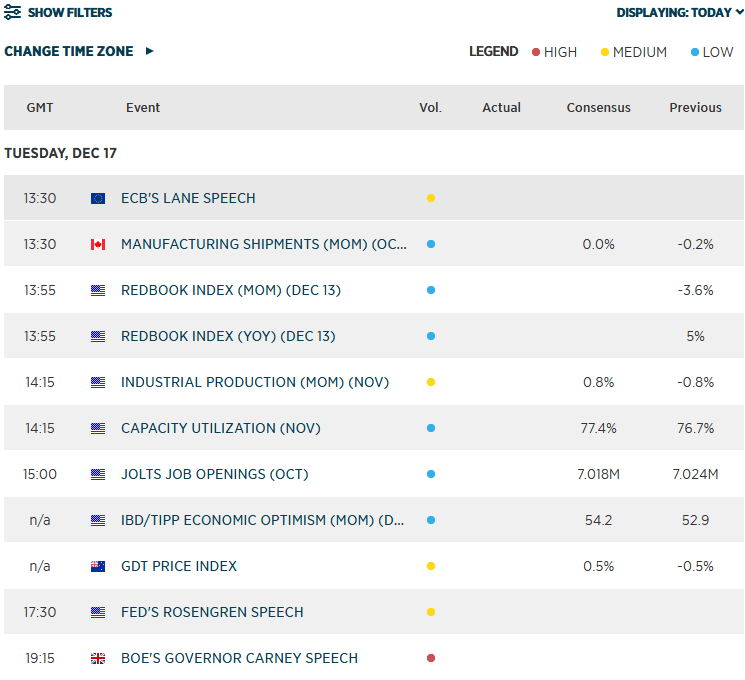

- Coming up

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM