Market Brief: Solid NFP Report Pumps Up Risk Appetite

View our guide on how to interpret the FX Dashboard.

- The October Non-Farm Payrolls report printed at 128k, above economists’ expectations (especially accounting for the nearly +100k positive revision to previous readings). While wage data came in a tick soft, last month’s earnings figures were revised up by +0.4% m/m, suggesting that the US labor market remains generally strong. Separately, the ISM Manufacturing PMI report missed expectations and remained in contractionary territory for the third straight month.

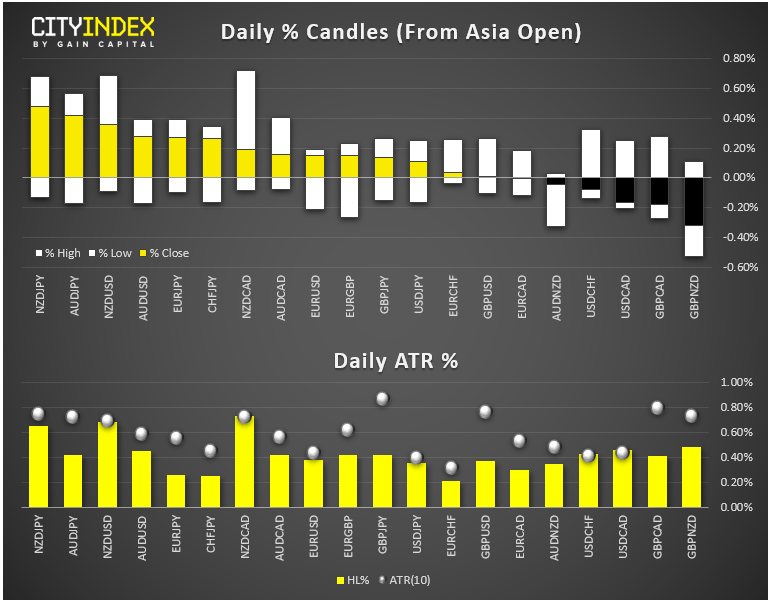

- FX: In a typical risk-on configuration, the growth-sensitive New Zealand dollar was the strongest major currency, with the safe haven Japanese yen bringing up the rear.

- Commodities: Oil surged nearly 4% today to extend its recent streak of volatility; gold was essentially flat.

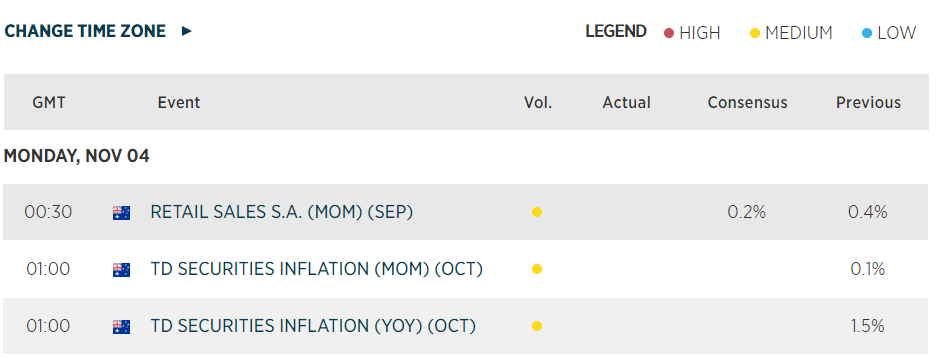

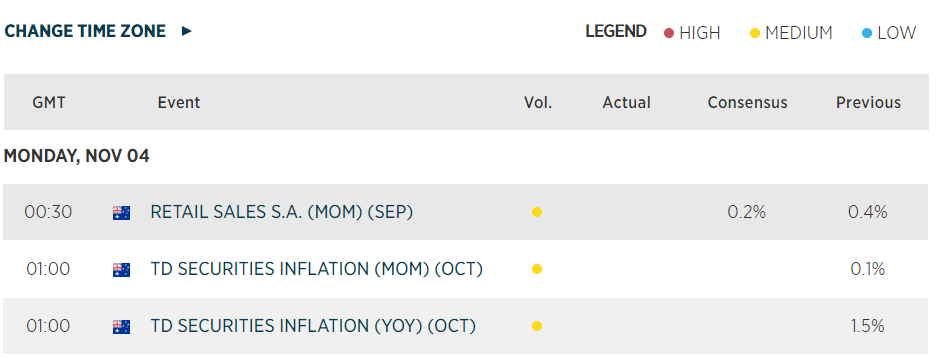

- See the key data and market themes we’ll be watching in the coming week!

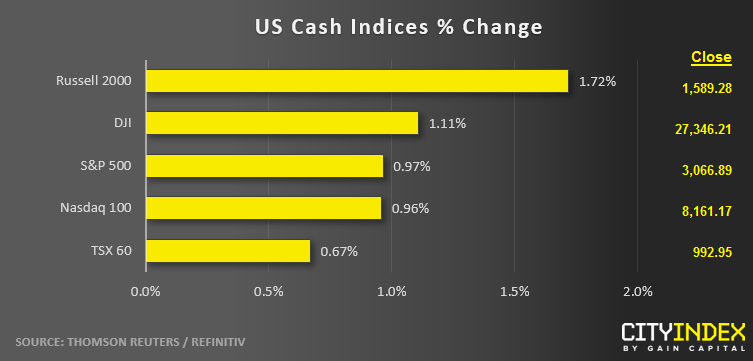

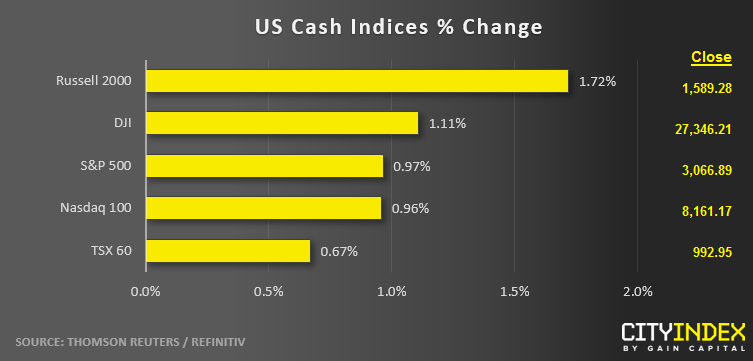

- US indices closed roughly 1% higher across the board to hit new record highs, reassured by the solid NFP report and continued optimism about a potential US-China “Phase One” trade deal.

- Energy (XLE) was the strongest sector, boosted by the big rally in oil prices. REITs (XLRE) were the weakest.

- Stocks on the move:

- Alibaba (BABA, -0%) reported strong adjusted earnings of RMB 13.10 per share, up more than 30% from last year. Despite beating both earnings and revenue estimates, the stock finished the day essentially flat.

- Exxon Mobil (XOM) tacked on 3% despite a 50% drop in earnings as the company reported better-than-expected revenue amidst falling oil prices. Rival Chevron (CVX, -0%) was essentially unchanged on the day after missing analysts’ EPS and revenue estimates.

- Pinterest (PINS) shed -17% today after yesterday’s disappointing revenue figures.

- US Steel (X) reported a loss this quarter, but beat revenue expectations, leading the stock to rise 15% on the day.

- Warren Buffett’s Berkshire Hathaway (BRK.B, +2%) reports earnings over the weekend.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM