Stock market snapshot as of [19/9/2019 1:06 PM]

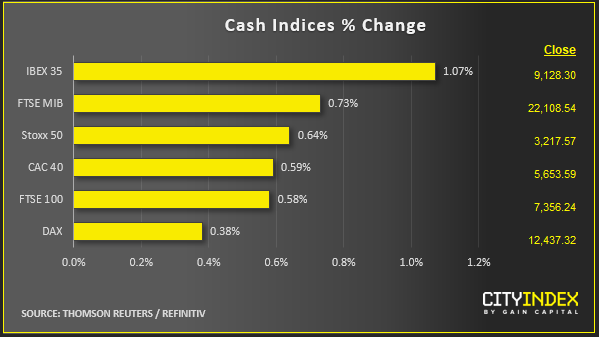

- Apart from the Fed, the monetary policy bonanza over the last several hours has been more about volume than action. And even at the Fed, the one central bank to adjust key policy, it came with trimmings the market interpreted as more hawkish than expected. That doesn’t appear to have derailed recently more resilient risk sentiment. As such, European and Mid-East market are by large pushing higher

- That said, the rebound in yields seen over the last several sessions has turned the mini trend lower

- The Bank of England also held few surprises, though after echoing the - dovish - bias of several other major banks sterling slipped further off its recent seven-week highs, giving a typical lift to the FTSE 100

- Brexit concerns haven’t gone away, though Parliament’s suspension offers a short, tense, break. If Brexit uncertainty persists, inflation is "likely to be weaker", said the BOE, another reason for sterling to soften more.

- Meanwhile UK Supreme Court judges are due to wrap up the hearing into whether the prorogation is lawful on Thursday. There’s no scheduled date for their judgement, though presumably it will be soon

- Elsewhere Washington flagged the ‘oil supply shock’ as still live, though volatility has calmed. The U.S. said it seeks to stop “Iran from supporting terror”, with more sanctions

- Wall Street futures are tracking the positive session trend on the back of a Fed statement that at worst did no harm

Stocks/sectors on the move

- Financials is the European super-sector out in front; no doubt the result of a raft of central bank meetings that barely dented the rates environment

- Energy is also up top; STOXX’s gauge for this segment rose about 1%. Oil producers and oilfield companies both gain, partly due to simmering oil-world tensions

- A drop by heavyweight brewer AB InBev drags the consumer sector lower. Though the institutional tranche of the beer giant’s Asia IPO is now fully, at $6.6bn, the total value is far lower than at the first attempt to list the unit, when ABI sought $9.8bn

- Wall Street pre-market movers include steel shares after bellwether U.S. Steel’s outlook view missed estimates. Set-top box maker Roku points lower for a second straight session on broker commentary, though after triple digit percentage run higher this year alone

FX markets and gold

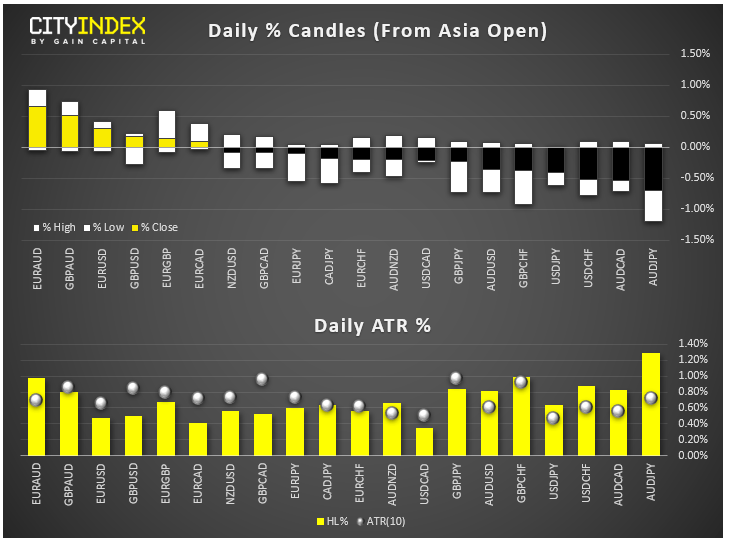

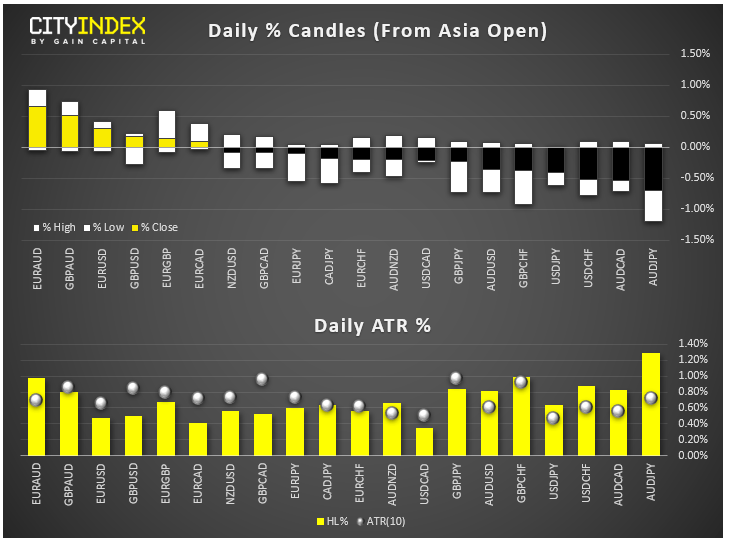

- A sharp rebound of the Aussie was in effect at the time of writing though there’s every chance it merely represents profit taking from a big drop in recent hours as RBA rate cut expectations toughen following the Fed move

- Meanwhile the New York branch of the Federal Reserve is spreading further calm after similarly emollient tones about the repo market turmoil. The NY Fed says the effective fed-funds rate returned to the top end of the target rate range that prevailed on Wednesday

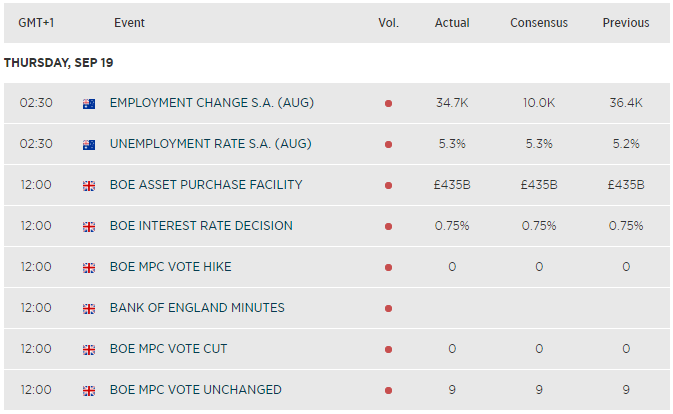

Upcoming economic highlights

Latest market news

Today 08:33 AM

Yesterday 11:48 PM