Market Brief: Slight Risk Aversion Ahead of NFP

View our guide on how to interpret the FX Dashboard.

- Markets saw a bit of risk aversion as traders digest Fed Chairman Powell’s mixed comments yesterday and looked ahead to tomorrow’s NFP report. Cautious comments from China about a potential comprehensive trade deal also contributed to the risk-off tone.

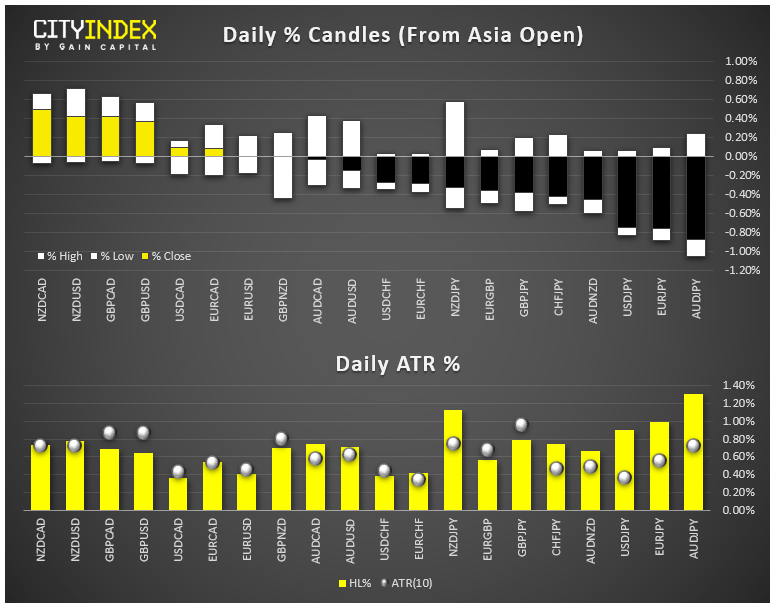

- FX: The safe haven Japanese yen was the strongest major currency on the day. The commodity-linked Canadian and Australian dollars were the weakest majors.

- Commodities: Oil dropped nearly 2% on the day while gold tacked on more than 1%.

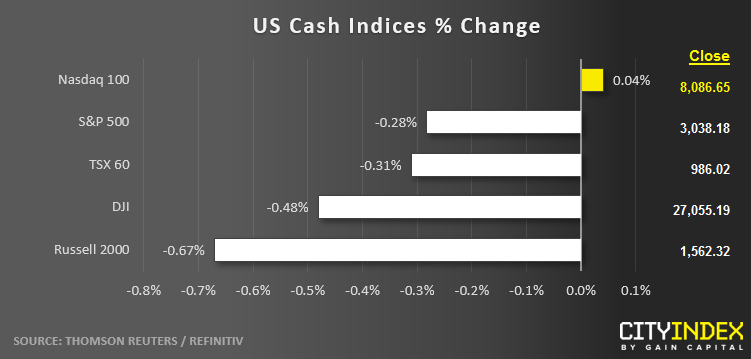

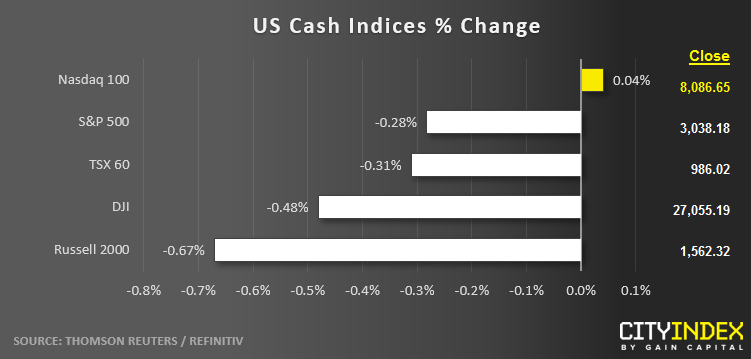

- US indices closed lower on the day despite a late rally into the close.

- Utilities (XLU) were once again the strongest sector, while Materials (XLB) brought up the rear.

- Stocks on the move:

- Both Apple (AAPL) and Facebook (FB) gained 2% today reporting solid earnings after the bell yesterday.

- Social media company Pinterest (PINS) beat expectations for users, but missed on revenues. The stock is tanking in after-hours trade, down -19% as of writing.

- Chinese search giant Alibaba (BABA, -1%) is set to report earnings before the opening bell tomorrow. Exxon (XOM, -0%) and Chevron (CVX, -0%) also report ahead of the open.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM