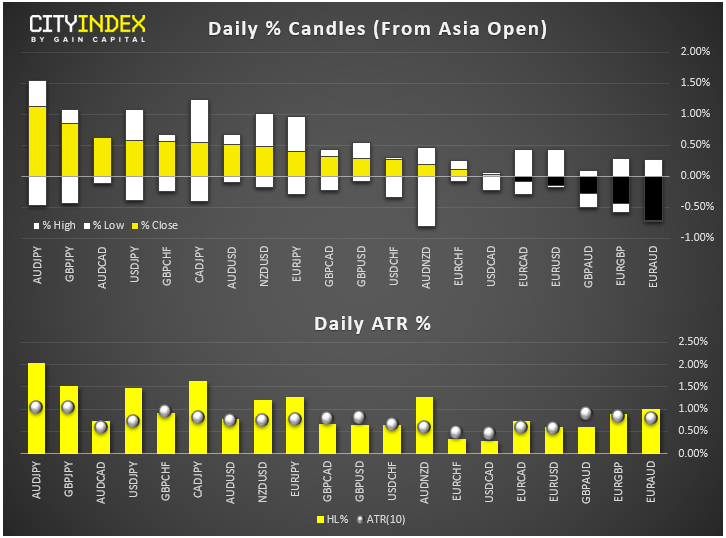

- The AUD is the strongest on RBA inaction and risk rebound, with safe-haven Japanese yen being the weakest after its sharp rally in recent days. EUR has not found much support from strong German data

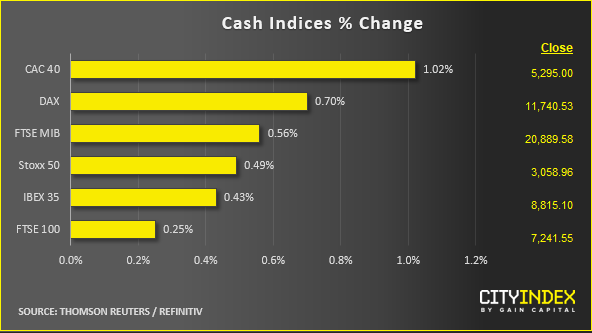

- The ongoing US-China trade dispute remains the main focal point after the US government formally named China a “currency manipulator” after the close of Wall Street on Monday. This came after Beijing allowed the renminbi to fall below 7 against the dollar for the first time in more than a decade, apparently in retaliation to the imposition of fresh tariffs on Chinese goods arriving in the US that were announced last week. However, after an initial dip on the news, stock index futures managed to rebound and were up noticeably at the time of writing. The People’s Bank of China set the daily currency fixing stronger than expected overnight, presumably to distance itself from the accusation it manipulates the yuan.

- Also supporting the markets is probably bargain hunting of companies with good fundamentals and short-covering elsewhere. BUT we think too much technical damage may have already incurred to suggest the bulls are still in control after a multi-month rally sent US indices to virgin territories and markets elsewhere to elevated levels, before the plunge that started last week.

- Meanwhile there was good news from Germany for a change following an onslaught of negative news. Here, factory orders unexpectedly jumped 2.5% in June. This was well above the 0.5% increase expected and more than made up May’s 2% decline. Still, given the sheer amount of data disappointment from Germany, a recession could be looming anyway for the Eurozone’s largest economy. More German data is on the way tomorrow, this time industrial production.

- Overnight, the Reserve Bank of Australia (RBA) decided to leave monetary policy unchanged, disappointing some expectations for a hat-trick of 25 basis-point rate cuts. However, the RBA left the door open for further rate cuts: “It is reasonable to expect that an extended period of low interest rates will be required in Australia to make progress in reducing unemployment and achieve more assured progress towards the inflation target. The Board will continue to monitor developments in the labour market closely and ease monetary policy further if needed to support sustainable growth in the economy and the achievement of the inflation target over time.”

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM