Kelvin Wong and Matt Simpson both contributed to this article.

- Japanese exports declined for an 8th successive month, falling -1.6% YoY compared with -2.2% expected. China-bound shipments of car parts was the main drag on the headline figure, and exports to China declined by -9.3% YoY. Separately, a Reuters Tankan survey showed manufactures were pessimistic for the fort time in 6 years as the trade war continues to bite.

- New Zealand producer prices rebounded in Q2 by 0.5% QoQ, up from -0.5% prior. Input prices also improved and hit 0.3% QoQ versus -0.9% prior.

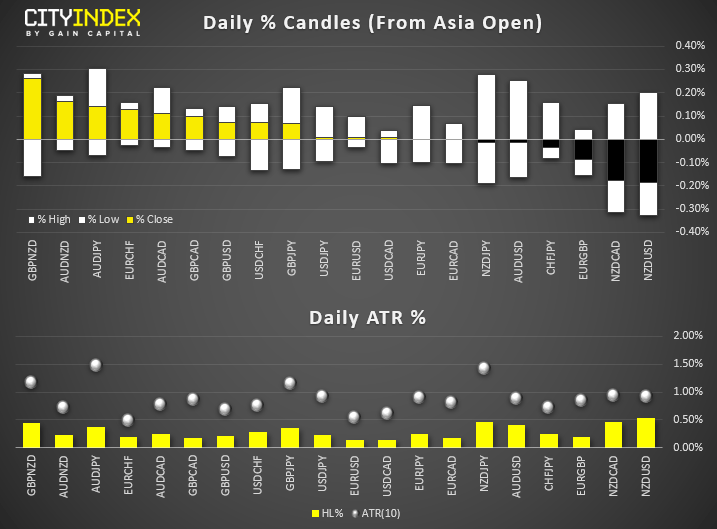

- Narrow ranges across the FX space with all monitored pairs remaining well within their typical daily ranges. GBP and AUD are currently the strongest majors, CHF and CAD are the weakest.

- NZD/USD edged its way to an 8-day low (when RBNZ cut by 50bps) and is the only major to break Friday’s range. USD/CHF is testing resistance around 0.98, gold is consolidating around $1509, Silver has touched a 3-day low.

- The Asian stock markets have reacted more positively towards the interest rate reforms plan proposed by China central bank, PBOC over the weekend where all of them have gained as at today’s Asian mid-session

- The top performers are Hong Kong’s Hang Seng Index and China A50 which have rallied by 1.87% and 1.08% respectively. The on-going rally seen in the Hang Seng Index has also been supported by a peaceful large-scale protest event held yesterday in contrast with previous mass protest demonstrations that have been chaotic with clashes between the police and protesters.

- The S&P 500 E-mini futures has traded up by 0.60% in today’s Asia session to print a current intraday high of 2903 after a positive close of 1.14% seen on last Fri, 16 Aug U.S. session.

- The FTSE 100 and German DAX CFD futures are trading with modest gains as well at this juncture; up by 0.50% and 0.45% respectively.

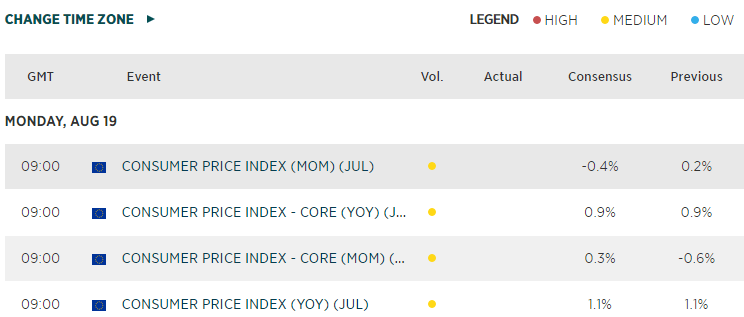

- A quiet session awaits, with the main data including final CPI reads for Europe. In fact data this week is quite sparse ahead of the Jackson Hole Symposium over the weekend, here the main topic is “challenges for Monetary Policy”.

- U.S. Commerce Department’s announcement on whether to extend the existing permit in place for U.S. firms to conduct business dealings with China’s Huawei Technologies.

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Kelvin Wong and Matt Simpson both contributed to this article.

Latest market news

Today 04:00 PM

Today 01:15 PM

Today 11:30 AM

Today 08:18 AM