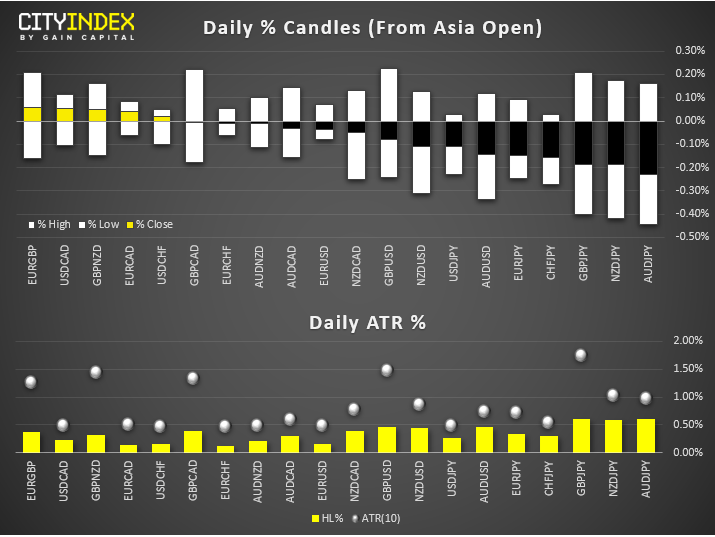

View our guide on how to interpret the FX Dashboard

FX Brief:

- With British parliament still unsure of how or when Brexit could go through, it was a mild risk-off session in Asia overall yet volatility remained contained. All pairs from the FX dashboard remaining below their daily ATRs. JPY is the strongest major whilst AUD and GBP are the weakest.

- RBNZ’s Hawkesby “very happy” with how cuts have fed through to the economy, adding that inflation could be fuelled by higher house prices (so long as this leads to consumption).

- DXY and USD/CHF nudged their way to a 3 and 4-day high respectively as the greenback extends yesterday’s correction.

- AUD/USD and NZD/USD also retreated earlier in the session, with AUD finding support just above the June ’19 low. EUR/USD also edged lower yet key support resides 1.110.

- GBP/UD also tested a 4-day low but we’re waiting for Brexit headlines from the UK or US session to really get this one moving.

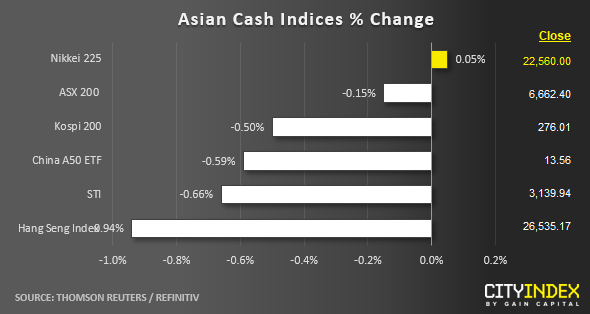

Equity Brief:

- A sea of red for Asian stock markets today after soft earnings numbers from a bellwether U.S. semiconductor firm, Texas Instruments also the 3rd largest component stock in the PHLX Semiconductor Sector Index.

- After the close of yesterday’s U.S. session, the share price of Texas Instruments has tumbled by close to -10% to print an intraday low of 114.40 in after-hour trading after it reported Q3 revenue that came in below expectations (US$3.77 billion versus US$3.8 billion consensus) and offer a lacklustre Q4 earnings guidance. It has closed yesterday at $128.57.

- The worst performer so far today is the Hong Kong’s Hang Seng Index which has declined by -0.94% where major technology related stocks took the brunt today. ACC Technologies and Tencent Holdings have plummeted by -3.70% and -1.89% respectively. In addition, there is media report that stated that the Chinese government is drafting a plan to replace the current Hong Kong’s Chief Executive Lam with an “interim” chief executive and Lam’s successor is likely to be installed in March. Perhaps such action will be not be able to alleviate the 5-month long of street demonstrations as the chief executive is still picked by the central government rather than local Hong Kong votes.

- Japan’s Nikkei 225 has managed to escape the carnage where losses in technological related stocks have been offset by gains seen in health care and industrial related stocks, Sumitomo Heavy Industrials has recorded a gain of 3.09%.

- Nikkei 225 heavy weightage stock, Softbank Group has tumbled by -2.6%; dragged down by its investment related woes in embattled start-up WeWork. Softbank has agreed to cough up a US$9.5 billion rescue package in exchange for a 80% stake in WeWork.

- The S&P 500 E-Mini futures has extended a modest decline of -0.19% in today’s Asian session to print a current intraday low of 2982 after it reintegrated back below the 3000 psychological level at the close of yesterday’s U.S. session.

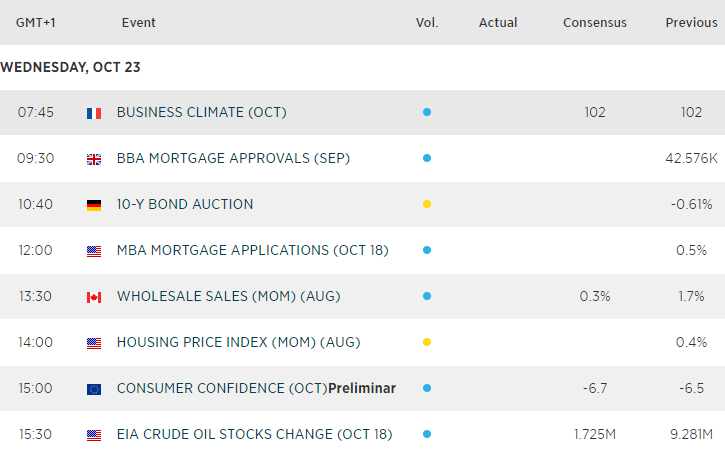

Economic Calendar

Matt Simpson and Kelvin Wong both contributed to this article

Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions

Latest market news

Yesterday 11:09 PM

Yesterday 11:01 PM

Yesterday 04:00 PM

Yesterday 01:15 PM

Yesterday 11:30 AM