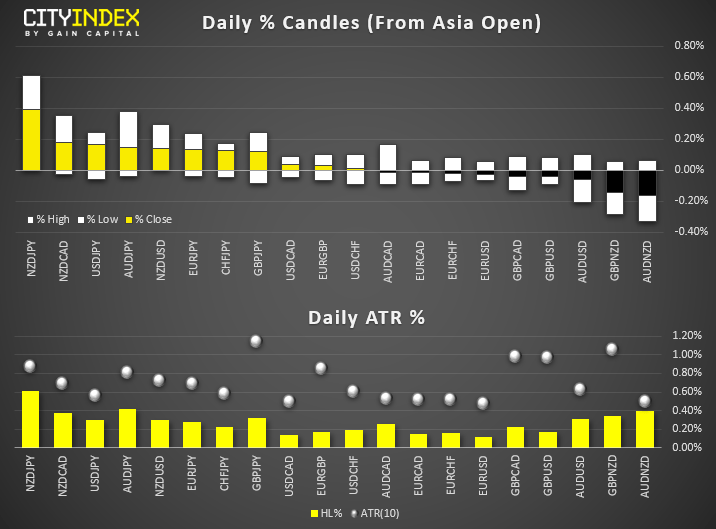

- Minor ranges across FX markets saw all monitored pairs remain within their typical daily ranges, ahead of UK and European open.

- USD/JPY hit a 6-week high and remains firm, USD/CHF only made a marginal 6-week high before returning back within yesterday’s range.

- North Korea fired short-range projectiles today according to South Korean officials. This comes within hours of NK saying via a statement they’re willing to restart denuclearisation talks.

- China threatened ‘military response’ if a UK warship travels through waters in the South China Sea.

- NZD is the strongest major on the back of firmer electronic retail sales. August sales rose 1.1% versus 0% expected, and up 2.8% on the year compared with 1.6% expected.

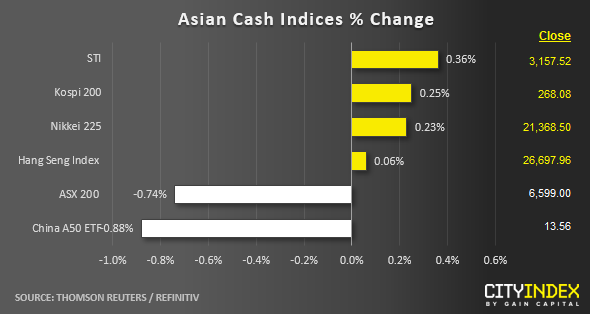

- Asian stock markets have traded in a mix fashion in line with a flat session seen in the overnight key U.S. stock indices after last week’s gains of 2.5% to 2.8%.

- Also, weak economic data from China has indicated further deflationary pressure that may have led to some profit-taking activities. China’s producer price index has dropped to -0.8% y/y in Aug from -0.3% y/y in Jul; the worst y/y contraction in three years.

- The China A50 is the worst performer so far follow by its one of its proxies, Australia’s ASX 200 that has shed -0.74% as at today’s Asian mid-session; dragged down by technology and healthcare stocks.

- At the other end of the spectrum, Singapore’s STI and Korea’s Kospi 200 has managed to post modest gains of 0.36% and 0.26% respectively.

- The S&P 500 E-min futures has continued to pull-back from yesterday’s high of 2991 printed in the European session. It has inched down slightly by -0.10% to print a current intraday low of 2975 in today’s Asian session.

Up Next:

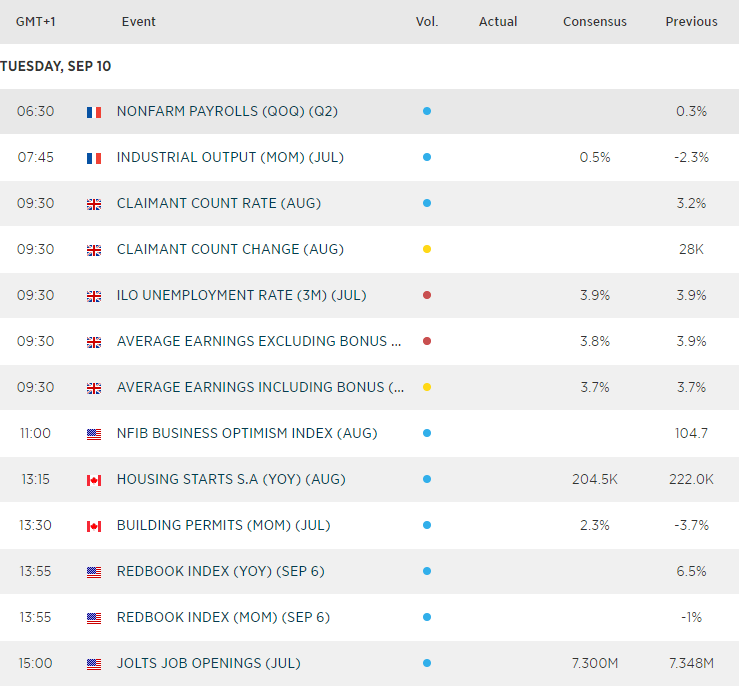

- GBP was given a boost with yesterday’s stronger than expected GDP print. Today we get to see if it can extend its momentum with employment data. Unemployment rose to 3.9% in June, although is expected to remain steady this month. So, it may require a print of 3.8% or less to keep those GBP juices flowing.

- Average weekly earnings (an inflationary input) is expected to soften, so anything from 3.9% or higher warrants attention.

Latest market news

Today 08:15 AM