View our guide on how to interpret the FX Dashboard

FX Brief:

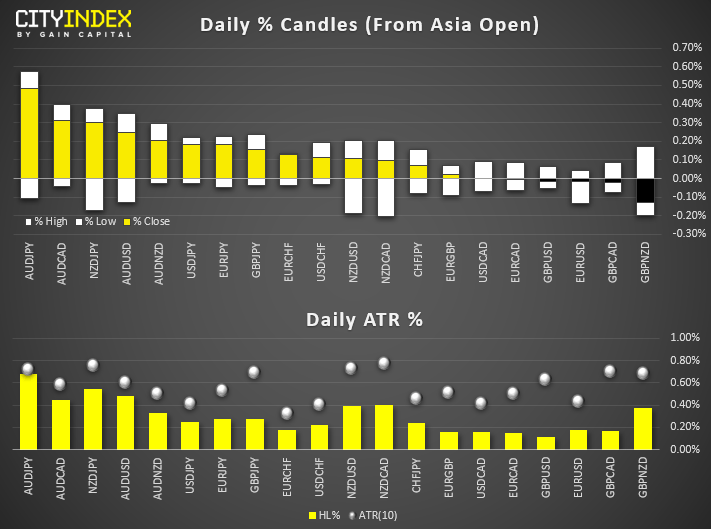

- AUD is today’s strongest major after RBA held rates. AUD/JPY is the biggest mover of the session and its daily range has spanned 95% of its 10-day ATR – given it remains beneath key resistance, we may need another catalyst for risk-on to break higher.

Reports that US was considering remove tariffs on $120 billion of Chinese goods was also supportive for AUD and NZD pairs. - Trade optimism saw the yuan appreciate further, taking USD/CNH to a 60-day low.

- DXY nudged its way to a 4-day high after yesterday’s rebound from key support.

- GBP/USD is stuck at yesterday’s, with potential for further downside given Friday’s bearish pinbar and Monday’s bearish engulfing candle.

Equity Brief:

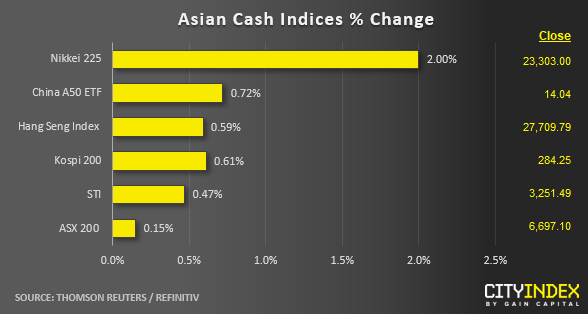

- Risk on mode has continued to prevail in key Asia stock markets that has recorded modest gains between 0.15% to 0.70% except for Japan’s Nikkei 225 that has surged by 2%, more of a “catch-up play” due to a holiday closure yesterday.

- Continued bout of U.S-China trade deal optimism news flow seems to be the catalyst as a media report has cited that the White House is considering rolling back the 01 Sep tariffs imposed on $112 billon of Chinese imports, one of the sticking points that China has requested before any trade deal is being finalised.

- Also, China central bank PBOC has continued to provide liquidity by cutting its medium-term lending facility (MLF) by 5 bps to 3.25%, the first cut since early 2016. Perhaps such liquidity injection has managed to offset the expected negative reaction from China’s weak services sector activities. The Caixin China Services PMI has slipped unexpectedly to 51.1 in Oct (versus consensus forecast of 52.8) from 51.3 recorded in Sep; the weakest pace of growth in the services sector since Feb 2019.

- Technology sector has led the gains in the Hong Kong stock market for today where AAC Technologies, a supplier of Apple has surged by 3.5% to hit a 6-month high of HKD 53.30; the stock has rallied by 60% from its Aug 2019 low of 32.85.

- The performance of Australia’s ASX 200 was tepid due to a dent in overall sentiment by Westpac Banking Corp, one of the “Big 4” banks that plummeted as much as -5.1% to A$26.46 after a trading halt was lifted from yesterday, the biggest drop since Nov 2018. Westpac had completed a discounted A$2 billion equity placement where the issue price was at A$25.32 per share which was a significant 9% discount to its closing price on last Fri, 01 Nov.

- Oversea-Chinese Banking Corp (OCBC), a major component stock in the Singapore’s Strait Times Index (STI) has shed by -0.36% so far after it has reported a fall of 6% on its Q3 profit due to a one-off charge for Indonesian unit.

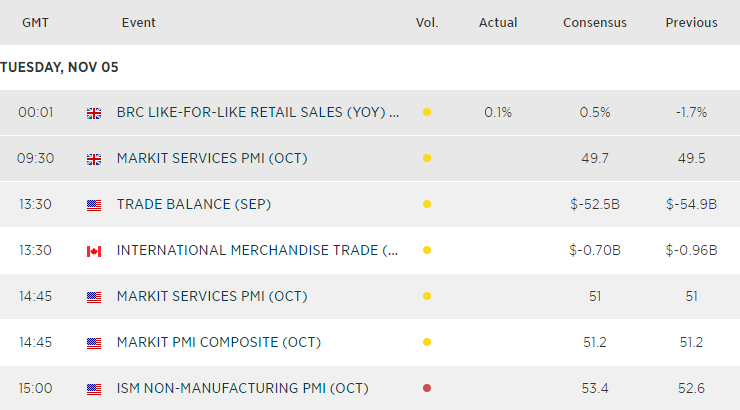

Up Next:

- UK manufacturing PMI is expected to contract at the slower rate of 49.7, versus 49.5 prior.

- ISM Non-manufacturing could shed further light on whether the US is headed for recession. The manufacturing counterpart has contracted for three consecutive months, yet services remains expansionary. Given we saw manufacturing’s contraction slow this month, it could leave potential for a positive surprise. USD pairs and US indices are markets to track around this release.

Matt Simpson and Kelvin Wong both contributed to this article

Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM