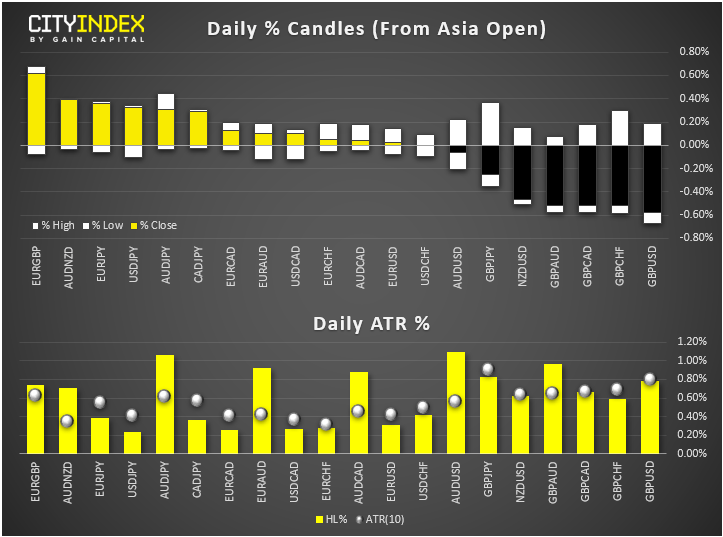

- Market update at 11:50 GMT: In FX, EUR and USD were among the biggest risers, while GBP brought up the rear; stocks rallied and commodities fell across the board.

View our guide on how to interpret the FX Dashboard

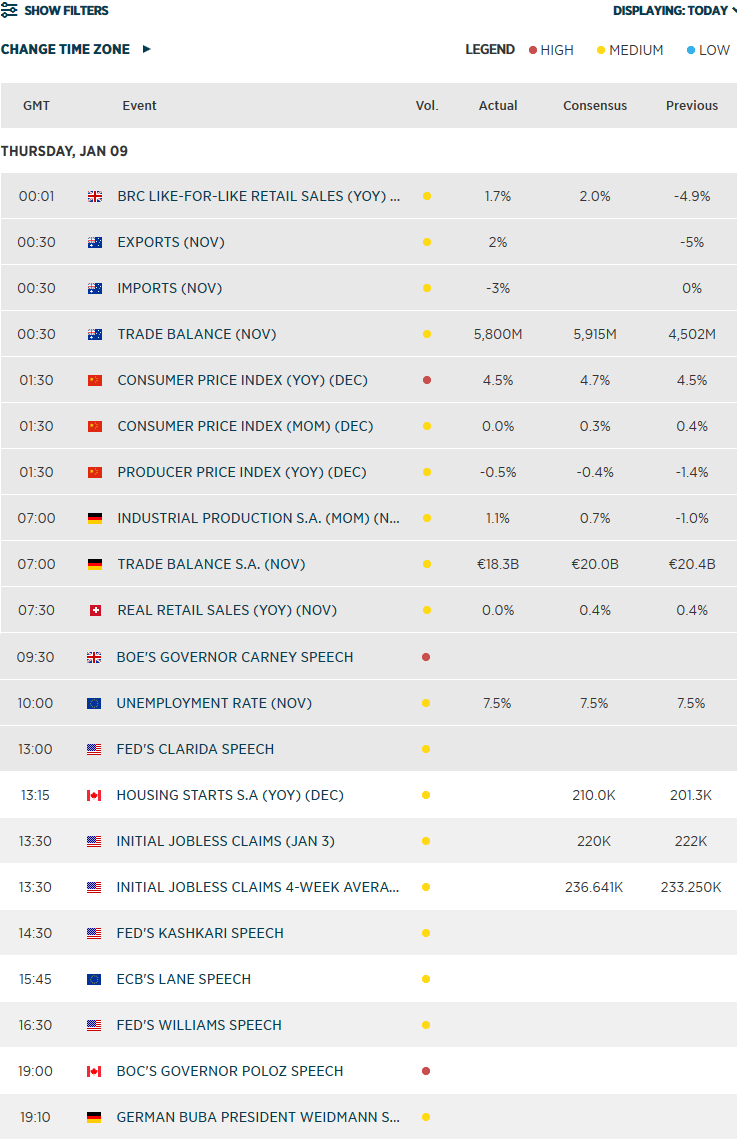

- GBP fell sharply this morning after the Bank of England’s Mark Carney delivered a dovish speech. The outgoing Governor said persistent weakness could require prompt response and that there is headroom equivalent of 250 bps of policy space. Meanwhile, UK Prime Minister Boris Johnson and EU Commission President Ursula von der Leyen met yesterday and set out some red lines for the negotiations set to take place this year. Leyen warned that getting a full and comprehensive exit deal by the end of 2020 is “impossible,” and an extension is therefore required – something Johnson has previously ruled out.

- EUR rose as German industrial output increased by 1.1% m/m in November, its biggest rise in a year and a half. However, declining exports made for mixed signals on Europe's largest economy.

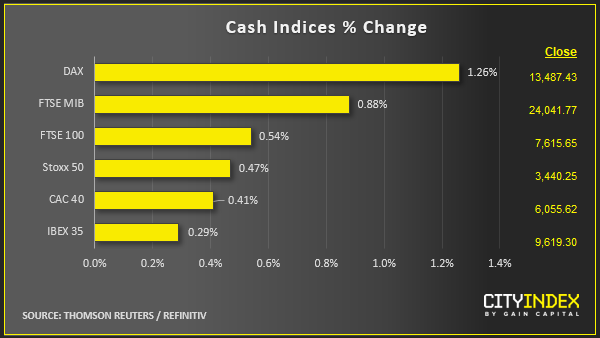

- Risk ON: Following Donald Trump’s speech on Wednesday, crude oil and gold both fell after the US President made no mention of military action against Iran and called for peace and negotiations. While these commodities fell, the more risk-sensitive copper rallied along with stocks. Equities have extended, with the German DAX hitting a new high above last year’s peak and US index futures suggest the S&P 500 will hit a new record high. In addition to the easing of Middle East tensions, sentiment is boosted by news China's Vice Premier Liu He will sign the "Phase 1" deal in Washington next week, according to the commerce ministry.

- UK company news:

- Tesco (TSCO) shares fell more than 1% after Britain's biggest retailer managed only a 0.1% rise in underlying UK sales over Christmas, disappointing expectations.

- Marks & Spencer (MKS) saw its shares fall 9% as weak menswear and gift sale caused same-store sales in the clothing and home business to fall 1.7%.Although this was an improvement from last year, it was nonetheless worse than the 0.8% decline expected.

- Coming up:

Latest market news

Yesterday 08:33 AM