FX & Stock market snapshots as of [06/08/2019 0500 GMT]

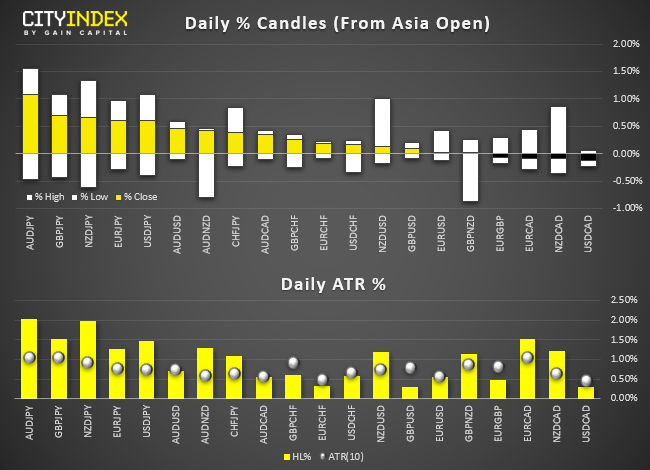

- The JPY crosses have continued to see heightened volatility where profit taking can be seen in yesterday’s USD/JPY shorts positions. The USD/JPY has rallied closed to 1.00% in today’s Asian session to retrace yesterday’s steep decline due to trade tensions escalation.

- RBA has left the key policy cash rate unchanged at the lowest level of 1.00% as expected and admits that the Australian economy has slowed and cited renewed trade tensions between U.S. and China as a major concern. The AUD/USD has traded sideways below yesterday’s high of 0.6804.

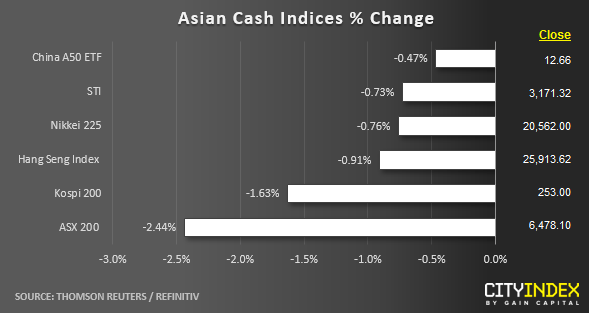

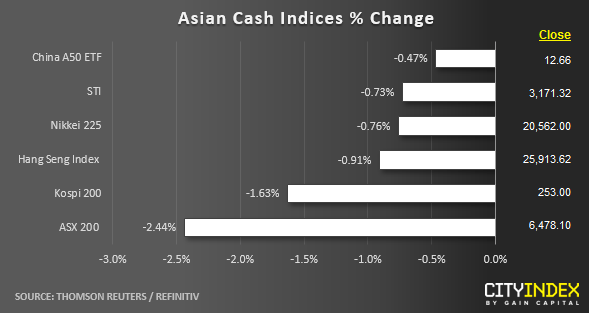

- Ahead of the European opening session, all Asian stock markets are still trading in the red with the Australia’s ASX 200 being the worst performer with a loss of -2.44% as at today’s Asian mid-session. Technology & Healthcare sectors are the biggest drag on the ASX 200 where both sectors have declined by -3.98% and -3.33% respectively.

- After the U.S Treasury Dept has officially named China as a “currency manipulator”, the China central bank PBOC has guided the opening fixing on the onshore USD/CNY at 6.9683, above yesterday fixing of 6.9225 but below expectations of 6.9871.

- The offshore USD/CNH has dropped by 807 pips from today’s Asian session high of 7.1400 to a current intraday low of 7.0593. A weakening USD/CNH has managed to trim earlier losses seen in the Asian stock markets.

- The S&P E-mini futures has traded up by 2.91% from today’s Asian session low of 2775 to print a current intraday high of 2850.

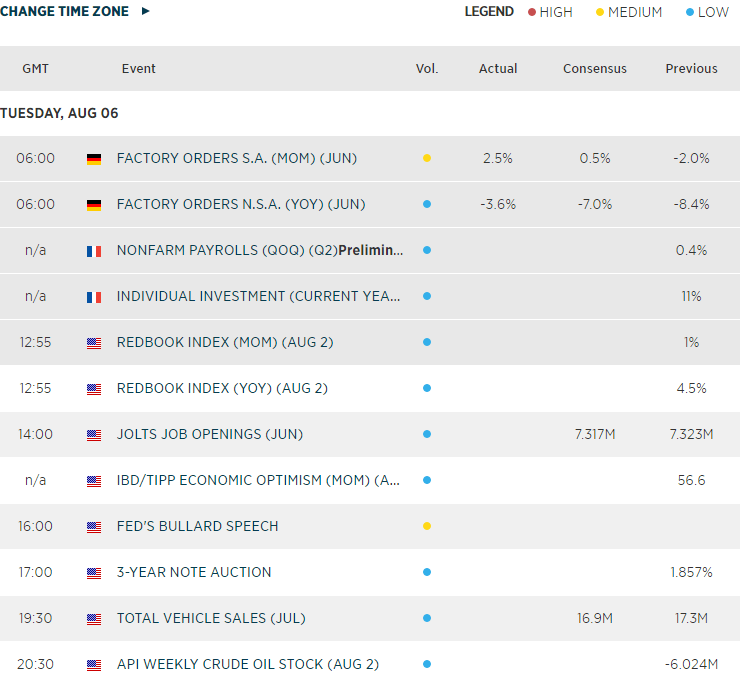

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM