FX & Stock market snapshots as of [15/08/2019 0420 GMT]

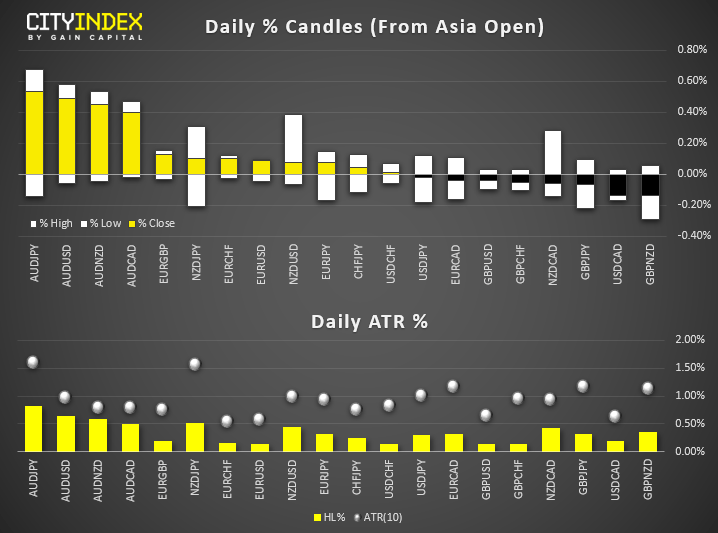

- Despite the mounting risks of a global economic recession reinforced by the U.S. Treasuries yield curve inversion between the 10-year and 2-year tenure, the risk sensitive AUD is the top performer in today’s Asian session. The AUD/USD, AUD/JPY and AUD/NZD have rallied by 0.40%.

- The catalyst for this rare outperformance seen in the Aussie was a better than expected AU jobs data for Jul. Employment change came in at +41.1K above consensus of +14.0K. In addition, the interest rate futures market has also pared down expectations of an RBA rate cut in Sep from a probability of 38% to 18%.

- Despite the intra-session stellar performance of the AUD/USD, the pair is still trading below its intermediate range resistance of 0.6820 in place since last Thurs, 08 Aug.

- Another risk sensitive pair, USD/JPY is also not showing much significant movement in today’s Asian session where it has traded in a tight range of around 0.20% below its 10-day ATR of 1.00%. From a technical analysis perspective, the pair is evolving within a minor “Pennant” range consolidation after a slide from its 13 Aug high of 106.97.

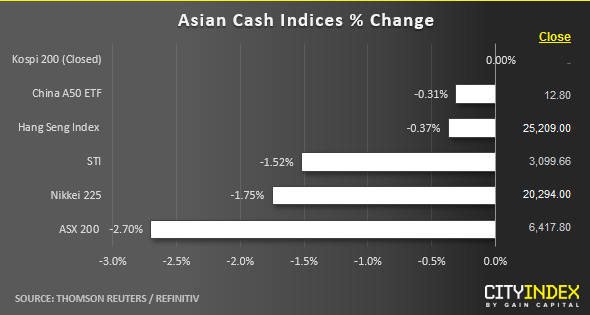

- In contrast seen in the FX markets, the worst performer in today’s Asian mid-session is Australia’s ASX 200 which has recorded a decline of -2.70% that broke below last Tues, 06 Aug low of 6444.

- The underperformance seen in the ASX 200 has been dragged down by external demand and growth-related sectors where Industrials, Technology and Energy stocks have tumbled by-3.19%, -4.55% and -5.01% respectively.

- The Korea’s Kospi 200 is closed today for a public holiday.

- Also, geopolitical risk in the Asian region, specifically in Hong Kong remains on red alert. U.S. politicians have raised the concerns of the sightings of Chinese armed police personnel and vehicles on the Hong Kong border where the China officials have reiterated that the on-going Hong Kong’s protests have resembled terrorism.

- Based on the latest tweets from U.S. President Trump yesterday, these tweets implied indirectly that the U.S. administration is trying to tie a trade agreement with China to the protests in Hong Kong being resolved “humanely”. Thus, with such implicit backing from the U.S, the Hong Kong protesters are not likely to be backing down soon which may see further weakness in the Hong Kong’s stock market that can trigger a contagion effect to the rest of the world.

- After a -2.9% tumble seen in the S&P500, the E-min futures is now trading higher by 0.45% to print a current intraday high of 2857 in today’s Asian session.

Up Next

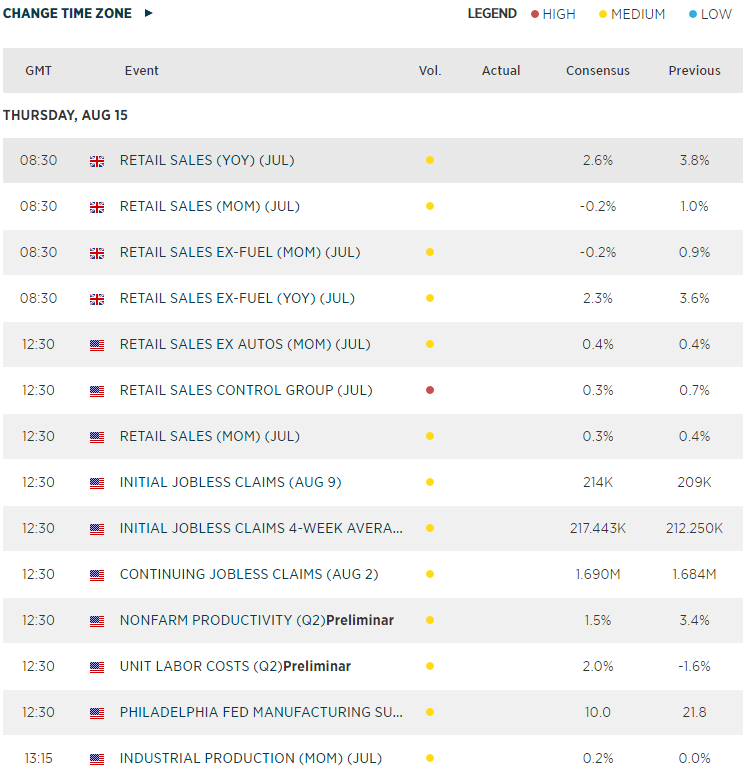

- U.K. retail sales for Jul out at 830 GMT where consensus is set at 2.6% y/y down from 3.8% y/y seen in Jun.

- U.S. retail sales (control group) for Jul out at 1230 GMT where consensus is set at 0.3% m/m down from 0.7% m/m seen in Jun.

- U.S. industrial production for Jul out at 1315 GMT where consensus is set at 0.2% m/m up from 0% m/m in Jun.

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Today 08:33 AM

Yesterday 11:48 PM

Yesterday 11:16 PM