Markets update:

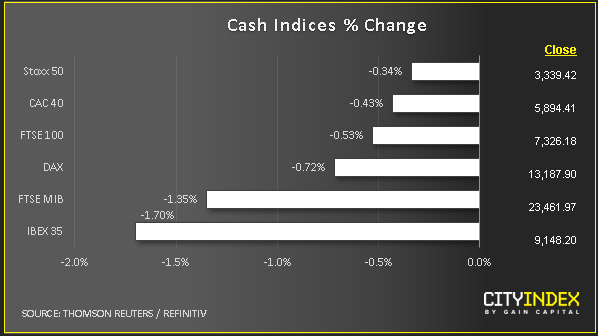

- Stocks: Mild risk-off tone prevailed amid profit-taking after the S&P 500 yesterday hit a new record high before quickly easing back as Donald Trump disappointed prior expectations by providing no fresh news regarding the US-China trade situation. The US President merely suggested that a phase one deal “could” happen soon and that China wanted it so badly. Sentiment is also hurt by falls in Asian markets due to ongoing tensions in Hong Kong where anti-government protesters have changed tactics to disrupt the city’s transportation system on weekdays. At midday in London, European stocks and US index futures were lower.

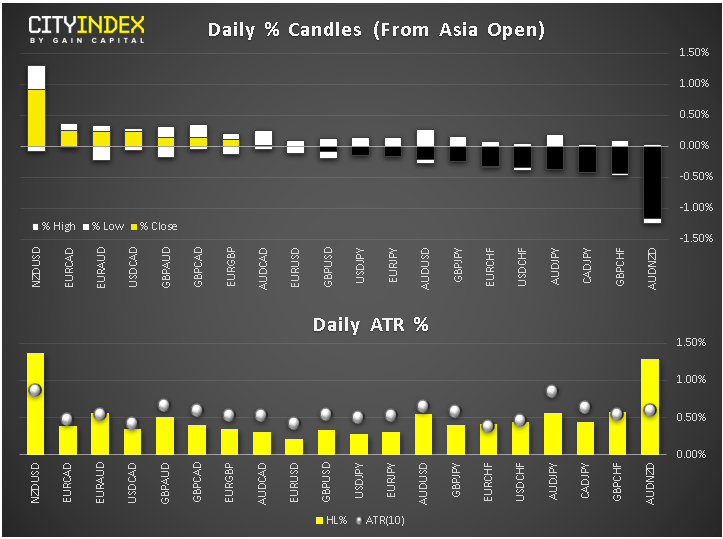

- FX: Thanks to the pullback in equity markets, safe-haven JPY and CHF were higher, only bettered by RBNZ-driven NZD, while other commodity dollars such as the AUD and CAD brought up the rear. Bitcoin was continuing to coil inside a falling wedge technical pattern.

View our guide on how to interpret the FX Dashboard

- Commodities: Thanks to a weaker stock market and USD/JPY, gold managed to extend its gains from the day before when it bounced nicely off that $1450 key support level as we had highlighted the possibility before. Crude oil prices fell along with other risk-sensitive assets.

Data recap:

- RBNZ surprised the markets last night by deciding against a rate cut and NZD pairs spiked broadly higher after RBNZ held rates and didn’t deliver the dovish press conference that many expected.

- UK CPI missed expectations with a print of 1.5% y/y, versus 1.6% expected and down from 1.7% previously. Core CPI was in line and unchanged at 1.7%y/y. RPI also missed the mark at 2.1%, down from 2.4%. Possibly due to a stronger pound, PPI input slumped 1.3% m/m, pointing to subdued inflationary pressures. GBP/USD struggled to move in one or the other direction in a meaningful way, holding below 1.2850.

- Eurozone Industrial Production rose 0.1% m/m, better than a drop of 0.2% expected.

Up Next:

- US CPI due at 13:30 GMT. Both headline and core CPI measures of inflation are expected to print unchanged readings of 1.7% y/y and 2.4% y/y, respectively. On a month-over-month basis, they are expected to print +0.3 and +0.2 per cent respectively.

- Fed Chair Jay Powell testifies at 16:00 GMT. Investors will be watching for any insights into interest rates outlook and comments on the health of the US economy to gauge the possibility of a further rate cut this year.

Stocks/sectors in focus:

- Spanish Banks are among the biggest fallers on a quadruple whammy of negatives. These are: weaker sector earnings, waning optimism on a trade breakthrough, sliding Eurozone long-dated yields, and Spain's new Socialist/far-left coalition.

- ABN Amro fell almost 7%. A criminal probe into alleged money laundering raises doubts about its cost-cutting targets, whilst trading profits tanked.

- UK oil mid-cap Tullow collapsed 25% after cutting output guidance.

- Commercial property developer British Land traded 4.4% lower as it expects business to remain "uneven".

- Homebuilder Taylor Wimpey fell 2.3% after an in-line update with no guidance upgrades.

- Pub operator JD Wetherspoon rose 2.2% on relief from positive comparable sales which rose 5.3%.