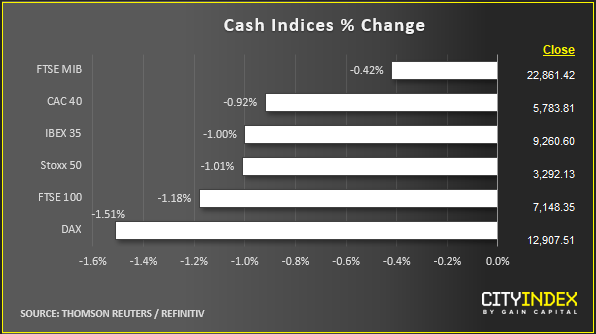

Market update at 11:53 GMT: European stocks were sharply lower along with US index futures ahead of a busy few days. Sentiment has turned cautious as we near towards a US tariff deadline on Sunday which will highlight the state of trade relations with China. Before that, we have the Fed, SNB and ECB policy decisions in mid-week, while the outcome of the UK general election is expected in the early hours of Friday. In FX, GBP has again ignored weaker-than-expected UK data as investors continue to price out risks of a snap election; the EUR has been supported by stronger sentiment data from surveyed investors and analysts in Germany, while commodity dollars have been held back on slight risk aversion. Meanwhile, gold was up on haven demand as equities sold off while crude oil was lower along with other risk assets.

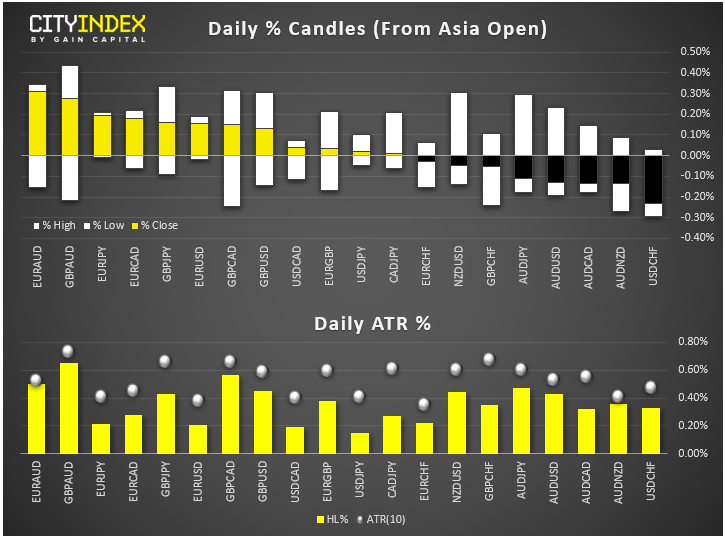

View our guide on how to interpret the FX Dashboard

Good news from Europe: the German ZEW Economic Sentiment index, which fell to a multi-year low in August before improving in the subsequent months, has now risen to its highest level since 2018 on hopes of improvements in exports and private consumption. The print of 10.7 was well ahead of 1.1 expected and marks a sharp improvement from -2.1 recorded in the previous month. The ZEW Economic Sentiment for the Eurozone, likewise beat expectations with an even impressive reading of +11.2 compared to +2.2 expected. This comes after the Sentix Investor Confidence barometer went back above the optimism threshold of zero as we found out on Monday.

UK data largely disappointed: Monthly GDP +0.0% m/m vs. +0.1% expected; Index of Services +0.2% 3m/3m vs. +0.3%; Construction Output -2.3% m/m vs. +0.2%; Industrial Production +0.1% m/m vs. +0.2%. However, Manufacturing Production was slightly ahead of forecasts at +0.2% m/m vs. +0.1%. This morning’s data barely caused any reaction in the pound with the GBP/USD climbing to a new multi-month high.

Coming up: Economic calendar is light for the North American session today. Things will pick up on Wednesday though and it could be a volatile few days in the markets. See our week ahead report for more.