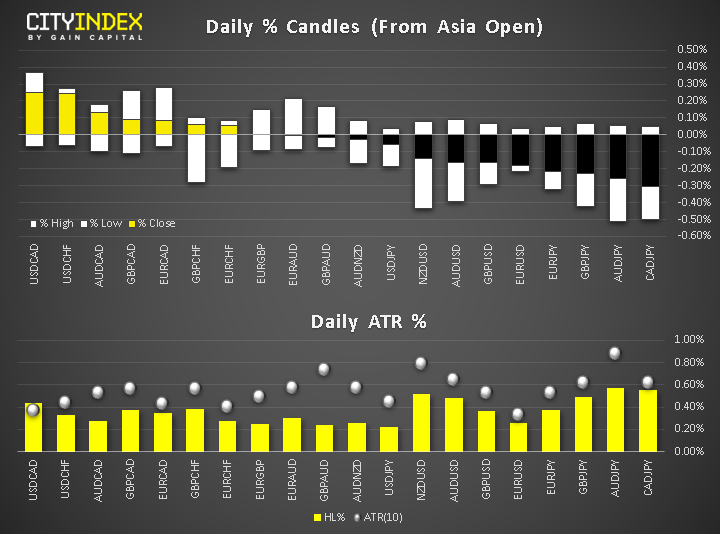

- Risk aversion has crept up, weighing on all yen crosses except the USD/JPY. This means that the US dollar is the strongest currency today with all other majors also being down against the buck. The weakest currency was the Canadian dollar:

View our guide on how to interpret the FX Dashboard

- Doubts continue to grow over the ability of the US and China to agree a phase one trade deal. The latest concern is that the decision by the US Senate to pass a bill supporting the pro-Democracy protesters in Hong Kong will only aggravate an already fragile US–China relationship. Indeed, China has voiced displeasure and raised warning of retaliation. Separately, a couple of days ago, Trump had threatened of further tariff if no deal is done.

- FX market participants are looking forward to Canadian CPI (13:30 GMT) and FOMC meeting minutes (19:00 GMT).

- Canada CPI expected at 1.9% y/y and 0.3% y/y for core CPI. If the data disappoints, this could very well increase the pressure on the CAD as speculation grows over a possible rate cut by the Bank of Canada.

- FOMC minutes may not contain much in the way of new information. Fed Chair and several officials have guided market participants towards a “wait and see” approach in terms of monetary policy after three rounds of interest rate cuts.

- In commodities, gold and silver turned lower as earlier gains evaporated with an appreciating US dollar. Meanwhile crude oil rebounded after an extended drop in the previous session. Official EIA crude oil inventories data at due at 15:30 today.

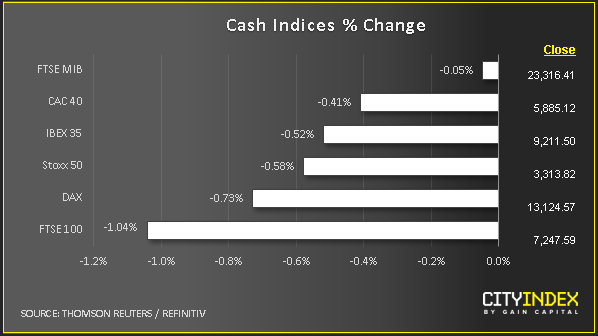

- European stocks were lower with all European sectors in the red though energy fell the most, led by a 3.2% tumble by Equinor. US index futures pointed to a subdued start on Wall Street.

- Stocks on the move, courtesy of my colleague Ken Odeluga:

- Swedbank drops 3.5% as it becomes the latest Nordic lender to come unstuck due to Russia-related corruption allegations

- Shell, BP and Total dragged European indices lower, thanks to yesterday’s sizeable drop in oil prices. Equinor, formerly known as Statoil, said current output from a key North Sea field exceeded 300,000bbl/day, but that's lower than expected.

- HSBC, the Hong Kong-exposed bank, fell 0.9%, dragging the FTSE 100, on which the stock is the heaviest single weight.

- Kingfisher also weighing the FTSE down with a big drop on shares after a quarterly sales miss

- Target, the American retailer, may lift this week's gloom in the sector after reporting higher than forecast Q3 earnings, key sales and Q4 guidance, lifting the stock 8% in pre-market trade. Victoria's Secret operator L Brands reports after tonight's U.S. close.

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM