Market Brief: Risk Assets Recover, but Trade Uncertainty Remains

- Risk assets rallied today after President Trump indicated that China was willing to come back to the negotiating table over trade tensions (a claim that China disputes, but that ultimately might not matter for traders).

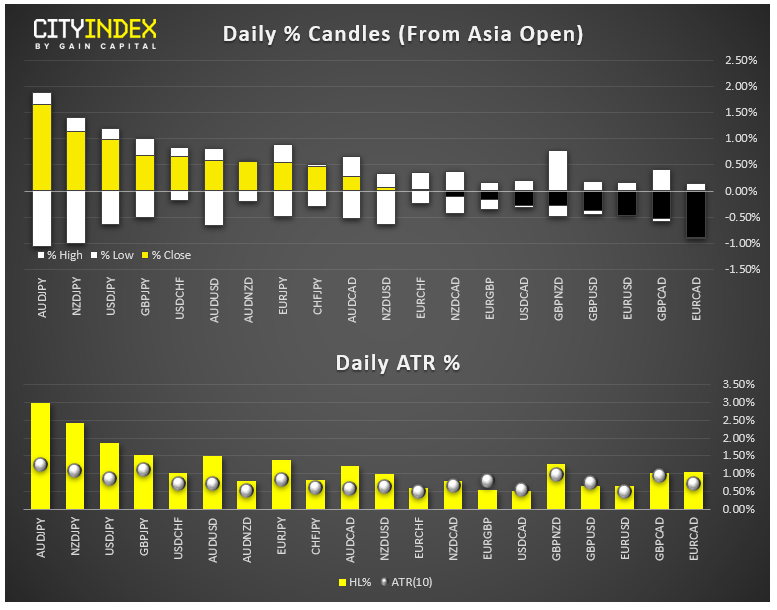

- FX: Risk-sensitive currencies like the Australian and Canadian dollars led the way higher, while the safe haven Japanese yen was the day’s weakest performer.

- Commodities: Gold was essentially flat on the day. Oil dipped about 1%.

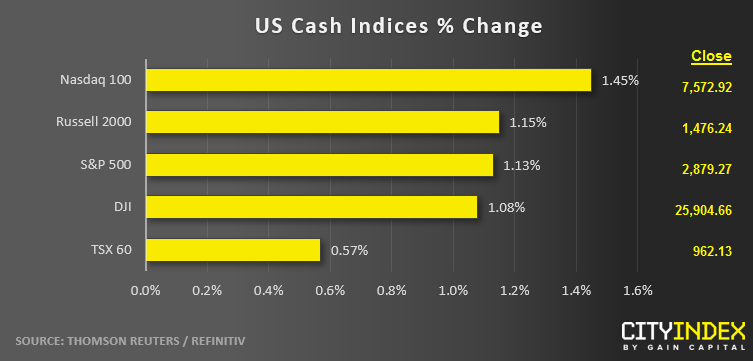

- US indices closed around 1% higher on US-China trade talk optimism. Time will tell if the latest developments mark a turning point or merely a short-term bounce off support.

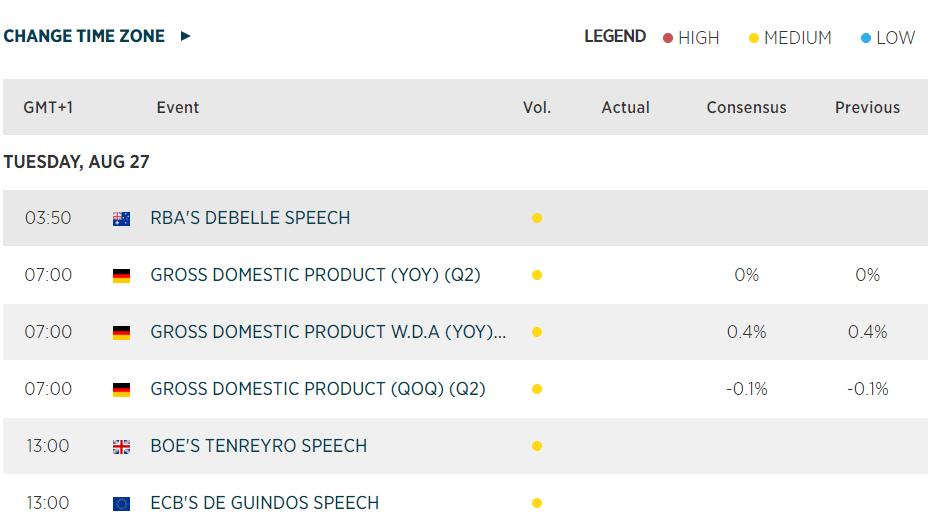

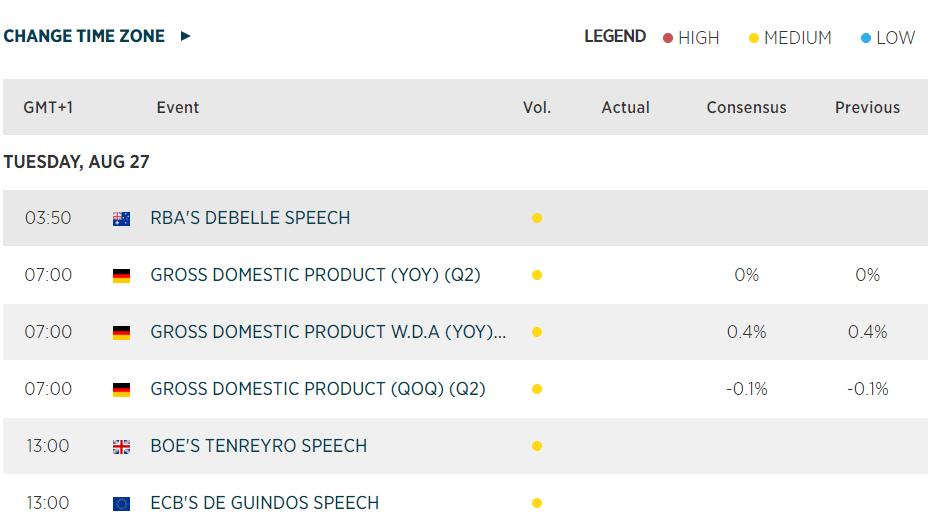

- See the key data releases and market trends we’ll be watching over the rest of the week!

- Stocks on the Move:

- Biotechnology company Amgen (AMGN) rallied 3% after announcing a deal to buy Celgene’s (CELG, +3%) Otezla subsidiary for $13.4B. Bristol-Myers Squibb (BMY, +3%) said the deal was necessary for regulatory approval of its pending acquisition of Celgene.

- Pitney Bowes (PBI) lost -8% on news that it was selling its software solutions business to data company Syncsort.

- Dish Network (DISH) rallied 4% after an analyst at Raymond James upgraded the stock.

Latest market news

Today 08:33 AM