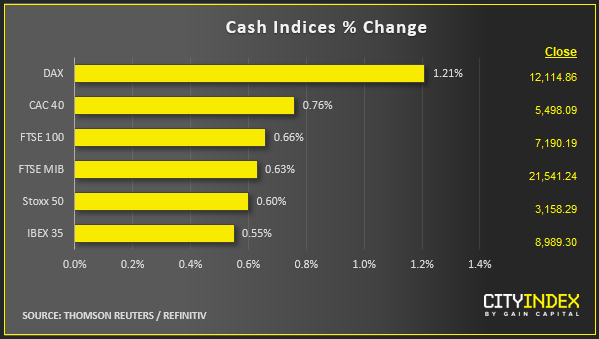

Stock market snapshot as of [9/10/2019 2:08 PM]

- A profusion of trade and Brexit-related tape bombs has brought some confusion to Europe’s Wednesday session, though revived risk appetite is holding

- U.S. stock futures are in step, and also not flinching after the Financial Times corrected an earlier report to state that China would be prepared to expand purchases of U.S. soybeans by 10 million tonnes to a total of 30 million from 20 million at present. An earlier bulletin suggested China would purchase an additional $10bn in U.S. agricultural products

- There’s ample room for disappointment once resurgent market optimism moderates. China’s apparent offer echoes at least one similar instance. In February, Chinese officials offered to buy an additional 10 million tonnes of U.S. soybeans. The offer came to nothing

- Separate reports point to Beijing remaining willing to come to a limited trade agreement, even after this week’s tit-for-tat incidents. Washington moved to blacklist more Chinese tech groups and prevent some top Beijing officials from obtaining visas, amid indications that China may retaliate by restricting visas to some U.S. officials. The screening of some NBA games in China has been cancelled

- The country’s efforts to salvage some promise from top-level talks set to begin at the end of the week is what’s keeping a floor under stocks. Low expectations might also be playing a part. Risk seeking looks like it could evaporate just as swiftly as it has returned

- UK assets are also tilting towards a qualified ‘risk-on’ as flurries of headlines throw sterling every which way but loose. Gilts lead European government bond yields higher after sterling spiked on a London Times report that the EU might be willing to accept a time-limited Irish backstop. Meanwhile, PM Boris Johnson won yet another Scottish court case. This time judges ruled that only he—and not any senior UK minister or official—can send a letter to the EU requesting an extension. The judges noted that campaigners can bring their case back to court if Johnson fails to act accordingly

- Other headlines are less positive: the EU’s Budget commissioner called the latest UK proposals “inadequate”, whilst other unnamed EU figures briefed Reuters saying they expect “no breakthrough”. Sterling remains lower

Stocks/sectors on the move

- Technology shares are leading Europe’s 12 industry sectors higher, with software and services mostly level pegging with hardware on gains of 1.3%-1.5%. A conference call with analysts left chipmaker Infineon among the leaders, with a 2.4% lift. Only Europe’s defensive utilities segment was lower as the U.S. session approached

- Pharma and med-tech firm Johnson & Johnson is standing out into the start of Wall Street cash trade. Following a recent well-received court ruling on opioids, the group has been ordered to pay $8bn to a man who said J&J’s antipsychotic drug caused him to develop enlarged breasts

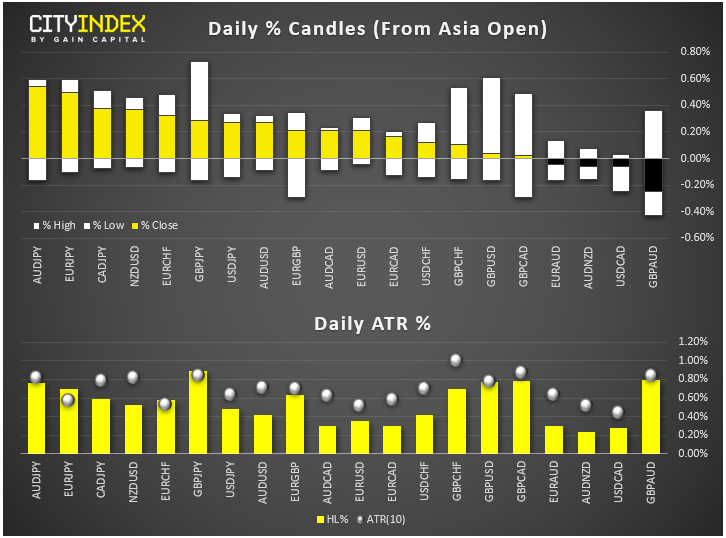

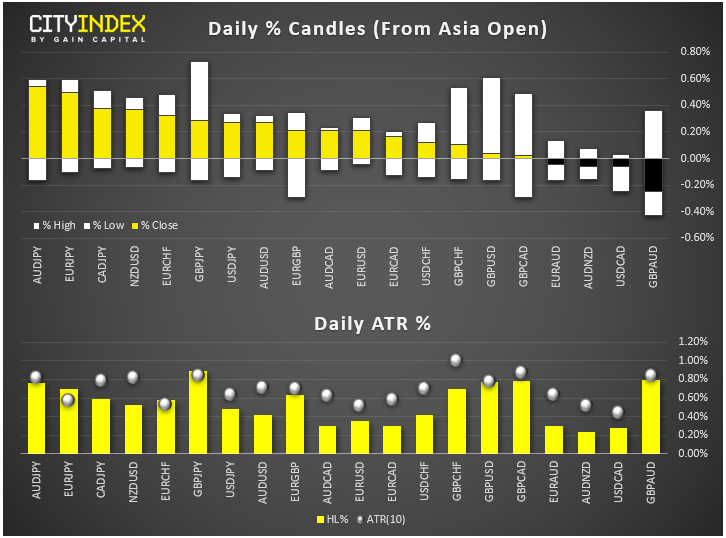

FX snapshot as of [9/10/2019 2:10:09 PM]

FX markets and gold

- Sterling volatility is writ large in the tug of war between risk-sensitive Aussie and yen. Price action has left almost equal parts of the day’s range on the upside of the pair as on the downside versus AUD, so far

- More broadly, rumours of the demise of the U.S. bond rally may have been exaggerated. Even after a 50 basis point rally by U.S. 10-year Treasury yields from the low in September, the total decline over about 11 month has been some 170 basis points

- That will continue to spotlight the dollar’s decoupling from Treasurys. The Dollar Index has retreated less than 1% in recent days from a 29-month high notched at the beginning of the month. The watch is on whether safe-haven tendencies will continue to underpin the greenback, or whether massive yield pressure will soon begin to take a toll

Upcoming economic highlights

Latest market news

Yesterday 08:33 AM