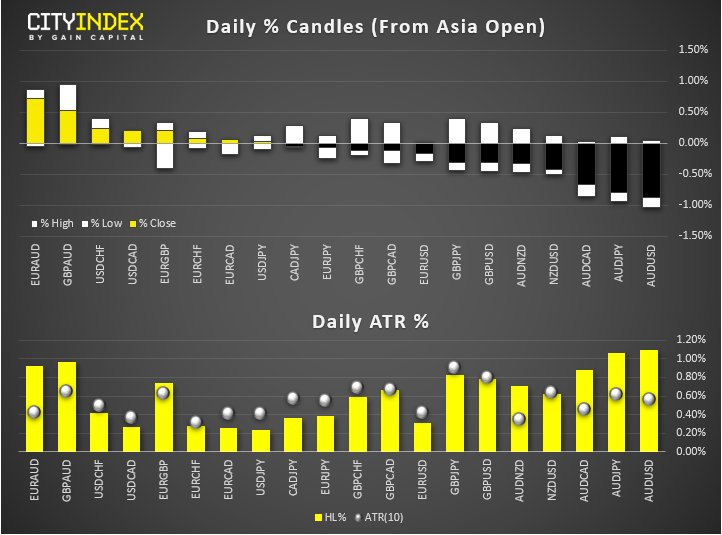

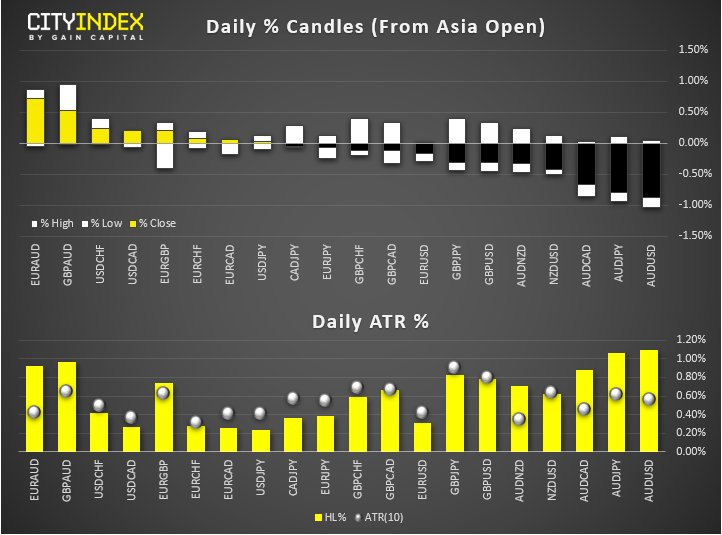

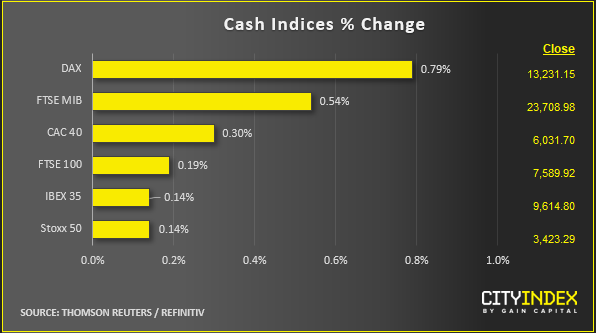

- Market update at 12:0 GMT: Among the major currencies, the EUR and USD were the strongest while AUD and GBP were the weakest; stocks were higher, crude oil lower and gold flat.

View our guide on how to interpret the FX Dashboard

- EUR strengthened as Eurozone CPI inflation climbed to a six-month high of 1.3% (up from 1.0% previously but in line with expectations) thanks to strong pre-Christmas consumer spending, which saw retail sales rise a good 1.0% month-over-month in November (vs. +0.6% expected).

- AUD was the weakest as the implied probability of a Feb rate cut rose more than 50% due to the economic damage of the wildfires raging across Australia.

- As optimism over a phase one trade deal between the world’s largest economies rise, it is no wonder to see the yuan strengthening to its best level since August, causing the closely-followed USD/CNH pair to break down.

- The escalation of tensions between the US and Iran may have underpinned safe-haven gold and caused a spike in crude oil prices over the past few days, but its impact on the wider markets have been minimal, even if Tehran has promised "severe revenge" for the death of Soleimani. Global stocks were rebounding, oil prices were weaker, and gold was flat at the time of writing.

- In major company news:

- Aston Martin issued a fresh profit warning as its sales dropped, causing its shares to fall more than 12%.

- Morrison shares rose 2% after the UK’s fourth largest supermarket posted better-than-expected same-store sales, even if they were down 1.7% in the second half (compared with a drop of 2.2% expected by analysts)

- Coming up: ISM Services PMI (54.5 expected) and US factory orders (-0.6% m/m expected) at 15:00 GMT.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM