Market Brief: Powell Whipsaws Markets, Apple Earnings on Tap

View our guide on how to interpret the FX Dashboard.

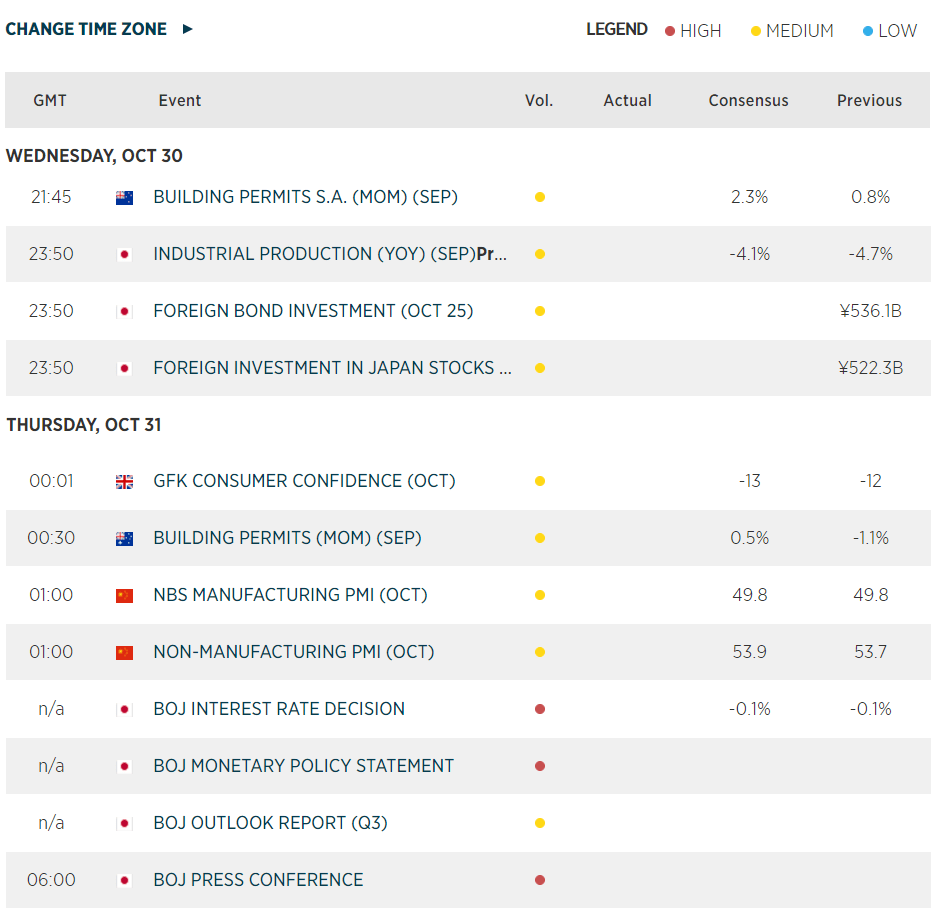

- The Federal Reserve initially delivered a “hawkish cut,” reducing interest rates by 0.25% to the 1.50-1.75% range, though Chairman Powell noted that monetary policy is now “in a good place” and that it would take a “material reassessment” of the central bank’s outlook to change policy from here. However, many markets reversed their initial moves when he noted that it would take a significant rise in inflation before the central bank considers an interest rate hike.

- Separately, the Bank of Canada left interest rates unchanged at 1.75% as expected, though dovish comments from Governor Poloz suggest that the central bank was considering an “insurance cut” to rates.

- Chile cancelled the planned APEC summit in November, where Presidents Trump and Xi were planning on signing the “Phase One” trade deal. China has reportedly offered to hold a signing event in Macau instead.

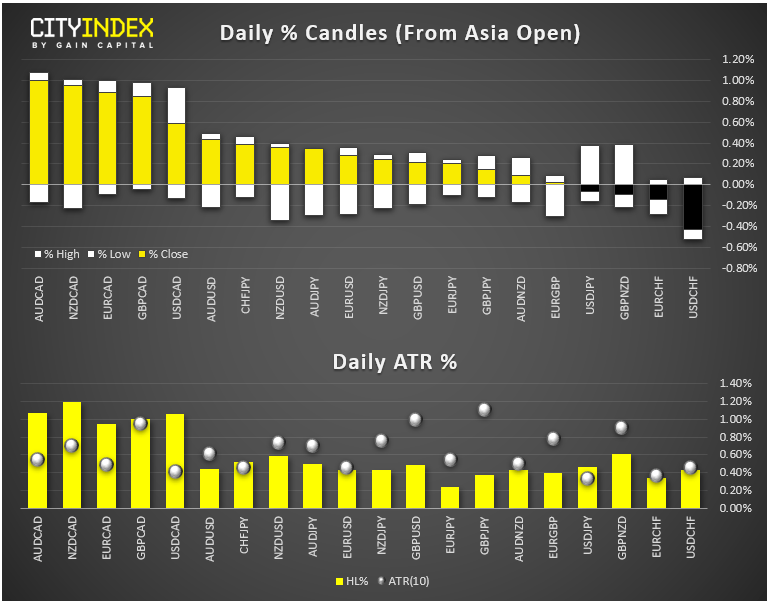

- FX: The loonie was the weakest major currency on the back of the BOC and falling oil prices. The Swiss franc was the strongest major.

- US data: US GDP (Q3) printed at 1.9%, above expectations of 1.6% growth, though the accompanying inflation readings were lower than anticipated. ADP employment (Oct) printed at 135k vs. 110k expected and a revised 93k last month.

- Commodities: Oil fell -1% on the day to hit a 1-week low after a surprisingly large build in inventories. Gold rallied about 0.5%.

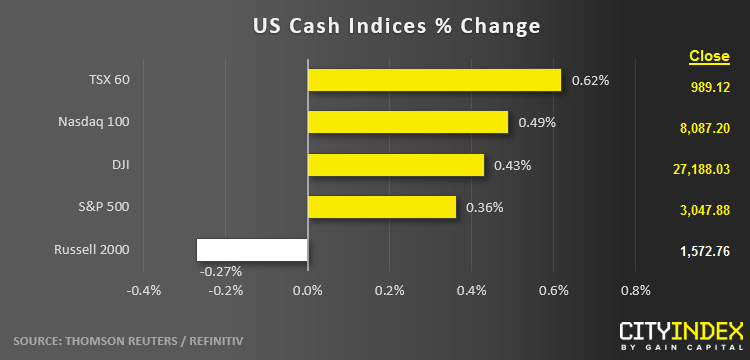

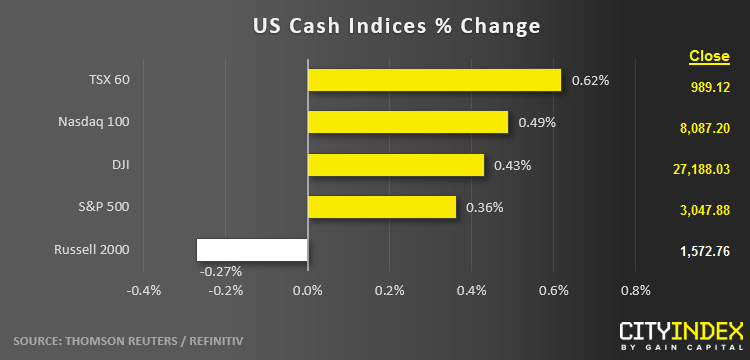

- US indices closed higher on the day, supported by the perception of a “Powell Put” if economic data worsens.

- Utilities (XLU) were the strongest sector, while Energy (XLE) was the weakest, falling more than -2% on the day.

- Stocks on the move:

- Apple (AAPL, +0%) is poised to report earnings as we go to press.

- Facebook (FB) reported $2.12 in EPS vs. $1.88 expected. Revenues also came in stronger than expected at $17.65B vs. $17.45B eyed. The stock is trading up 3% in after hours trade on the initial reaction.

- General Electric (GE) gained +12% after it forecast better cash flow in 2020 on the back of its renewable energy division.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM