Market Brief: Powell Leaves Traders Scratching Their Heads

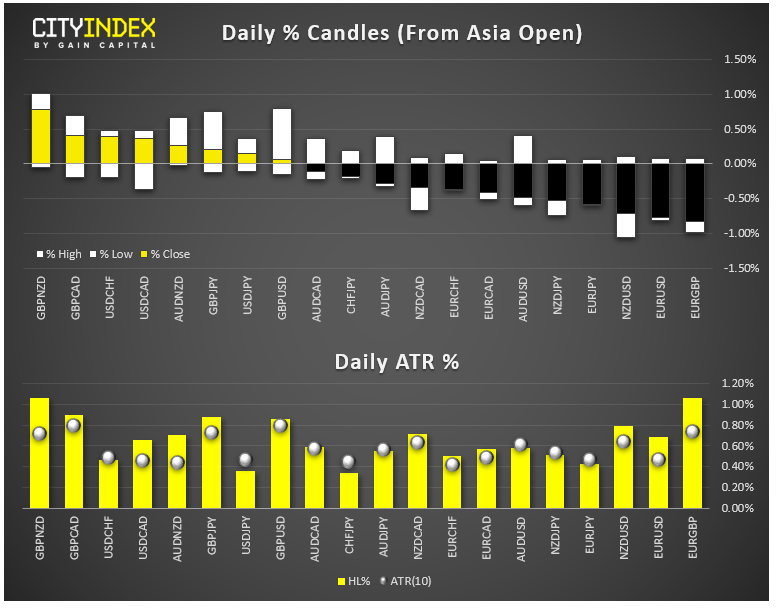

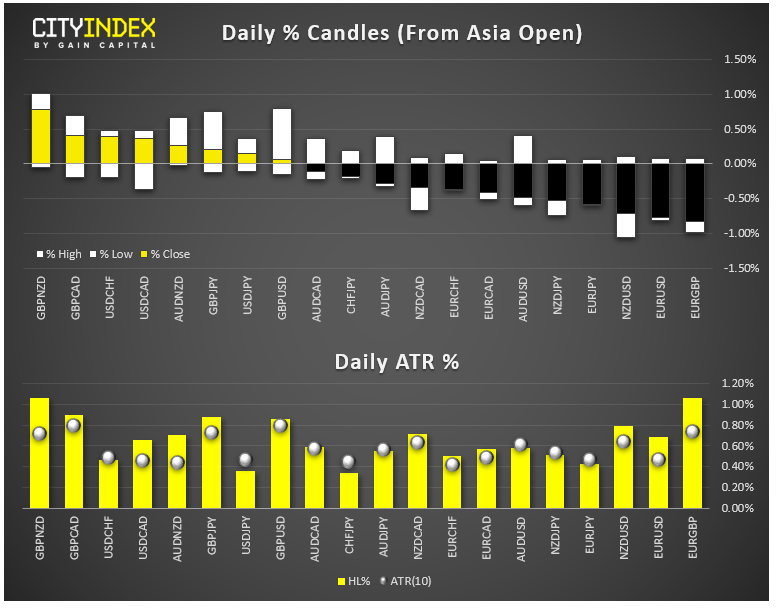

- FX: The pound was the strongest major currency after bringing up the rear each of the first two days of the week.

- The Federal Reserve cut interest rates as widely expected, simultaneously vowing to end its balance sheet rundown program tomorrow, two months earlier than expected (see our full review of the decision and statement).

- While the Fed statement seemed to suggest the potential for a follow-up cut, Fed Chairman Powell was cagey in his press conference, highlighting the “insurance” aspect of the cut and noting its not the start of a long series of cuts… but also noting that he wasn’t necessarily saying the cut was “one-and-done.” Not surprisingly, traders struggled to interpret Powell’s message.

- EUR/USD currently trades at a 2-year low below 1.1100

- Commodities: Gold dropped 1% on the day while oil finished flat.

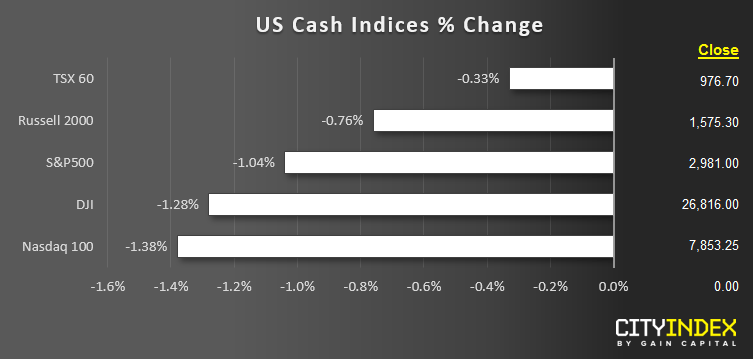

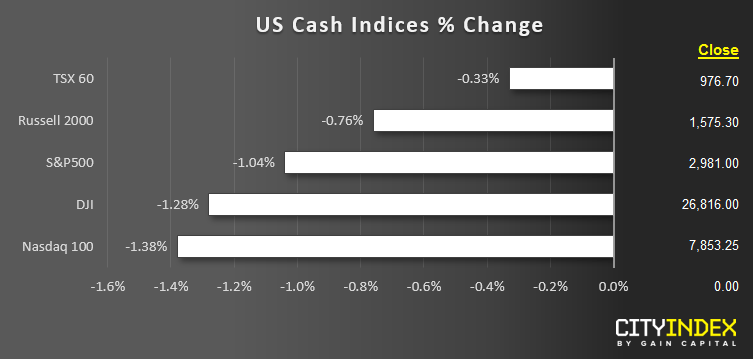

- US indices recovered from their lowest levels, but still closed around 1% lower across the board.

- Financials (XLF) led the way, while Consumer Staples (XLP) were the weakest sector.

- Stocks on the Move:

- Apple (AAPL) rose 3% after reporting stronger-than-expected earnings and revenue figures after the bell yesterday.

- General Electric (GE, -1%) tracked the overall market lower, despite reporting earnings and revenue beats.

- Advanced Micro Devices (AMD) dropped 10% on weak revenue guidance.

- Other earnings movers include Humana (HUM, +5%), Molson Coors Brewing (TAP, -5%), and Electronic Arts (EA, +4%).

Latest market news

Yesterday 08:33 AM