Market Brief: Powell a Dud, Traders Terrified of Trade Tensions

- The day’s (week’s? month’s?) marquee event, Fed Chairman Powell’s speech at the Jackson Hole Symposium, was a bit of a damp squid, with Powell emphasizing the central bank’s data dependence and the risk of protectionism escalating. These comments proved timely in the wake of this morning’s announcement that China would be imposing additional tariffs on US exports.

- Shortly after Powell’s remarks concluded, President Trump went off on twitter, asking whether Powell (his hand-picked Fed Chair) or China was a bigger enemy to the country, ordering US companies to stop doing business with China, and teasing a big announcement in the afternoon. As of writing, investors remain on edge to see if more headlines cross over the weekend.

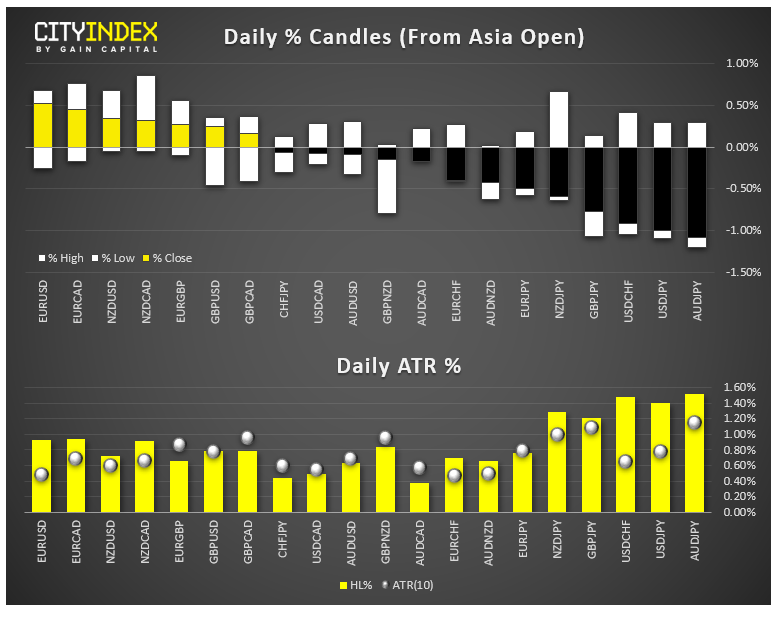

- FX: The US dollar and risk-sensitive aussie were the weakest major currencies on the day. Predictably, the safe haven Japanese yen and Swiss franc were the strongest major currencies.

- The Chinese yuan also dropped to test its 11-year low against the US dollar near 7.14.

- Commodities: Gold tacked on 2% while oil fell nearly 3% in classic risk-off trade.

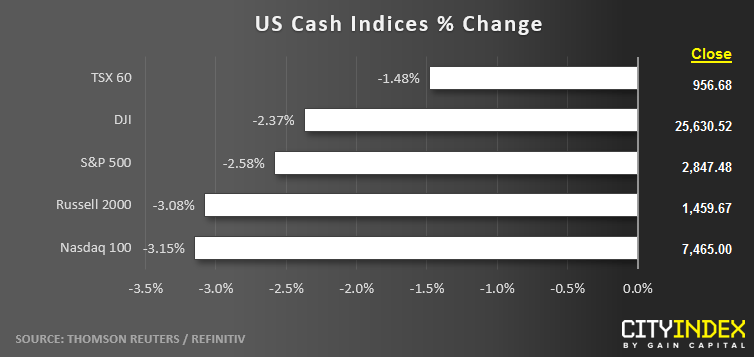

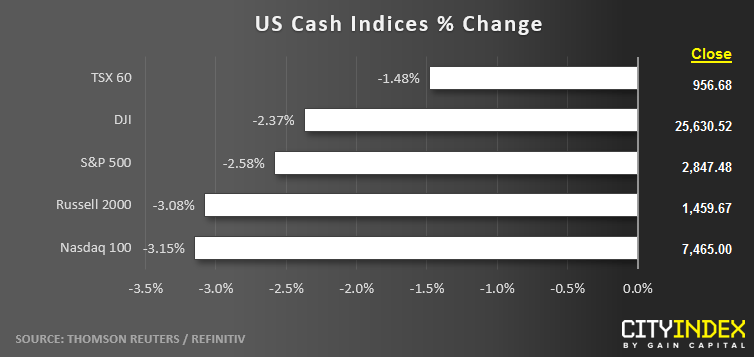

- US indices closed sharply lower on the day to approach the lower end of the recent 2-week range.

- Defensive Utility stocks (XLU) were the strongest sector while Energy (XLE) was the weakest.

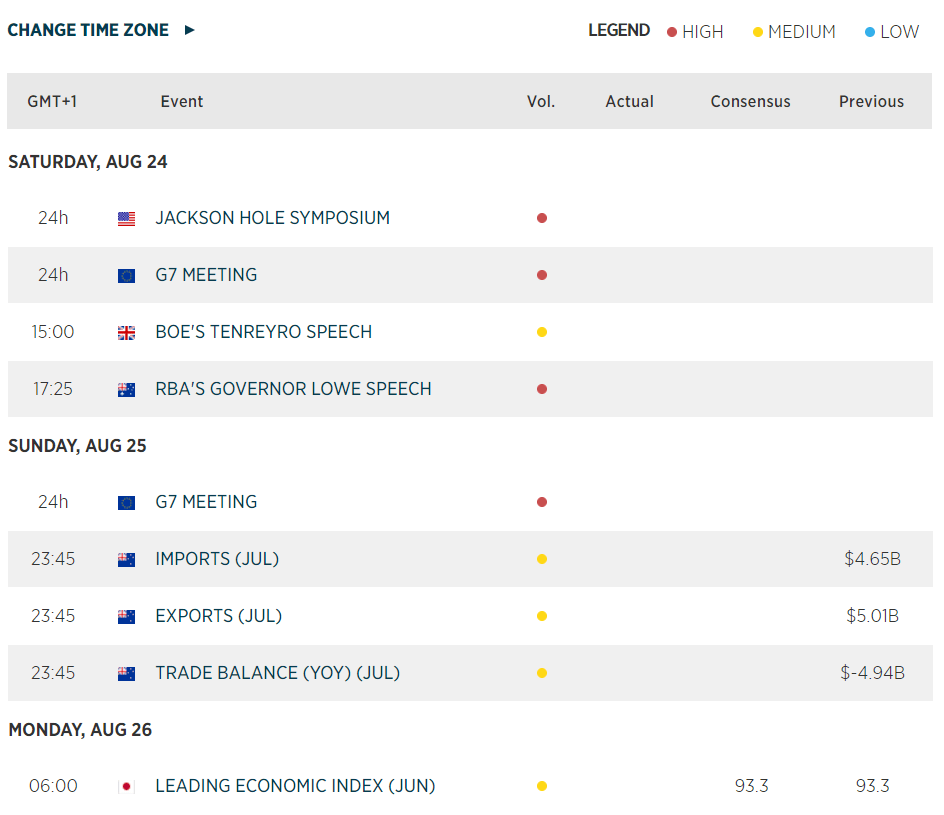

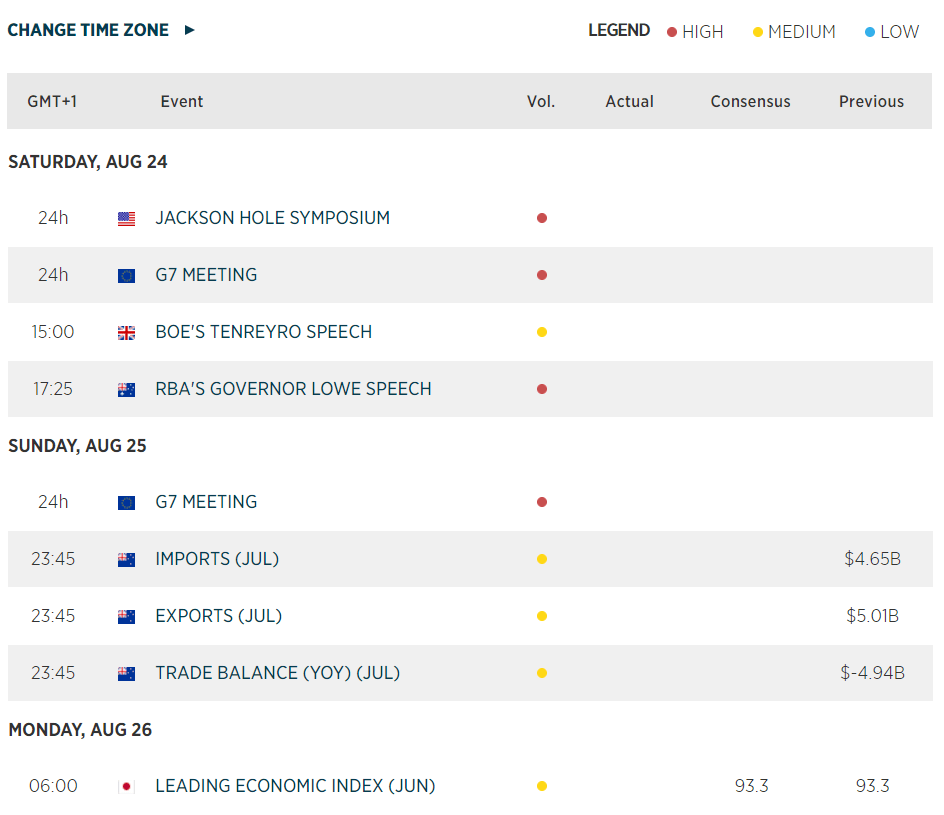

- See the key data releases and market trends we’ll be watching in the week to come!

- Stocks on the Move:

- Foot Locker (FL) dumped 19% after missing sales and revenue forecasts, bringing the string of strong retail reports to an end. Proposed tariffs on Chinese-manufactured shoes heading into the holiday season could hurt sales further moving forward.

- HP (HPQ) shed 6% after matching earnings estimates and appointing a new CEO.

- Both Intuit (INTU, +1%) and Salesforce.com (CRM, +2%) reported strong earnings and were able to buck the relentless selling pressure in broader indices.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM