Market Brief: Pound Surges, Now Up 600 Pips in Less Than a Week

- Bloomberg reported that EU and UK negotiators were “closing in on” a draft Brexit deal, centered around a customs border in the Irish Sea pending DUP support; the party has been skeptical toward the proposal to say the least and even if a deal is agreed, Brexit would likely have to be delayed to year-end.

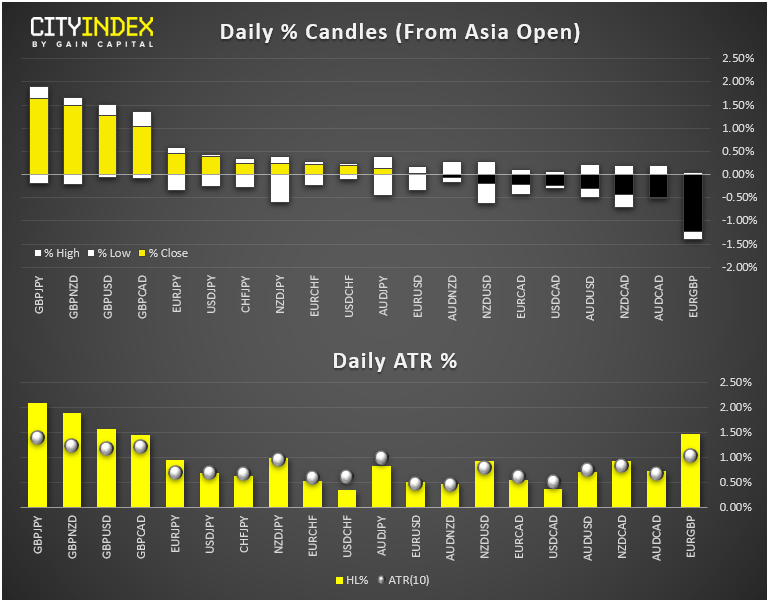

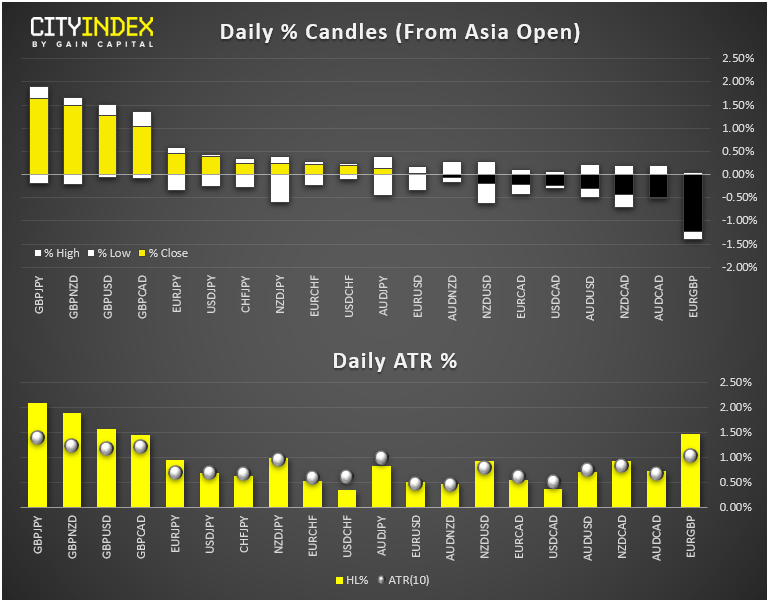

- FX: The pound was once again the strongest major currency, gaining at least 1% against each of its major rivals. The safe have Japanese yen was the day’s weakest major currency.

- The IMF cut its global growth forecast to 3.0% (from 3.2% in July), with the ongoing trade war potentially shaving as much as 2.0% off China’s GDP growth and 0.6% off the US’ in the short term.

- Commodities: Oil and gold both tacked about -1% lower on the day.

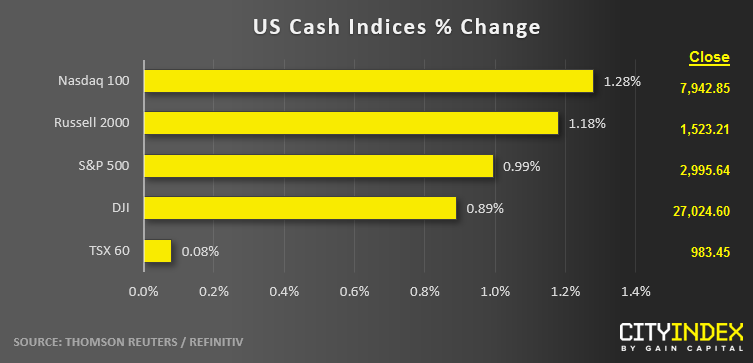

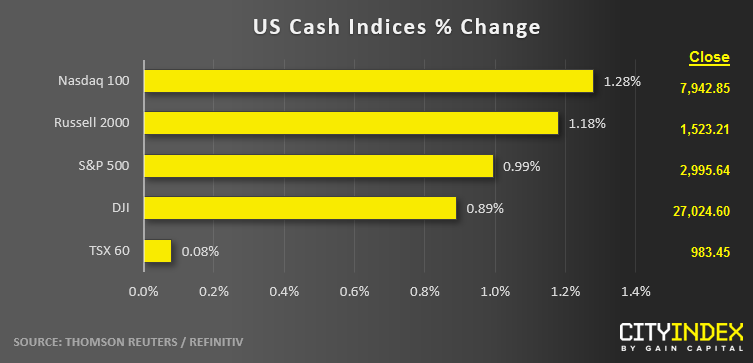

- US indices closed roughly 1% higher, bolstered by bank earnings and Brexit optimism.

- Health Care (XLV) was the strongest sector on the day while Consumer Staples (XLP) brought up the rear.

- Stocks on the move:

- JP Morgan (JPM, +3%) was the standout among the banks reporting earnings today, though all four ultimately closed higher on the day – see our full recap here.

- UnitedHealth (UNH) tacked on over 8% after reporting stronger-than-expected earnings.

- Johnson and Johnson (JNJ) rallied nearly 2% on a solid earnings report.

- Multiple reports suggested that General Motors (GM, +2%) was close to a deal with striking employees.

Latest market news

Today 08:33 AM