Market Brief: Pound Strong Again Amidst Ongoing Brexit Drama

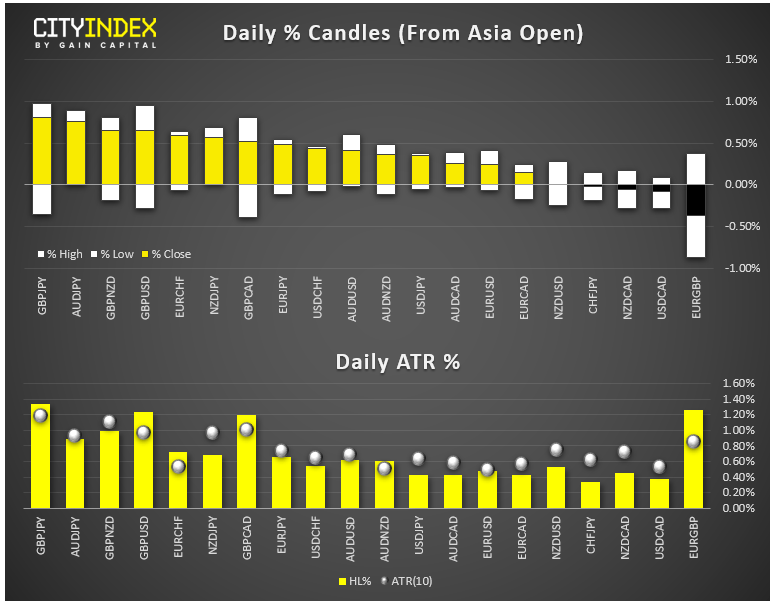

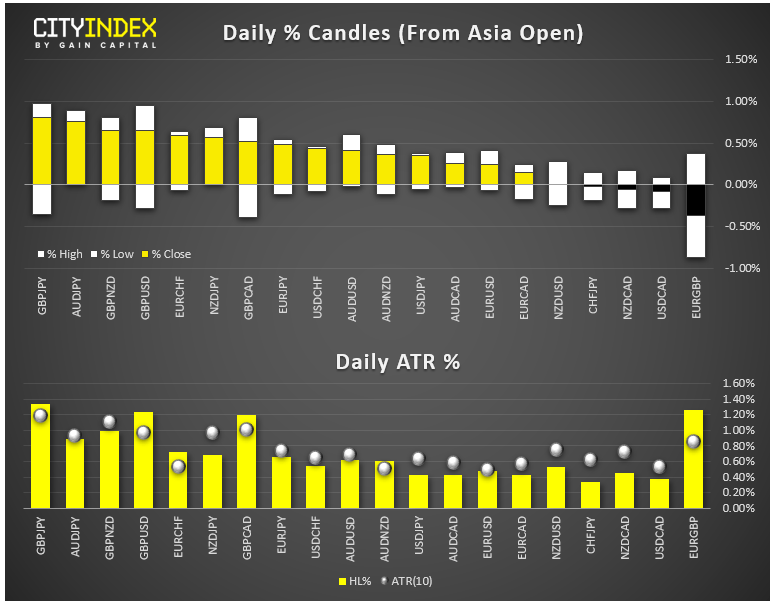

- FX: It was another day of drama in London, including Speaker Bercow announcing his resignation, but at the end the pound was the strongest major currency (see our full breakdowns of today’s developments here and here). Safe haven currencies like the Japanese yen and Swiss franc.

- Speaking of major currency pairs, see our analysis on EUR/USD and USD/CAD for more technical levels to watch!

- Commodities: Gold edged about 0.5% lower on the day, while oil surged nearly 3% to a 1-month high.

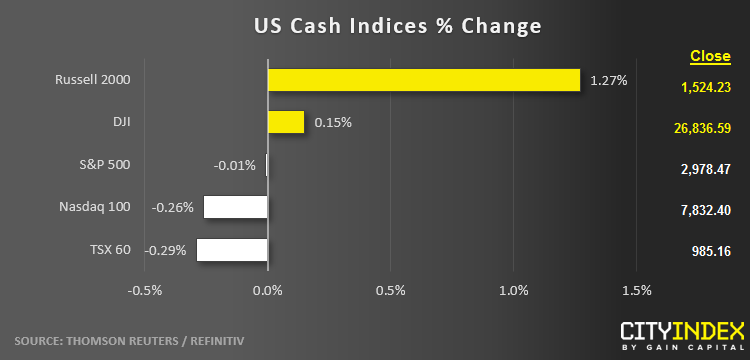

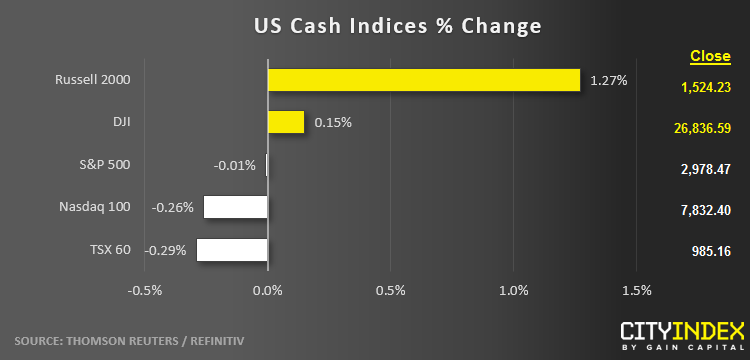

- US indices closed mixed in relatively quiet trade.

- Energy (XLE) and Financials (XLF) were the strongest major sectors; Technology (XLK) brought up the rear.

- Stocks on the move:

- AT&T (T) rallied more than 1% on new that activist fund Elliott has taken a stake in the company and is pushing for a breakup.

- Cloud software stocks like Slack (WORK, -9%), Zoom Video Communications (ZM, -8%), and Twilio (TWLO, -10%) all fell sharply as investors questioned their elevated valuations.

Latest market news

Today 08:18 AM

Yesterday 10:40 PM