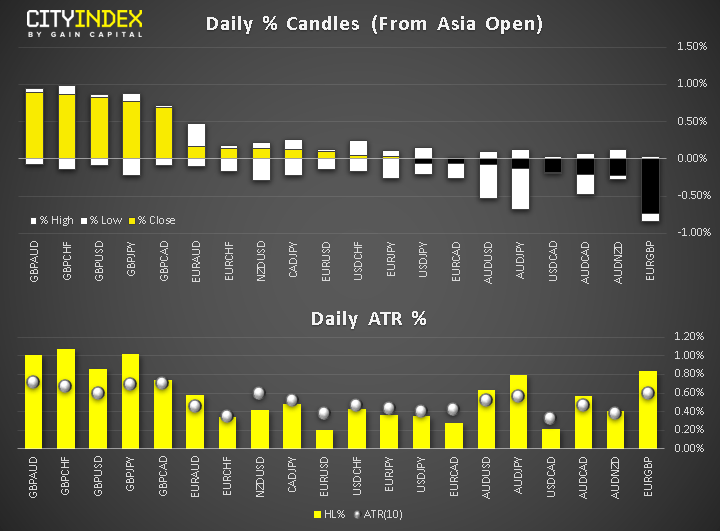

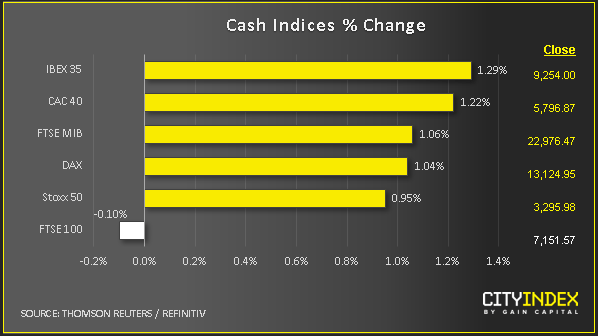

- Market update at 13:20 GMT: the GBP was easily the strongest currency while the AUD and USD brought up the rear. European stocks and US index futures were rebounding sharply, although the FTSE underperformed, hurt once again by a stronger pound. Crude oil was up along with risk assets ahead of oil inventories today and OPEC meeting tomorrow. Gold was supported by a weaker dollar, although the gains were kept in check due in part to rebounding equity prices.

View our guide on how to interpret the FX Dashboard

- GBP as expectations grow that the Tories will win the majority of the votes in the upcoming election. AUD fell after a sharp two-day rally when it was supported by stronger Chinese manufacturing PMI data. It was hit as growth data showed Australia’s GDP missed expectations at 0.4% Q/Q vs. 0.5% expected. USD was hurt by the ADP employment report showing jobs growth was much weaker in November than expected.

- Services PMI recap: Final services PMIs were revised higher for the Eurozone (to 51.9 from 51.5), Germany (to 51.7 from 51.3) and UK (49.3 from 48.6), but lower for France (to 52.2 from 52.9). Separately, flash services PMIs showed Spain beat (at 53.2 vs. 51.9) and Italy disappointed expectations (at 50.4 vs. 51.2 eyed). Overnight, China’s Caixin services PMI topped expectations at 53.5 compared with 51.1 expected and last.

- Stocks: Sentiment towards risk turned positive after a report by Bloomberg suggested that the phase 1 trade deal between the US and China was actually much closer than thought, and that it could be signed by December 15 tariffs deadline. Today’s gains for stocks come after a sharp two-day sell-off, triggered by concerns that a trade deal was not imminent. On Tuesday, it was Donald Trump himself who surprised the markets by saying a trade deal with China could wait until after the 2020 presidential election in November. It remains to be seen whether the gains can be sustained though, given that Bloomberg’s source was “unidentified.” What’s more, the US has imposed fresh tariffs on Argentina and Brazil exports of metals, while Trump has threatened to impose duties on French goods. On top of this, China has warned that the US bill calling for a tougher US response to Beijing's treatment of its Uighur Muslim minority will impact bilateral cooperation. So there are plenty of reasons why trade jitters could escalate.

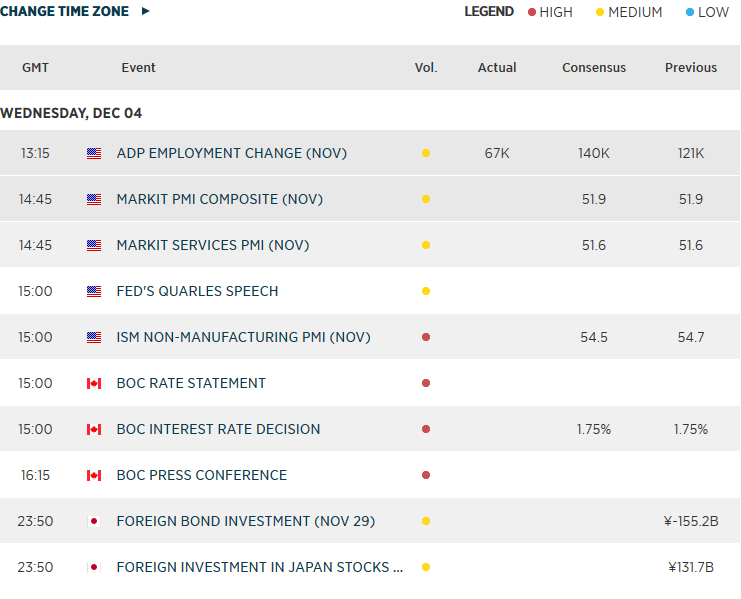

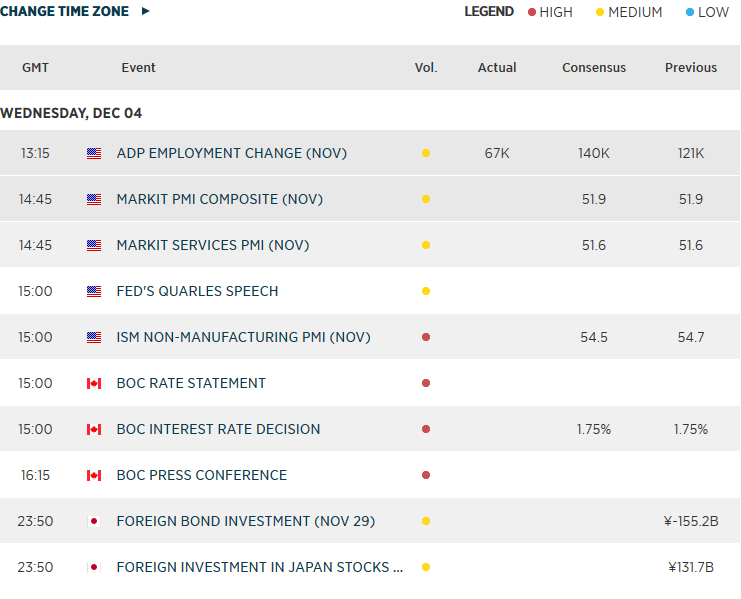

- Coming up:

Latest market news

Today 08:33 AM

Yesterday 11:48 PM